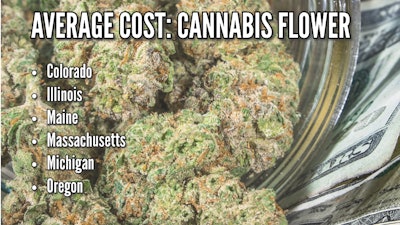

How much does an ounce of cannabis flower cost at dispensaries these days: $100, $200, $300?

The answer is all of the above, as the old saying “you get what you pay for” is only relative to the state market in which consumers are making their purchases in the cannabis world.

While flower prices generally come down in states as their cannabis programs mature, the rate of these price drops are dependent upon myriad variables, such as licensing structures, legal statuses in neighboring states, and, of course, supply and demand.

And these pricing dynamics are perhaps no more evident than in a comparison between Michigan and Illinois, whose adult-use markets launched sales within one month of each other in December 2019 and January 2020, respectively.

Notably, while the days of $300 ounces are a thing of the past in Michigan, where the average adult-use cannabis flower price was roughly $92 per ounce at retail in 2023, Illinois’ adult-use dispensaries averaged $293 per ounce for adult-use flower this year. These numbers are according to the Michigan Cannabis Regulatory Agency (CRA) and the Illinois Cannabis Regulation Oversight Office (CROO).

Here’s how prices in six adult-use markets of various ages have trended in the past four years:

As depicted above, Michigan’s market experienced a 78% decrease ($419 to $92 per ounce) for its average adult-use cannabis flower price from 2020 to 2023, while Illinois’ average price decreased 35% ($452 to $293 per ounce).

So, what’s the deal with the Michigan-Illinois comparison?

For starters, the cannabis retail landscape is much more competitive in Michigan, where there are 741 active dispensary licenses as of Nov. 30, or roughly 7.4 storefronts per 100,000 people. In Illinois, there are 177 licensed dispensaries as of Dec. 15, or roughly 1.4 storefronts per 100,000 people.

In addition, Michigan has roughly 950 active cannabis cultivation licenses in its adult-use marketplace and another 96 licenses for “excess growers,” each of whom are allowed to cultivate up to 10,000 plants at a time. This has led to what many call the “race to the bottom” amid price compression struggles throughout much of 2022 and 2023.

Earlier this year, Will Bowden, CEO of Michigan-based Grasshopper Farms, told Cannabis Business Times that the state’s supply finally caught up to demand, which invoked pricing wars.

“They’re losing money just to keep shelf space, and they think they’ll be able to raise the price later,” he said. “It’s very hard to raise your prices later. When you lower your price, you’ve actually just set your new price.”

RELATED: Michigan's Plummeting Cannabis Prices: A Closer Look

From a demand standpoint, Michigan’s adult-use dispensaries are on pace to sell roughly 950,000 pounds of adult-use flower in 2023, representing a 2,175% increase from the 41,750 pounds sold in 2020, according to CRA.

Although this isn’t exactly an apples-to-apples comparison, Illinois’ adult-use dispensaries are on pace to sell 41.7 million products in 2023, representing a 188% increase from the 14.5 million products sold in 2020, according to CROO.

More Price Dips

Massachusetts’ average adult-use flower price dipped 56% ($394 to $173 per ounce) from 2020 to 2023, while Maine’s average price dropped 51% ($449 to $222 per ounce), Oregon’s price sank 28% ($152 to $110), and Colorado’s price also came down 28% ($136 to $98).

Colorado and Oregon’s smaller rates of price decrease since 2020 can be largely attributed to the age of their markets, which launched adult-use sales in January 2014 and October 2015, respectively.

For example, Colorado’s average adult-use flower price experienced a more drastic decrease of 52% from its first year of sales in 2014 ($344 per ounce) to its fourth year of sales in 2017 ($165 per ounce), according to the state’s Marijuana Enforcement Division. This rate decrease is more in line with other states over their first four years.

So, will prices continue to fall?

Like many other questions facing the industry, it depends on lingering unknowns: When will Congress get serious about passing the SAFE Banking Act? Is the DEA going to take up the U.S. Department of Health and Human Services’ recommendation to reschedule cannabis? Will broader economic conditions change the direction of the wind?

During favorable market conditions at the height of COVID-19, for example, Oregon’s average adult-use retail price for cannabis flower shot up to $161 per ounce in August 2020, after it had dropped to as low as $118 per ounce in mid-2019, according to the state’s Liquor and Cannabis Commission.

But under current market conditions from the post-pandemic correction, prices in more mature markets appear to have hit rock bottom—at least for now.

Oregon’s all-time low of $105 per ounce and Colorado’s all-time low of $92 per ounce for adult-use cannabis flower came in April 2023. And Michigan’s all-time low of $80 per ounce came in January 2023.

Meanwhile, all-time lows in Maine ($213), Illinois ($268) and Massachusetts ($159) came just last month (November 2023).