LED Adoption Continues to Surge

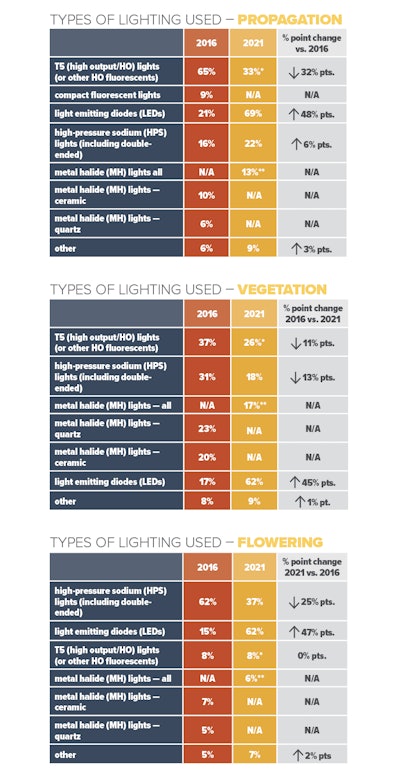

One of the most consistent trends noticed in the historical data of Cannabis Business Times’ “State of the Cannabis Lighting Market” report is the continued adoption of light-emitting diode (LED) fixtures across all stages of plant growth. In the 2021 report, LED usage grew by at least 45 percentage points in all stages of growth compared to 2016 results.

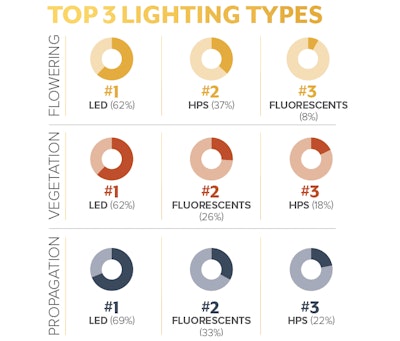

In this year’s research, 69% of participants noted using LEDs during propagation, compared to 33% who use fluorescent lights, 22% who use high-pressure sodium (HPS) fixtures, and 13% who use metal halide (MH) lights. (Nine percent indicated that they use a lighting type not listed in this year’s survey.)

In vegetation, 62% of research participants indicated using LEDs, by far the most-used lighting type in this year’s study. Fluorescents were the second most-used lighting type (26%), followed by HPS (18%) and MH (17%).

In flowering, 62% of growers who participated in the study indicated employing LEDs, up from 15% in 2016’s report and 52% in 2020. HPS fixtures are used by more than a third of participants (37%), while fluorescents and MH lights are used by less than a tenth of cultivators (8% and 6%, respectively).

Industry Continues Its Upward Growth

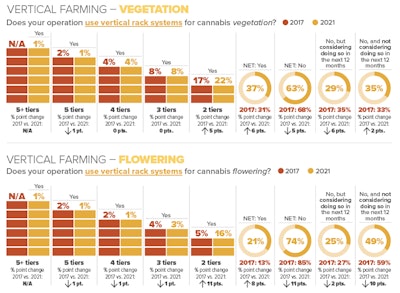

Accompanying (and potentially driving) this surge in LED adoption is the increasing implementation of vertical racks. These systems allow cultivators to use their facility’s cubic footage instead of limiting cultivation activities to the floor space.

Vertical farming in vegetation has remained fairly consistent over the years: In 2017, 31% of research participants indicated growing using vertical racks during vegetation; this increased to 37% in 2021’s research, a response in line with more recent years (38% in 2020).

Using tiers in flowering continues to slowly gain adoption, with 21% of this year’s research participants indicating growing on at least two tiers, up from 13% in 2017 and 20% in 2020. The plurality of growers who use vertical racks in flowering grow on two tiers (16%), while 22% grow on two tiers during vegetation.

The portion of growers not considering vertical farming in flowering has declined steadily over the years since this question has been included. In 2017, 59% of research participants were not considering a vertical farming system in flowering. This group dropped to 49% in 2021, potentially indicating that more growers have adopted vertical farming systems or are more open to the idea than they once were.

LED Hesitancy Dwindles, But Reasons Preventing Adoption Remain

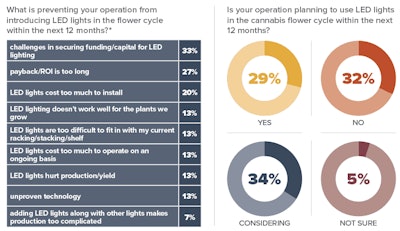

LED adoption is expected to continue to rise as growers strive for further efficiencies, whether to maximize profitability, comply with state energy use regulations, or both. Of the research participants who currently do not leverage LED fixtures in flowering, 63% indicated they are planning to use or are considering using LEDs in the flower cycle within the next 12 months. About one-third (32%) of participants indicated having no plans to bring LEDs into their flowering spaces.

