A plumbing system is a critical yet costly component of a cannabis facility. That’s why growers can’t overlook proper system design. Each system design should take into account a grower’s specific needs as well as code and regulatory requirements. Proper planning can help growers avoid costly and time-consuming rework. Here are some of the most important plumbing considerations when designing a cannabis facility:

1. Consider and select water reclamation systems early.

One of the common set-ups we come across in cannabis cultivation is a water reclamation system, which filters and reuses wastewater collected by HVAC installations from plant transpiration. Water reclamation systems vary depending on facility size, types of irrigation processes, environmental conditions and compliance and regulations. When designed properly, they can reclaim a very high percentage of wastewater, which, in turn, will reduce water usage, reduce waste and save money. Growers should determine their needs early in the design process, as adding these systems later can be costly from a budget and time standpoint.

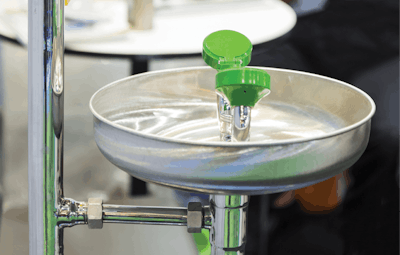

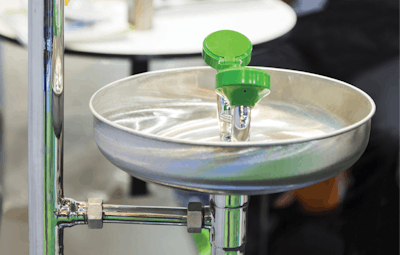

2. Understand safety requirements, including eyewash stations and emergency showers.

For cultivators involved in extraction or processing, eyewash stations and/or emergency showers may be necessary, and they are not uncommon in cultivation facilities utilizing fertilizer or another fertigation system. Installing this equipment is typically much more costly and complicated than growers might think. Showers in most residential homes flow at a rate of about 2.5 gallons per minute, while emergency showers typically use 20 gallons per minute and must provide tempered water for 15 minutes. This means water meters, supply mains, water heating equipment and, in some cases, electrical systems, need higher capacities to accommodate the added water supply load.

Also, emergency fixture placement must meet certain standards, such as being located within 55 feet of the hazard, being reachable within 10 seconds and include a path that is free from obstructions, such as steps and doors. It’s important to get this right, as Occupational Safety and Heath Administration (OSHA) penalties can be thousands of dollars.

3. Consider reverse osmosis systems.

Reverse osmosis (RO) systems are frequently used in cannabis cultivation facilities as a water filtration method. RO water can provide a more consistent way to add nutrients and other additives to a cultivator’s irrigation/fertigation water. But these highly engineered systems are prone to maintenance issues, such as corrosivity and backflow pressure, and other issues due to pipe material choice. Be sure to hire a plumbing engineer with experience in cannabis facility designs to avoid common complications.

4. Install hand sinks—even if they’re not required.

The health department generally requires hand sinks in any sort of food processing environment, and adult-use cannabis cultivation and processing facilities typically fall into this category. Cultivators should check with the health department to understand their facility requirements. Even if hand sinks aren’t required in post-harvest process areas like drying, extraction or in kitchens, growers should consider them as the industry continues to place a higher value on contaminant-free products.