Massachusetts and Illinois exemplify how wholesale prices frequently trend upward in expanding medical cannabis programs that transition to adult-use markets. However, the fact that each state has its own unique quirks means that the extent and duration of price inflation will vary.

Massachusetts

In Massachusetts, adult-use sales began in late November 2018. Demand in the medical program was expanding rapidly already, with sales volume to patients increasing by more than 50 percent from 2017 to 2018.

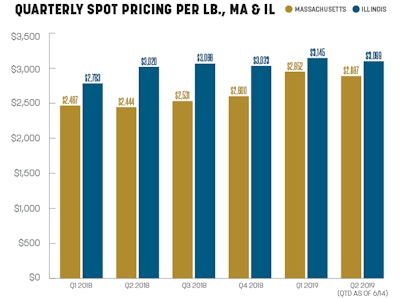

Massachusetts medical cannabis businesses that expanded into adult-use could transfer some inventory to the recreational sector, tightening supply overall. Accordingly, the state’s quarterly spot index rose from $2,600 to $2,952 per pound during Q4 2018 to Q1 2019.

However, as more cultivators gained adult-use licenses, state data shows that wholesale prices trended downward as production increased. Weekly wholesale prices in Massachusetts rose to more than $3,000 per pound late in Q1 2019 but declined in April and May. As of June 14, the state spot index was averaging $2,887 per pound for Q2 2019.

As of late May, Massachusetts only granted 18 adult-use retailers permission to begin sales. As such, there is limited shelf space to fill, and access to the licensed market is not widespread, allowing production to catch up to demand.

Illinois

Illinois’ rollout of an adult-use cannabis industry may proceed differently given current medical market conditions and the state’s plan to begin recreational sales quickly. Illinois’ medical cannabis program saw significant growth in 2018, when dispensary sales rose by almost 60 percent over 2017. Revenue growth accelerated in early 2019 as the state’s dispensaries and producers repeatedly set new monthly sales records.

In Q4 2018, Illinois’ spot index averaged $3,033 per pound. It opened 2019 by rising 3.7 percent to average $3,145 per pound in Q1. Prices almost reached $3,200 per pound in April but declined in May. As of June 14, the state’s spot index was averaging $3,099 per pound for Q2.

Legislation legalizing an adult-use cannabis industry in Illinois calls for sales to begin in January 2020. The state’s 55 medical dispensaries will be permitted to begin sales right away if they qualify for licenses and may also apply to open a second storefront. The state’s existing growers, of which there are about 20, will be allowed to expand, but no new cultivators will be licensed until July 2020. With about 100 adult-use retailers possibly opening their doors early next year and medical sales booming, cultivators could struggle to produce supply adequate to meet demand in a state with a significantly larger population (12.7 million in 2018, according to the U.S. Census Bureau) than Massachusetts (6.9 million in 2018).

Overall, Cannabis Benchmarks’ historical data shows that the transition to a legal adult-use cannabis market has resulted in wholesale flower prices behaving uniquely state-to-state, depending on various factors such as how many businesses are licensed, the prevalence of outdoor cultivation, and regulatory burdens. For example, in Colorado, wholesale rates were not observed to decline steeply until about two-and-a-half years after the opening of recreational sales in 2014. However, Oregon saw a steep decline less than 18 months after its first licensed retailers opened.