California lawmakers didn’t act quickly enough to halt the state’s cannabis excise tax rate from increasing to 19% on July 1, but industry stakeholders celebrated a better-late-than-never victory on Sept. 10.

The California Senate voted, 39-1, on Wednesday to approve an Assembly-passed bill that will roll back the increase to 15% starting on Oct. 1 and suspend the excise tax from going up again until at least June 30, 2028.

The impact of this policy shift is a game-changer for many of the state’s cannabis retailers.

In 2024, there were roughly 1,200 licensed dispensaries that reported $4.9 billion in taxable sales, according to the California Department of Tax and Fee Administration (CDTFA). For the average dispensary, the difference between a 15% and 19% excise tax is more than $100,000 per year.

The Assembly passed the legislation, Assembly Bill 564, in a 74-0 vote in early June. The chamber concurred with the Senate amendments on Sept. 11, meaning it’s now being prepared for Gov. Gavin Newsom’s consideration.

Pushing the legislation across the finish line comes after Rep. Matt Haney, D-San Francisco, first introduced A.B. 564 in early February.

When Sen. Christopher Cabaldon, D-Yolo, introduced the legislation on the Senate floor this week, he pointed out that California’s regulated cannabis market continues to be dwarfed by the unlicensed market nearly nine years after California voters legalized adult use through approving Proposition 64 in the 2016 election.

In passing Prop. 64, voters wanted three things, Cabaldon said:

- To make cannabis legally available and safe

- To shut down the illicit marketplace

- To support a wide variety of environmental, social and educational programs

“That deal is fraying because the market is collapsing,” he said. “And, today, legal businesses in California capture just 40% of the cannabis market. Sixty percent is in the illicit market, subject to no protections for consumers or for the environment. And California is losing ground.”

Cabaldon was referencing a California Department of Cannabis Control (DCC)-commissioned report that was released to state lawmakers in March. ERA Economics LLC prepared the report, which estimated that 38% of cannabis consumed in California in 2024 came from the licensed marketplace, while the other 62% came from unregulated and untaxed sources.

Moreover, ERA Economics estimated that unlicensed cultivators produced 11.4 million pounds of cannabis, or roughly eight times more than the 1.4 million pounds produced by licensed cultivators. An estimated 9 million pounds left the state.

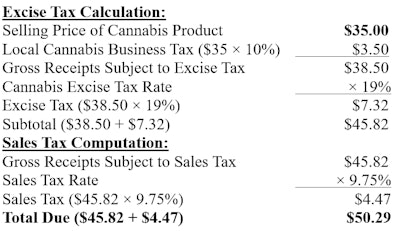

While California’s licensed dispensaries offer some of the cheapest cannabis prices in the nation, it’s also one of the heaviest taxed markets in the U.S., with the selling price of a product often marked up as much as 44% at retail after computing local cannabis business taxes, the excise tax, and the state sales-and-use tax.

Here’s an example of how a $35 cannabis product in Los Angeles is currently taxed at a cumulative 43.7% rate for a final $50.29 transaction:

While some may think that higher taxes lead to more tax revenue, that’s not always the case.

If $4.9 billion in taxable sales represents 38% of the market, then California is missing out on taxing $8 billion in unlicensed sales. That said, if California’s licensed program were able to capture 80% of the market, the state could cut the excise tax in half, to 7.5%, and it would still collect more revenue than it does now at the 15% rate.

Sens. Jerry McNerney, D-Pleasanton, and Tony Strickland, R-Huntington Beach, expressed this viewpoint during the Senate’s Sept. 10 floor session.

“The nonprofits are depending on this tax revenue [and] are really needing help,” McNerney said. “But even the bigger picture is that we want to control and contain and reduce the illegal market. Raising taxes right now is going to have an opposite effect. It’s going to drive people into the illegal black market on cannabis, which is a bad outcome.”

Strickland said, “I’m glad that my colleagues understand when you raise taxes, it’s bad for business. I understand that now you understand that when you raise taxes, it’s not good for the people who are actually providing the product. So, I hope you remember not just cannabis, but other issues we talk about, that when you lower the tax burden, it actually is good for business and the economy of California.”

Specifically, the cannabis excise tax increase to 19% was a trigger that was put in place under a law, A.B. 195, that Newsom orchestrated in 2022 as a trailer to the state budget he signed that June. The legislation was the result of a compromise he struck with certain cannabis tax revenue beneficiaries to make up for California’s elimination of a $161-per-pound cultivation tax.

The Allocation 3 recipients of California’s cannabis tax revenues include dozens of organizations, from childcare programs and youth groups to environmental, wildlife and conservation programs, law enforcement and justice organizations, and drug treatment prevention centers.

Many representatives from the tax beneficiary organizations opposed A.B. 564 during committee hearings, arguing that keeping the excise tax at 15% would deprive them of crucial funding.

Meanwhile, supporters of A.B. 564 argue that those Tier 3 organizations should be funded through the state budget and not tied to the successes or struggles of the cannabis industry.

Under A.B. 564, the DCC would be required to consult with the CDTFA and the Legislative Analyst’s Office and submit a report to the Legislature by Oct. 1, 2027, that analyzes the impact of the state’s cannabis tax law on the regulated market. The report must also recommend options for changing the law to accomplish the intent of legalization.

Despite the Legislature lining itself up to go through this process again in two years, industry stakeholders are taking the suspended excise tax increase as a win.

The passage of A.B. 564 “proves that sound policy wins” when state lawmakers listen to “data over rhetoric,” said Amy O’Gorman Jenkins, the executive director of the California Cannabis Operators Association.

“This bill protects consumers from dangerous illicit products while preserving the tax revenue that supports essential programs like child care and community reinvestment,” she said. “By stopping this misguided tax hike, the Legislature recognized that smart policy grows revenue by keeping the legal market viable. Driving consumers away from regulated dispensaries would have only undermined public safety and reduced funding for the very programs we all want to protect.”

O’Gorman said A.B. 564’s passage will also save thousands of jobs in the nation’s largest cannabis market, which employs nearly 75,000 workers throughout the state.