Patient and caregiver numbers have been dropping in Michigan’s medical cannabis program during recent months, stemming in part from a domino effect propelled by falling prices in the overall market.

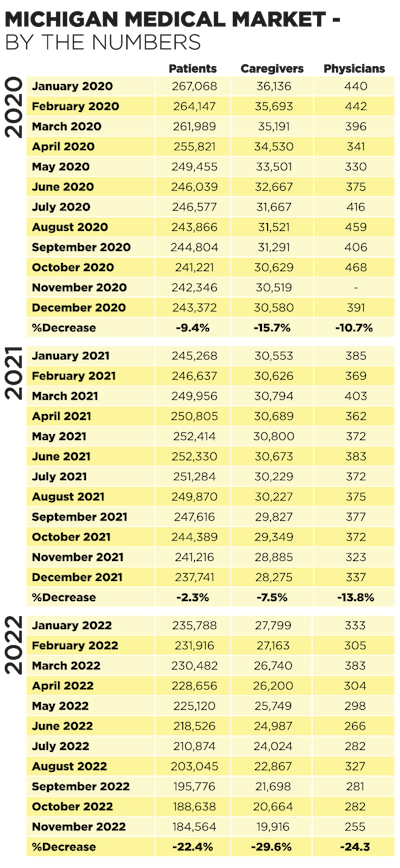

As of Nov. 30, 2022, there were 184,564 qualifying patients and 19,916 primary caregivers approved in the state, a far cry from the roughly 284,100 patients and 40,200 caregivers in early 2019—before adult-use sales began—according to data from Michigan’s Cannabis Regulatory Agency (CRA).

While patient numbers in any state-licensed market generally decline following an adult-use sales launch, it wasn’t until more recently, specifically 2022, that monthly fallouts have come at such rapid rates in Michigan. During the first 11 months of 2022, patient numbers decreased by 22% compared to a 2% decrease in all of 2021, while caregiver numbers were down nearly 30% compared to a 7.5% drop in all of 2021.

Fewer caregivers equate to fewer patients, and the sharp decline in caregivers in recent months can be directly attributed to declining market prices, says Rick Thompson, owner of the Michigan Cannabis Business Development Group and executive director for Michigan NORML.

In Michigan, registered caregivers can grow up to 12 cannabis plants and purchase and possess up to 2.5 ounces for each registered qualifying patient with whom he or she is connected through the state’s medical program, according to the CRA.

“The caregiver numbers are declining because the price of cannabis has gotten so inexpensive at the retail marketplace [that] it’s now cheaper to actually purchase cannabis than it is to cultivate it and grow it yourself,” he says. “So, people that were utilizing the privilege of growing in order to save their patients money are no longer doing that; it’s not advantageous.”

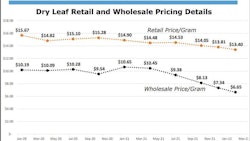

Michigan’s average retail price for an ounce of cannabis flower has plunged dramatically during the past year, specifically with the price in the adult-use market falling below the medical market in October 2022—a phenomenon that was without precedent since the adult-use market commenced in December 2019.

The average adult-use flower retail price was $95.12 per ounce in November 2022, a 50% decrease from November 2021; meanwhile, the average medical cannabis flower retail price was $102.60 per ounce in November, a 41% decrease from the previous year, according to CRA. Furthermore, medical cannabis sales represented less than 7% of Michigan’s overall marketplace in November 2022—its smallest share since adult-use retail commenced.

With consumer demand still growing in Michigan’s adult-use market—from nearly 25,000 pounds of flower sold in January to nearly 59,000 pounds sold in November—retailers continued to report record sales figures throughout most of 2022, but cultivators and wholesalers have been caught in a “race to the bottom” that has led some to call for a licensing moratorium.

Despite those trends, Thompson says there will always be a need for a medical cannabis industry in the state, especially for patients under the age of 21 who cannot access the adult-use market. “A medical card is the only way for them to access the life-saving medicine,” he says. Still, the services provided to patients and caregivers by retailers and by others will be reduced and may, in some cases, go away, he says.

“You have sick children that are coming out of their pediatric stage and want to get into the adult-use market, but they may not have this medical support that they need,” Thompson says. “They may not have those specialized strains that only medical producers create that are not necessarily financially viable for a commercial cultivation operation but might be incredibly important for a particular person’s significant illness. So, I see a lessening, a worsening of the compassion level in this state as the medical program goes down.”