As the newly titled SAFER Banking Act remains calendared for a committee markup at 9:30 a.m. Sept. 27, the center of attention this past week has been on revised language following months of negotiations in the U.S. Senate.

But perhaps most iconic about recent movement on the Secure and Fair Enforcement Regulation (SAFER) Banking Act of 2023 (S. 2860)—with the word “regulation” added to the revised legislation that was formally introduced Sept. 20—is that fact that the upper chamber is taking the lead this time around and has navigated a path forward after years of no action.

In particular, the Senate Banking Committee appears to be on the eve of advancing the federal cannabis banking reform legislation with Majority Leader Chuck Schumer, D-N.Y., vowing to bring it to a full floor vote thereafter.

While past renditions of the bill attracted far-reaching bipartisan support for seven passages in the U.S. House since 2019 (which this article highlights below), leadership in the Senate has been unwilling to push a filibuster-proof envelop until now.

This history is representative of two key questions that dictate the success for any legislation viewed as nonessential in the eyes of the U.S. Congress: Does it have the votes to pass, and are the four corners of Washington’s political playbook on board?

Today, these four corners include Senate Majority Leader Schumer, House Speaker Kevin McCarthy, R-Calif., Sen. Mitch McConnell, R-Ky., and Rep. Hakeem Jeffries, D-N.Y., who replaced Rep. Nancy Pelosi, D-Calif., as the House Democratic leader at the beginning of 2023. As it stands, McConnell is the only pillar to vehemently oppose SAFE Banking as a standalone measure, but McCarthy's priorities in the House don't necessarily open the door for swift legislative action on SAFE Banking.

And the power of these “big four” lawmakers is largely at play with regard to the Senate’s recent quarterbacking of banking reform for the cannabis industry. Notably, based on his voting history, McCarthy has supported the SAFE Banking Act as standalone legislation in the House but not as attachments to larger bills, such as various spending packages.

This is significant, because McCarthy took over the reigns as House Speaker from Pelosi in January. So, if he fails to bring the SAFE Banking Act forward as a standalone measure in the lower chamber, the likelihood of it being attached to another bill is slim to none in the Republican-controlled House.

Also significant, Schumer, who took his majority leadership position from McConnell at the beginning of 2021, recently committed to bringing the revised SAFER Banking Act to the floor of his chamber (a first for the reform effort).

“For too long, the federal government has continued to punish marijuana users and business owners—even when doing so is actively harmful to our country,” Schumer said Sept. 20 in a press release. “This ‘war on drugs’ has turned into a war on people and communities—specifically people and communities of color—and a war on business.”

Schumer also indicated his intention to attach the HOPE and GRAM acts to a SAFER Banking vote.

The Harnessing Opportunities by Pursuing Expungement (HOPE) Act, sponsored by Rep. Dave Joyce, R-Ohio, would authorize the Department of Justice to make grants to state and local governments to reduce the financial and administrative burden of expunging convictions for state cannabis offenses.

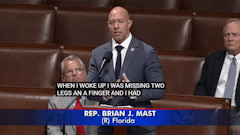

And the Gun Rights and Marijuana (GRAM) Act, sponsored by Rep. Brian Mast, R-Fla., would remove federal firearms-related restrictions on certain individuals who use or are “addicted” to cannabis.

Schumer’s attitude toward supporting incremental cannabis banking reform ahead of his own broader legalization effort—the Cannabis Administration and Opportunity Act (CAOA)—is a shift that he came around to during last year’s lame duck session, when the realization of a changing House majority was setting it. Democrats largely had the capability to advance their legislative agenda with majority power in both chambers and the presidency last Congress.

But, after failing to bring the SAFE Banking Act forward as standalone legislation in the Senate throughout 2021 and 2022, Schumer made a last-ditch effort following the November 2022 election to attach the bill to the National Defense Authorization Act (NDAA). McConnell pulled his four-corner card and squashed that attempt during negotiations.

And here we are in 2023, with Schumer and Senate Banking Committee Chairman Sherrod Brown, D-Ohio, working toward the SAFER Banking Act’s standalone passage in the upper chamber. But now, despite seven House passages coming under Democratic control, the tables have turned with McCarthy largely holding the keys to the floor in the lower chamber.

So, the questions dictating possible enactment have changed: Will McCarthy’s past support for SAFE Banking roll over to what the Senate puts forward in the revised SAFER Banking language? And will Schumer’s intentions to attach the HOPE and GRAM acts to the measure enhance or diminish its chances of passage?