New Cultivar Acquisitions and Priorities

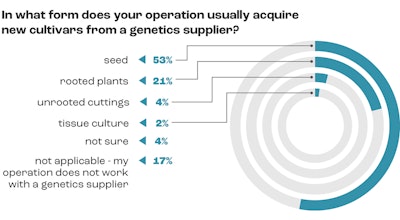

About 79% of study participants in this “Breeding & Genetics Market Report” research source new cultivars through outside breeders. Two-thirds (53%) acquire new cultivars in seed form. Another 21% acquire rooted plants. Less than 2% of participants acquire new cultivars via tissue culture. Looking at the data, 27% are sourcing new genotypes via unrooted or rooted cuttings or tissue culture. Roughly 1 in 6 (17%) noted they do not work with outside suppliers for new varieties, and those participants were not included in subsequent related questions.

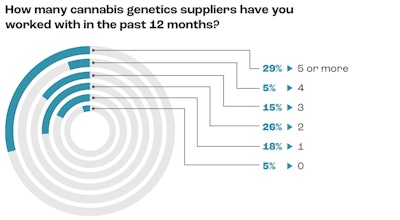

When looking at activity during the past 12 months, most businesses that rely on outside breeders for genetics work with more than one supplier, and close to one-third (29%) report working with five or more genetics suppliers in that period. Nearly half (44%) of participants in this research limited their genetics acquisitions to one or two genetics suppliers within the past year.

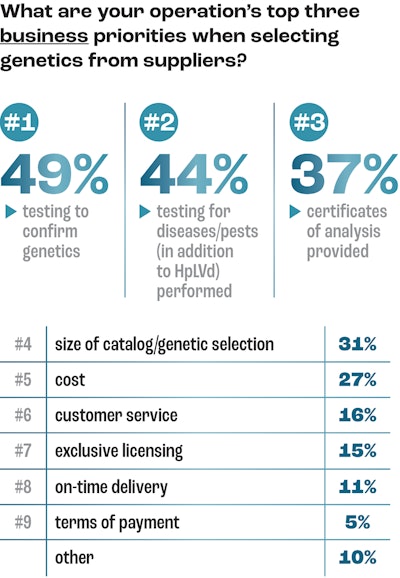

Business priorities figure heavily in variety selection for participants who work with outside breeders for new cultivars. Nearly half (49%) of study participants in this group note “testing to confirm genetics” as a top-three business priority. “Testing for diseases and pests performed (in addition to Hop Latent Viroid testing)” and “certificates of analysis” followed as top-three business priorities for 44% and 37% of participants respectively. “Size of catalogs/genetic selection” (31%) and “cost” (27%) rounded out the five most-cited top business priorities for selecting new genetics among those participants using suppliers.

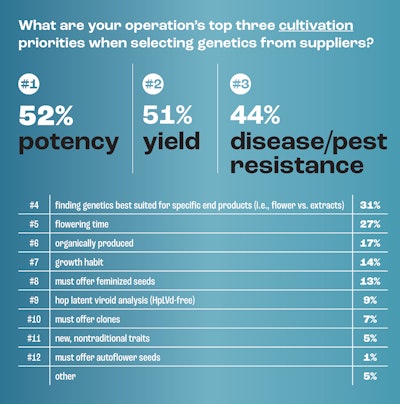

Top cultivation priorities when selecting genetics from external suppliers reflected a melding of production and end-market concerns. For more than half of participants who use a genetic supplier, “potency” (52%) and “yield” (51%) were top cultivation priorities in genetics selection. “Disease/pest resistance” (44%) followed closely behind, while “finding genetics best suited for specific end products” (31%) and “flowering time” (27%) also were among top cultivation priorities for participants shopping new genetics from suppliers.

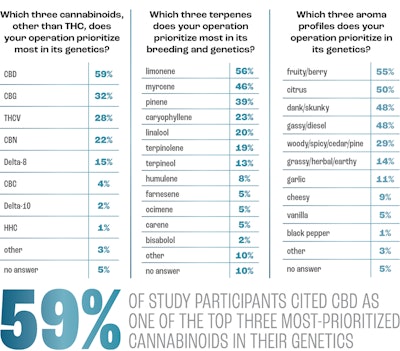

Cannabinoids, Terpenes and Aroma Profiles

With a growing palette of cannabinoids in play and in demand, cultivators and consumers are looking beyond THC. When considering cannabinoids other than THC, not surprisingly, CBD was cited as one of the top three most-prioritized cannabinoids in genetics by 59% of study participants. Next in line for cannabinoids most-prioritized in genetics were CBG, named as a top-three priority by 32% of participants, along with THCV (28%) and CBN (22%). One participant noted interest in THCP, which was not listed, in the other field.

Like craft beer lovers who’ve grown to appreciate the nuances of aromatic, terpene-rich hops, cannabis consumers have tuned in to terpenes. Whether breeders and growers are driving consumer trends or vice versa remains to be seen. But it is a key focus area among participants in this study, as they cited “terpene profile” most when noting improvements they would like to see in their genetics. Among participants in this 2022 “Breeding & Genetics Market Report” study, more than half cited limonene (56%) as a most-prioritized terpene in their operation’s breeding and genetics. Other leading terpene priorities for study participants included myrcene (46%), pinene (39%), caryophyllene (23%) and linalool (20%).

As with terpenes, aroma profiles prioritized in genetics by study participants aligned closely with consumer trends. Topping the list of most-prioritized aroma profiles, named by nearly half of all participants, were “fruity/berry” (55%), “citrus” (50%), “dank/skunky” (48%) and “gassy/diesel” (48%). “Woody/spicy/cedar/pine” was next in line, named as a top-three priority by 29% of study participants.