State revenue officials are working on the roll-out of the latest medical marijuana program with a tax on the drug — the first of its kind in the state — which could increase the agency's capacity for handling cash.

Legislators passed SB333 this spring, adding a number of regulations to the program. That includes a gross sales tax that providers will start putting on the books on July 1.

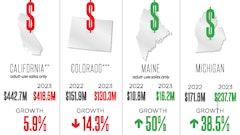

STATE BY STATE: Montana Cannabis News

The tax will be 4 percent of gross sales from July 1, 2017, to June 30, 2018. After that the tax will be 2 percent.

For the Montana Department of Revenue, much of the setup is no different from any other specialty tax.