Illinois’ adult-use cannabis sales began in January 2020, mere months before the onset of the COVID-19 pandemic. As a result, the state’s expansion of licenses continues to be slow and arduous. Despite this, Illinois residents made no delay in purchasing legal cannabis. Adult-use cannabis sales in the state continue to break records, with July 2021 setting the new monthly high of nearly $128 million. Using Brightfield Group’s 2021 U.S. Cannabis Consumer Insights, we look at how Illinois cannabis consumers are shaping up compared to the national average.

The Women Cannabis Consumers of Illinois

Nationwide, 51% of cannabis consumers in 2021 are women. In Illinois, the gender balance tips further female with 55% of consumers being women. Nationwide, female cannabis consumers skew younger, but this is even more true in Illinois, as 37% of women who use cannabis in Illinois are under 30 years old.

Young female cannabis consumers in Illinois appear to be less loyal than their older counterparts, according to Brightfield data that measures consumers on a scale of two extremes: loyal and fickle. Gen Z and millennial women in Illinois are 31% below average in terms of their loyalty, while Gen X and baby boomer cannabis consumers in the state are 19% above average. With their potential to spend decades in the market, gaining the loyalty of these younger consumers could be a profitable endeavor.

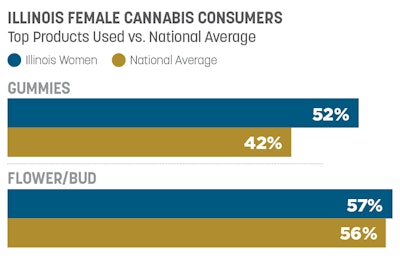

Looking at product types, women cannabis consumers in Illinois are loving gummies: 52% have used a THC gummy in the past 6 months, compared to 42% of cannabis consumers nationwide. At the same time, their flower usage (57%) remains in line with the national average (56%).

Relaxation is the Priority

Relaxation is the top desired cannabis effect nationally, and Illinois consumers at large are especially looking to unwind. In Illinois, 72% of consumers desire relaxation from cannabis, compared to 64% nationwide. They are also slightly more likely to use cannabis while relaxing at home and before bed.

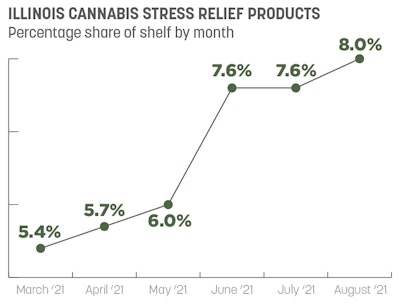

Why the need for relaxation? 52% of Illinois cannabis consumers report suffering from anxiety, which is 13% higher than cannabis users nationwide. Looking to Brightfield’s Distribution Trends data, products positioned specifically for stress relief grew their share of shelf by 48% from March 2021 to August 2021. Though it may be unclear why these consumers are more stressed than others, it is clear there is a large niche looking for stress relief in Illinois.

Spending Shifts

Illinois cannabis consumers are less affluent than the average cannabis consumer. Nationally, 41% of cannabis consumers report an income over $75K. In Illinois, only 27% report so. But Illinois consumers aren’t spending significantly less per product nor per month. They are most likely to spend in the middle range of $30 to $100 per product. They are less likely than average to spend under $30 per product, which is indicative of the small number of legal products available at lower prices.

As new brands enter Illinois, price could be a key differentiator. With 68% of Illinois cannabis consumers saying price is important to them, a well-positioned budget brand could stir up competition.

As the number of fully operational dispensaries, cultivation facilities, and infusers in Illinois rapidly increases in the coming years, keeping an eye on the Illinois consumer will make for the strongest brands and products.