In November 2020, voters passed the Smart and Safe Arizona Act (Prop 207), legalizing adult-use cannabis for those 21 and over. Thanks to its flourishing medical cannabis economy, Arizona is considered one of the most promising new recreational markets in the U.S. All medical retailers qualified for adult-use permits, and thanks to a new social equity license program, we can expect to see increased diversity and liquidity across the state.

However, the transition has not been without challenges. Adult-use sales officially kicked off in January 2021, but because of the tight timeline between approval and retail go-live, the market is playing catch up.

Still, there’s a lot of optimism around the state’s ability to succeed long-term. Here are some top trends to keep an eye on.

Testing delays are slowing retailers down.

When adult-use sales first went live, Arizona dispensaries were met with an influx of consumer demand. While Q1 2021 sales in Arizona through LeafLink’s marketplace (which has 100% dispensary penetration in the state) increased by 93% from the same period in 2020, new testing requirements enacted as part of Proposition 207 created supply-chain bottlenecks, as labs were unable to keep up. Brands struggled to bring enough product to market, and retailers found themselves with fewer options to stock their shelves.

Flower shortages give rise to a surge in cartridge demand.

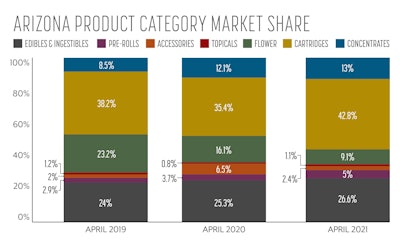

As with many newly-legalized markets, Arizona saw a spike in demand for flower in the early days of recreational sales—so much so that cultivators could not keep up. Starting in March 2021, flower prices skyrocketed, increasing 161% month-over-month compared to February. The increase in prices caused demand for these products to fall; by April 2021, flower’s market share dropped to 9%, a 3-percentage point decline compared to the previous month.

Meanwhile, as consumers looked for substitutes, cartridges increased their market share by 7 percentage points year-over-year. However, the increasingly popular cartridge category is not yet saturated. While these products made up 43% of April sales in Arizona on LeafLink, only 35% of brands in the state sell products in this category, meaning that there is great opportunity for new sellers to enter the market.

Big players have their eyes on Arizona.

Thanks to Arizona’s existing medical cannabis infrastructure and an addressable market of more than five million adults, many multistate operators see this state as a major investment opportunity. In other states with similar medical-to-recreational paths, the acceleration to success has been quick. In Michigan, for example, monthly sales through LeafLink’s marketplace in December 2020, just one year after adult-use sales launched in the state, were up more than 150% compared to the previous year. Industry leaders expect to see similar growth in Arizona, and are eager to get in at the ground floor. In one of the most exciting cannabis industry deals to date, Florida-based Trulieve bought well-known Arizona brand Harvest. We will likely see more industry players looking for their own foothold as more licenses become available.

Despite a few bumps, Arizona is on track to be the fastest recreational ramp up we’ve seen yet. In April 2021 alone, retailers purchased 65% more than they did during April 2020, and average order value was up 69% year-over-year. Now that the state has fully reopened post-COVID, we can expect demand to continue to grow. Brands that keep shelves well-stocked and offer consumers a healthy product assortment will come out on top.