schumer.senate.gov; Adobe Stock

Following a weekly caucus meeting, the majority leader and other Senate Democrats held a news conference about their legislative agenda for the week as well as President Biden’s upcoming State of the Union Address planned for 9 p.m. March 7.

Responding to a reporter who asked what the Senate can “realistically” accomplish to advance Biden’s agenda before the November election considering the partisan divide in Congress, Schumer said many of the bills his Democratic-controlled chamber has passed are bipartisan.

“We’re going to work very hard on many different things,” he said, adding that his caucus wants to provide $35 insulin “for everybody” and improve the nation’s health care system.

“We believe very strongly in so many things, and we are going to continue to work on the agenda that we put before us,” Schumer said. “We first have to fund the government. The supplemental is very important. But after that, you will see us turn to many of the bills that we passed: the SAFER [Banking] Act, safety on the rails, RECOUP [Act]—so many other things.”

The U.S. House passed a bipartisan funding package later on Wednesday in a 339-85 vote, with the legislation now heading to the Senate under pressure to hit a March 8 deadline to avoid a partial government shutdown. Notably, funding for federal programs under six appropriations bills runs out on March 8, and as well as under another six bills on March 22, ABC News reported.

Should Congress address these funding packages, lawmakers in Washington wouldn’t have to revisit the bills until September, according to ABC, providing roughly six months for party leadership in each chamber to focus on other legislative priorities.

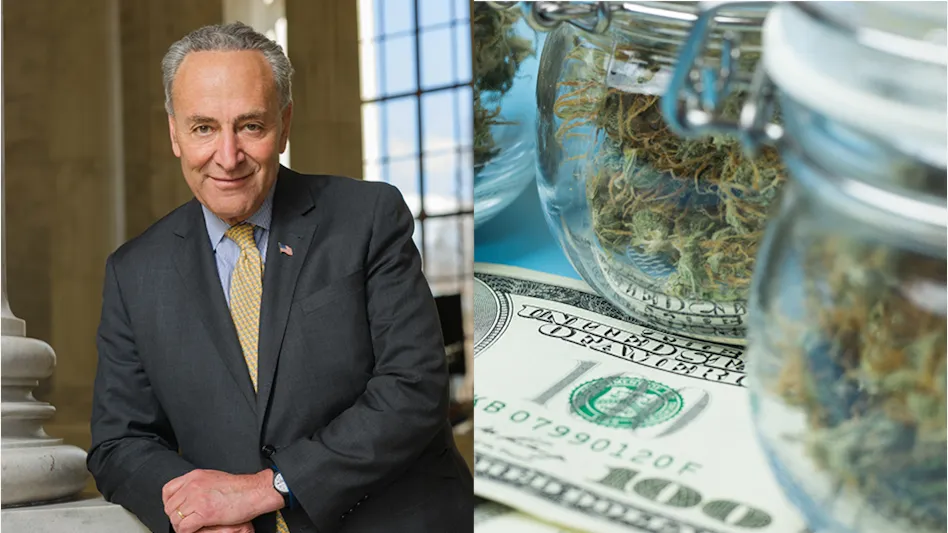

In the Senate, Schumer holds the power to call a floor vote for the Secure and Fair Enforcement Regulation (SAFER) Banking Act (S. 2860), legislation that intends to provide the green light for financial institutions to serve the cannabis industry without fear of penalty, as cannabis remains an illegal substance under federal law.

In particular, Schumer is one of 36 senators who has signed on to sponsor or co-sponsor the bill, which the Senate Banking Committee advanced in a 14-9 vote in late September, with three Republicans backing the measure.

At the time, Schumer said that he had planned to bring the bill “to the floor for a vote as quickly as possible.”

Schumer also said he was committed to including criminal justice provisions, like the Harnessing Opportunity by Pursuing Expungement (HOPE) Act, to the SAFER Banking Act, as well as the Gun Rights and Marijuana (GRAM) Act, which would allow state-legal cannabis consumers to purchase and possess firearm.

“Once it’s reported out of committee, I will put SAFER Banking on the floor for a vote very soon,” he said on Sept. 27. The bill was officially placed on the Senate legislative calendar Sept. 28 under general orders as calendar No. 215.

But it’s been more than five months since then and still no dice regarding a date for floor action.

While at least 43 senators from the Democratic caucus—if not more—likely support the SAFER Banking Act, according to Cannabis Business Times research, negotiations to gain more broad bipartisan support still remain tied to Section 10 of the legislation, federal cannabis lobbyist Don Murphy said Feb. 29 on social media.

Republicans have expressed concerns for years with previous versions of the legislation and how “Operation Choke Point,” an Obama-era initiative that put pressure on banks to break ties with certain “high-risk” industries like firearm manufacturers and payday lenders, could potentially come back to light under the SAFER Banking Act.

Moreover, even if the SAFER Banking Act gains the 60 votes it needs to pass in the Senate, it must be an attractive enough measure for Republican House leaders to move it forward in their chamber.

While the U.S. House passed previous versions of the legislation seven times between 2019 and 2022—with large bipartisan support—that was when Democrats controlled a majority in the lower chamber.

“I spent most of the day talking to members from the [House] Financial Services Committee and the Judiciary Committee, a lot of whom voted no on SAFE Banking in the past,” Murphy said last week on social media. “They are waiting for the thumbs up from [Rep.] Blaine Luetkemeyer, the negotiator on the project ‘Choke Point’ language—that’s Section 10 of SAFE Banking.

“When that is resolved, and it will be before it comes over from the Senate, there are a lot of Republicans that are going to fall in line and vote yes on SAFE Banking, not because it’s a banking bill about cannabis or it’s a pro-cannabis bill, but because it is a gun bill at that point. And Democrats are comfortable enough with it to let it go, and Republicans will get on board.”

“So you’re telling me there’s a chance!”

— Don Murphy (@donmurphy12a) February 29, 2024

Longtime NOs could vote YES on amended #SAFEBanking bill.

Have a great weekend Twitter friends. pic.twitter.com/w6O6YSCux7

While at least nine Republican senators backed a previous version of the SAFER Banking Act—the SAFE Banking Act—last year, enough to avoid a potential filibuster, only four Republicans have signed their names to co-sponsor the latest version of the bill in the Senate.

And as has been the case since January 2021, Schumer holds the keys to a potential floor vote in the upper chamber.

Latest from Cannabis Business Times

- Verano Opens MÜV Haines City, Company’s 75th Florida Dispensary

- Ascend Wellness Holdings Reports $142.4M Net Revenue for Q1 2024

- Trulieve Reports $298M in Revenue for 1st Quarter 2024

- SNDL Reports 1st Quarter 2024 Financial, Operational Results

- Leading Cannabis Brand STIIIZY Expands Retail Presence With Fresno Location Opening Saturday, May 11

- The Cannabist Co. Reports 1st Quarter 2024 Results

- Green Thumb Reports $276M Revenue for 1st Quarter 2024

- Colorado Legislature Gives Final Approval to Measure Aimed at Streamlining Marijuana Regulations