Recreational marijuana would be taxed at 20 percent, with 5 percent of that paid to communities that host growing or retail facilities, under a plan proposed Tuesday by a committee drawing up regulations for the new industry.

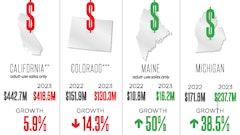

STATE BY STATE: Maine Cannabis News

Lawmakers proposed a 10 percent wholesale tax, or excise tax, and a 10 percent sales tax on recreational marijuana – the same overall tax rate as Massachusetts – during an 8-hour session Tuesday. The marijuana legalization committee proposed having the state distribute 5 percent of all state taxes collected from cultivation or retail operations to host communities.

In Maine, this tax scheme would drive the price of marijuana up from an average of about $200 an ounce to about $240, with a $20 excise tax levied on the cultivator, which would be built into the price, and a $20 sales tax charged to consumers at the time of purchase. Host communities would get $2 of that $40, with the rest going to the state.