California’s 19% excise tax on cannabis sales will go back to 15% next month after Gov. Gavin Newsom signed legislation Sept. 22, allowing the state’s struggling industry to avoid a possible increase until at least 2028.

While Newsom had until Oct. 12 to sign or veto the legislation, his early action ensures that the effective dates of the bill, Oct. 1, will be implemented, saving licensed dispensaries and consumers the burden of continuing the higher rate, which has been in place since July 1.

The governor’s signing of Assembly Bill 564 comes after the state Senate voted, 39-1, earlier this month to approve the legislation, and after the Assembly voted, 76-0, to concur with the Senate’s amendments.

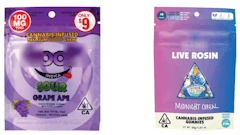

“We’re rolling back this cannabis tax hike so the legal market can continue to grow, consumers can access safe products, and our local communities see the benefits,” Newsom said in a press release on Monday. The state’s licensed market fosters “environmental stewardship, compliance-tested products and fair labor practices,” while funding vital social programs, according to the governor’s release.

The excise tax had automatically increased to 19% three months ago as a result of Newsom’s 2022 state budget, a hike he orchestrated as a compromise with cannabis tax beneficiary organizations as a means to make up for lost revenue for California’s elimination of a $161-per-pound cultivation tax.

Instead of funding certain social programs in the state budget itself, Newsom elected in 2022 to tie that funding to the success of the taxed cannabis industry.

Under A.B. 564, sponsored by Assemblymember Matt Haney, D-San Francisco, the 15% excise tax rate will remain in effect until at least 2028, when lawmakers will likely reconsider the issue.

“California’s cannabis economy can bring enormous benefits to our state, but only if our legal industry is given a fair chance to compete against the untaxed and unregulated illegal market,” Haney said. “A.B. 564 helps level the playing field. It protects California jobs, keeps small businesses open, and ensures that our legal cannabis market can grow and thrive the way voters intended.”

In California, where cannabis products are taxed at more than 40% after configuring local business taxes, the excise tax and sales-and-use taxes, the regulated marketplace is heavily outperformed by unregulated operators, who produce eight times more than licensed cultivators and sell nearly twice as much as licensed dispensaries, ERA Economics estimated in a March 2025 report.

This dynamic has proved problematic for California’s overtaxed cannabis operators, who, amid falling prices and declining sales figures, are on pace to provide the state $100 million less in excise tax revenue this year when compared to a market peak of $680 million in 2021, according to the California Department of Tax and Fee Administration.

In the Senate’s floor debate on A.B. 564 earlier this month, state lawmakers alluded to the idea that a lower tax burden on licensed cannabis retailers could actually net more tax revenue through grabbing a larger percentage of the market share from unlicensed operators. Under current market conditions, only about 38% of cannabis consumed each year by Californians is taxed.

During A.B 564’s committee hearings, many cannabis industry advocates said they believed there would be no industry left to tax without removing certain barriers.

Amy O’Gorman Jenkins, the executive director of the California Cannabis Operators Association, which represents more than 300 licensed operators, said Monday that the cannabis industry is grateful to Newsom for signing the legislation.

“He understood what opponents refused to acknowledge: You can’t fund social programs with revenue that doesn’t exist,” she said. “By stopping this misguided tax hike, the governor and Legislature chose smart policy that grows revenue by keeping the legal market viable instead of driving consumers back to dangerous, untested illicit products. This signing brings us closer to fulfilling Proposition 64’s promise: patients and consumers accessing safe, regulated cannabis while generating sustainable tax revenue for child care, youth prevention and public health programs.”