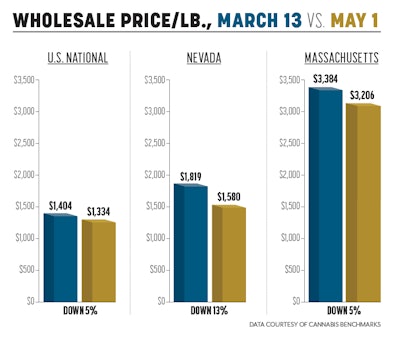

National wholesale flower prices generally have trended downward since the global COVID-19 crisis gripped the U.S. From March 13 to May 1, the U.S. Spot Index declined by 5%, from $1,404 to $1,334 per pound. The negative movement in national wholesale flower prices comes amidst reports of strong sales in late March, as consumers and patients stocked up ahead of stay-at-home orders and the possible shutdown of cannabis retailers, as well as the industry holiday 4/20, normally one of the market's strongest sales days that was dampened this year by coronavirus-related restrictions.

To make sense of how the pandemic is affecting the legal cannabis industry, familiarity with prior supply and demand trends is necessary. For example, several media outlets/analysts trumpeted that strong March sales figures released by officials in Oregon and Arizona were due to the fallout from the novel coronavirus. However, as Cannabis Benchmarks detailed in its U.S. Cannabis Spot Index report for April 24, March sales in both markets set new records each year from 2017 to 2020. Also, sales growth rates in both states from February to March in 2017 to 2019 were comparable to those documented under pandemic conditions this year. Sales increased by around 20% from February to March in Oregon each year from 2017 to 2019; in 2020 they grew by 24%. In Arizona in 2017 through 2019, sales volume increased by 12% to 16% from February to March each year; in 2020 the growth rate was 15%. Overall, seasonal sales trends and existing market growth were likely the main drivers behind strong March sales in Oregon and Arizona, though pandemic-related bulk purchasing provided a boost.

Two markets that undeniably have been impacted by the pandemic are Nevada and Massachusetts. Nevada cannabis retailers were forced to shift to delivery-only sales in late March, while the shutdown of Las Vegas tourism robbed the state of a large chunk of its usual demand. After trending upward through the first two months of 2020, Nevada’s state Spot Index has been on the decline. As of May 1, it had fallen to $1,580 per pound, off almost 15% from its recent peak in late February ($1,849/lb.)

Adult-use cannabis retailers in Massachusetts have been subjected to the strictest COVID-19 response in the country, having been ordered to cease sales completely in late March. From March 27, the week adult-use sales were shut down, to May 1, Massachusetts’ Spot Index fell by almost 6%, or by nearly $200, to $3,206 per pound, as demand from consumers disappeared.

Looking ahead, trends in supply, demand, and wholesale prices will almost certainly vary state by state. In hard-hit markets such as Nevada and Massachusetts, lower wholesale flower prices may persist even after sales pick up. This is because cultivation is continuing, even as demand has been severely diminished or eliminated, which will allow surplus inventory to build. This may also be the case if sales decrease in newer markets such as Illinois and Michigan, where growers were having trouble keeping up with demand prior to the pandemic.

Finally, the return to normalcy looks increasingly as if it could be an uneven process. For example, some states began to lift some restrictions on residents and businesses in late April and early May, but some experts are warning of a possible resurgence of the virus that could lead to restrictions being reinstated. It is possible that cannabis retailers could see peaks and valleys in sales, rather than a gradual, predictable recovery. While uncertainty typically leads to higher commodity prices in traditional industries, COVID-19 could suppress wholesale cannabis prices if retailers are hesitant to purchase large volumes of inventory and sales slow generally as part of an overall economic downturn.