Since legalizing medical cannabis in June 2018, Oklahoma regulators have taken a hands-off approach that lets the free market naturally decide the optimum number of operational businesses, while other new markets, such as Illinois, are attempting to create a closely controlled market.

This lax attitude extends beyond business licensing into patient applications. More than 7% of Oklahoma's population is enrolled in the medical program due to a lack of state-approved qualifying conditions. Patients only need a doctor's recommendation to join the state’s registry.

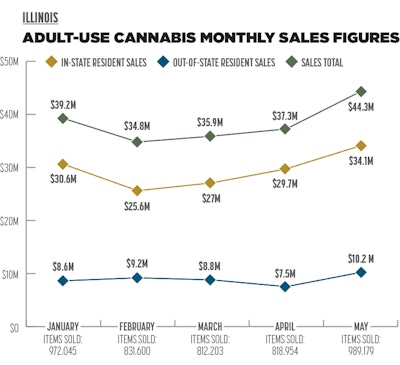

By comparison, Illinois has seen marginal growth since launching adult-use sales in January, in part due to market restrictions enacted by the legislation the governor signed. Even though adult-use legalization has made products available to Midwestern residents this year, the Illinois market’s total sales are only just matching those from Oklahoma's medical-only program, according to research from Brightfield Group.

Major limitations on Illinois' medical-market enrollment, including a restrictive qualifying conditions list and a fingerprint requirement, constrained participation in Illinois’ program until 2019 changes were implemented (e.g., Gov. J.B. Pritzker repealed the fingerprint requirement). At the same time, Illinois has granted roughly 40 times fewer dispensary licenses than Oklahoma as of June 12. Illinois’ medical program was designed to be highly regulated, depressing patient participation—less than 1% of the state's population is currently enrolled. As the state implemented adult use, regulators delayed allocating additional licenses until well after the program's inception. These licensing decisions stunted Illinois' growth by not allowing the supply to grow to meet demand.

As a result, Oklahoma's medical program sales are only slightly behind Illinois' totals despite only having a third of the population. Product selection in Illinois is lacking, and products are generally twice as expensive as they would be in Oklahoma due to supply constraints (~$65 for an eighth of flower in Illinois compared to ~$30 in Oklahoma). A bulk of Oklahoma's 9,266 business licenses are held by small local companies, while Illinois has a higher relative level of multi-state operator (MSO) presence.

Oklahoma has some of the lowest barriers to entry for dispensaries and producers (the state requires a $2,500 application fee, a fraction of the cost in other states) and lacks a vertical integration requirement, which sets up a boom for industry firms. The low barrier to entry has allowed interested residents with little capital to jump in.

With its plethora of licensed businesses, the Oklahoma market is encouraging greater competition, and Brightfield Group research shows the state has successfully driven down prices for customers and continues to attract new license applicants. Oklahoma might be a good case study for regulators weighing the impacts on local and state revenue against the creation of a sustainable marketplace.