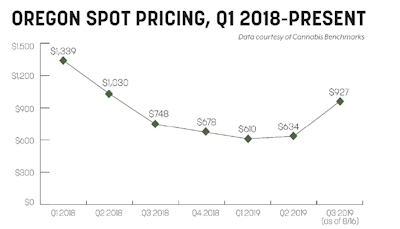

Oregon’s legal cannabis market continues to be one of, if not the most volatile in the country when it comes to wholesale pricing. The voluminous surpluses generated by the autumn harvests in 2017 and 2018, which exacerbated the problem, is well-known. The 2017 fall outdoor harvest generated a bumper crop, resulting in more than 1 million pounds of dried flower and trim logged in Oregon’s cannabis tracking system (CTS) in early 2018. The autumn harvest in 2018 was comparable in size to the year before, and about 1.35 million pounds of dried flower and trim were listed as unsold in Oregon’s legal market at the outset of 2019.

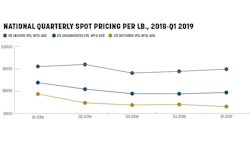

That increasing surplus generated more volatility in Oregon’s market, as evidenced by the state’s weekly spot index falling by 60 percent from the beginning to the end of 2018, the largest decline of any state with legal cannabis last year, according to Cannabis Benchmarks’ wholesale spot pricing. Wholesale price erosion continued into 2019 when Oregon’s spot fell to an all-time low for any market of just below $500 per pound in April.

Yet, despite robust crop inventories and crashing wholesale prices, Cannabis Benchmarks first reported in May 2019 that retailers were complaining of a shortage of desirable flower offered from sellers. Industry insiders said that much of the available inventory had been passed over when the market was flush with supply. Our data showed that the proportion of the total reported volume traded in the state made up of outdoor flower declined from over two-thirds early in 2019 to about a quarter by the end of July, suggesting that buyers are spurning such product.

However, soaring demand and the reported lack of desirable flower among the mountains of unsold plant material still logged in CTS are starting to have a positive effect on the cannabis wholesale market. Flower sales volume was up by about 40 percent year-over-year through the first half of 2019. The number of units of concentrates and extracts sold in the first half of 2019 was up by about 55 percent compared with the same period in 2018. The result: Even when taking into account the persistence of falling rates into 2019, Oregon’s spot index at the end of July was up by more than 42 percent relative to the beginning of the year.

More optimism is in the forecast for Oregon: Hemp production in the state for 2019 is expected to roughly triple compared to 2018, thanks in part to low wholesale rates and a highly competitive market. The boom is prompting numerous cannabis growers to turn to industrial hemp, sometimes farming the two side-by-side on adjacent plots or even giving up on cannabis altogether. In the midst of 2018’s harvest, Dave Singery of Oregon Sol said of cannabis, “That ship has sailed.” If more farmers opt to abandon cannabis or share their plot with hemp, the result could be a smaller cannabis harvest this year, which would contribute to more stable and potentially higher prices in the state going forward.