Not much in the cannabis industry is consistent, with changing regulations and more states coming online with medical or adult-use programs. However, the primary cultivation- and business-related challenges for cannabis operations, according to participants, have remained unchanged for the past three years Cannabis Business Times has conducted the “State of the Cannabis Cultivation Industry Report.”

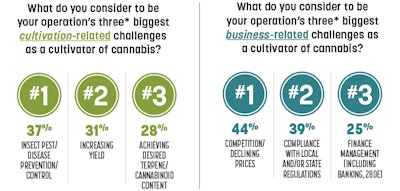

The top three cultivation-related hurdles cited again this year by participants are: “insect pest/disease prevention/control” (37%), “increasing yield,” (31%) and “achieving desired terpene/cannabinoid content” (28%). Other challenges noted included “humidity control” (21%), “maintaining consistent yields” (19%), “finding suitable genetics for growth environment” (15%) and “weather” (13%).

As far as business challenges, “competition/declining prices” again ranked as the No. 1 challenge among cultivators, with “compliance with local and/or state regulations” in a close second, and “finance management” ranking third. In addition to the top three business-related challenges, other highly cited options included “securing capital/funding” (23%), “uncertainty regarding federal law” (21%), “production costs” (20%), “marketing/brand building” (19%) and “product sales” (19%).

Cultivators Diversify

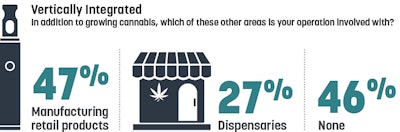

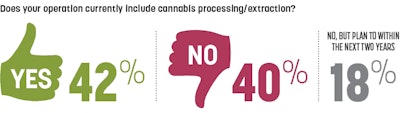

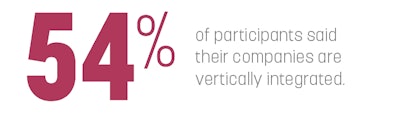

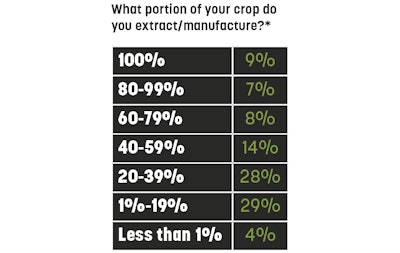

More than half of all study participants (54%) are vertically integrated companies, either manufacturing retail products and/or operating dispensaries. This year’s study took a closer look at companies that process/extract cannabis (42%), examining which methods were most prevalent. Of the 42% of cultivators that operate cannabis processing/extraction facilities, the top three extraction methods used included ethanol (45%), CO2 (40%) and solventless (36%).

About the research:

The data in this report was collected by independent research firm Readex Research via an online survey, which was sent to all emailable, active, qualified subscribers to Cannabis Business Times magazine and/or e-newsletter located in the U.S. or Canada, from April 15 to April 29, 2020. The survey was closed for tabulation with 298 responses. To best represent the audience of interest, the base for the results in this report, unless otherwise noted, are the 202 respondents who indicated they currently own or work for an organization that grows cannabis. Another 53 respondents indicated they do not currently own or work for an operation that grows cannabis, but plan to in the next 18 months. The margin of error for percentages based on the 202 respondents who currently own or work for an operation that grows cannabis is approximately +/- 6.8 percentage points at the 95% confidence level.

Read the rest of the 2020 State of the Cannabis Cultivation Industry Report

Letter: Five Years Inside the State of the Industry

Introduction: Tracking Data Reveals Industry Shifts, Sustained Growth

2020 Cannabis Research: Revenue and Profits Plateaued, But Solid

2020 Cannabis Research: Where Cultivators Grow

2020 Cannabis Research: Industry Optimism, Expansion Continues

2020 Cannabis Research: Challenges Are One Constant in a Dynamic Industry