For those not considering LED adoption, the main reason remains mostly similar to years past—cost. The top three reasons cited about what is preventing LED adoption all involve capital investments into the fixtures: “challenges in securing funding/capital for LED lighting” (cited by 33% of research participants), “payback/ROI is too long” (27%), and “LED lights cost too much to install” (20%). Other common reasons include: “LED lighting doesn't work well for the plants we grow”; “LED lights are too difficult to fit in with my current racking/stacking/shelf”; “LED lights cost too much to operate on an ongoing basis”; “LED lights hurt production/yield”; and “unproven technology.” Each of these latter reasons was mentioned by 13% of growers who do not currently use nor plan to use LED lights.

Top Factors When Purchasing Lighting Fixtures

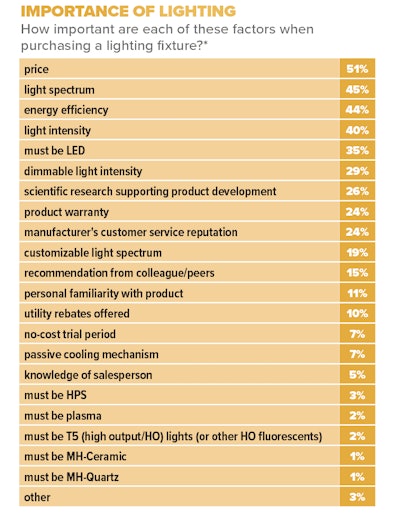

As in past “State of the Cannabis Lighting Market” reports, cost is a significant factor for cultivators purchasing a lighting fixture. However, in 2020, other considerations, such as light intensity and spectrum, product warranty, and scientific research and development, ranked higher. This year, the investment piece ranked first, with 51% of research participants placing “price” in their top five most important factors guiding lighting purchasing decisions. Light spectrum (45%), energy efficiency (44%) and light intensity (40%) were other important factors noted by growers in this year’s study.

A possible sign of LEDs becoming the industry-standard fixture, more than a third (35%) of growers surveyed this year indicated that any fixtures they would considering purchasing must be LED. Comparatively, only 3% reported requiring that the fixtures be HPS.

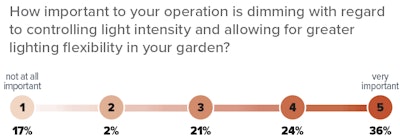

While just missing the top-five cut, dimmable light intensity capability was another top factor highlighted by growers when making fixture purchasing decisions. More than a quarter (29%) of growers ranked dimming capabilities in their top five most important purchasing factors, and 60% noted it as “important” or “very important” to their facility’s cultivation operations.

Top Lighting Challenges Remain Consistent

Compared to last year’s report, the greatest lighting challenges cited by this year’s study participants remained unchanged, but the order was shuffled. In this year’s report, “managing energy costs” was the top lighting-related challenge (15% vs. 13% in 2020), followed by “ensuring consistent/even lighting across the crops” (14% vs. 17% in 2020), “lighting’s impact on terpene/cannabinoid content” (13% vs. 14% in 2020), “managing heat load” (10% vs. 12% in 2020), “automation” (10%, new to the list this year) and “lighting’s impact on plant growth (yield, internodal spacing, etc.)” (10% vs. 16% in 2020).

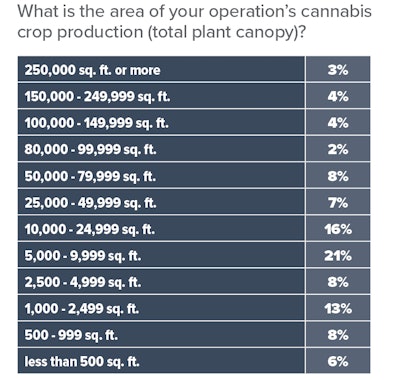

Where Cultivators Are Growing & Their Footprints

Each year, Cannabis Business Times asks participants to provide details about their facilities to gain some context for the data and to learn more specifically about cultivators who are using lighting to power their grows. Similar to 2020’s report, the vast majority of research participants indicated growing exclusively with artificial lighting as 79% of participants reported growing in an indoor facility. Meanwhile, 29% of participants rely on a mix of natural and supplemental lighting, growing in a greenhouse with supplemental lighting. (Cultivators who have multiple facility types could select more than one.)

Total growing areas varied greatly, with 21% cultivating in facilities that are 50,000 sq. ft. or more, and 14% with canopies covering less than 1,000 sq. ft.