Michigan’s licensed cannabis dispensaries are still seeing sales climb in a growing retail market that set a monthly record of $295.4 million in sales in August, according to new data released Sept. 11 by the state’s Cannabis Regulatory Agency (CRA).

This sales benchmark—which included more than $294.1 million in adult-use sales and nearly $1.3 million in medical sales—is $6.6 million more than the previous monthly record from March.

Notably, March and August each featured five Fridays and five Saturdays—traditionally the two best-performing sales days of the week for cannabis dispensaries.

RELATED: 5 Tips to Capitalize on Friday Sales at Your Dispensary

Michigan also broke a monthly sales record for most adult-use flower sold at 100,894 pounds in August, while the average price for adult-use flower remained near an all-time low of $80.14 per ounce, according to the CRA.

In August, Michigan’s adult-use flower sales represented 44% of retail revenue, while concentrates represented 19.6% of sales, vape cartridges represented 18.5% of sales, and infused edibles represented 9% of sales, according to the CRA.

The record month puts Michigan on pace to ring up more than $3.32 billion in total cannabis sales in 2024, representing an 8.6% increase from the $3.06 billion in 2023 sales. The state’s retailers are also on pace to sell nearly 1.1 million pounds of adult-us flower in 2024, representing a 12.8% increase over 2023.

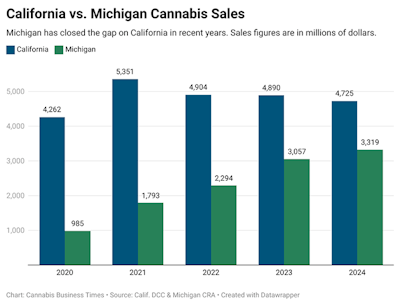

The 2024 projections, based on average monthly sales figures through August, means Michigan is continuing to close the gap on California, a state with nearly four times its population: California’s licensed dispensaries are on pace to finish 2024 with $4.75 billion in total sales, according to monthly figures from the state’s Department of Cannabis Control.

California’s retail market peaked at $5.35 billion in sales in 2021 and is now facing its third consecutive year of decline amid a continued lack of access to licensed dispensaries throughout much of the state: 57% of California cities and counties do not allow any retail cannabis business, according to the DCC.

While California has roughly 3.2 dispensaries per 100,000 people, Michigan has 8.7 dispensaries per 100,000 people.

“Michigan has nearly three times the number of legal dispensaries per capita as California,” Hirsh Jain, founder of California-based industry consultancy Ananda Strategy, told Cannabis Business Times.

“For this reason, it is much more convenient for people in Michigan to shop in the legal market,” he said. “In addition, Michigan’s 16% tax on cannabis sales is far lower than the 35%-45% tax imposed in California, depending on the local jurisdiction and the taxes often imposed at every point in the supply chain. This makes legal cannabis in Michigan much more affordable than it is in California, driving most consumers into Michigan’s legal market.”

California’s average flower price packaged per half ounce in 2024 is roughly $50 at retail, according to the DCC.

In addition, California’s 15% cannabis excise tax is set to increase to 19% next year.

RELATED: 15% of California Cannabis Businesses Default on Taxes as 2025 Hike Comes Knocking

As a result of myriad market dynamics, Michigan’s cannabis sales represent roughly $330 per capita per year compared to California’s approximately $120 per capita per year.

Since launching adult-use cannabis sales in December 2019, Michigan’s licensed dispensaries have sold more than $10.3 billion in adult-use and medical cannabis.