In Michigan and Oregon, supply and demand dynamics driven by each state’s different stages of market maturity are producing stark differences in wholesale purchase behavior and product pricing. While there are many factors at play when it comes to supply and demand, market maturity is a big reason for the differences in pricing and behavior. Oregon was one of the first movers to open its adult-use cannabis market in 2015, while Michigan completed its first year of adult-use sales in 2020.

To say that Michigan’s adult-use market has expanded rapidly during the past year would be an understatement. This expanding retail market serves an adult-use cannabis population that has grown by 75% since 2010, and adult-use cannabis retailers recorded more than $980 million in sales in 2020. Michigan orders on LeafLink grew 157% for the first six months of 2021, compared to the same period in 2020, further illustrating this significant increase.

Despite having less than half the population of Michigan (4.3 million vs. about 10 million), Oregon’s cannabis market topped $1 billion in sales in 2020. Comparing LeafLink order growth with Michigan’s 157% increase, Oregon sales grew 45% during the same period.

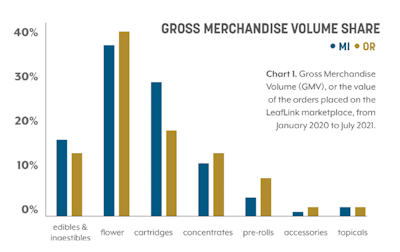

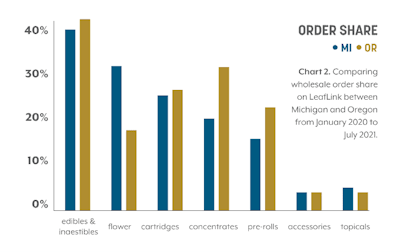

When it comes to market share by product category, Michigan and Oregon are fairly similar. While Michigan consumers tend to purchase more cartridges and Oregon consumers more pre-rolls, flower has the highest market share in both states as measured by Gross Merchandise Volume (GMV), or the value of wholesale orders placed on the LeafLink marketplace. Flower held a 39.2% market share in Oregon and a 35.1% market share in Michigan between January 2020 and July 2021.

Digging deeper into purchase behavior, 32% of all wholesale orders in Michigan include flower, compared to just 16% in Oregon. Also noteworthy is that Michigan wholesale flower orders average $11,000 at approximately $2,000 per pound, while Oregon flower orders average less than half of that ($5,000 and roughly $1,000 per pound). Despite a similar flower market share in each state, supply and demand realities are creating divergent wholesale purchasing behavior.

Michigan flower supply is constrained in the regulated market, and the demand for quality flower (whole flower, packaged goods/pre-rolls and for producing concentrates) continues to increase. In terms of purchase volumes, Michigan retailers are ordering large quantities about every 30 days, per Michigan’s recent Average Order Volume, which is 41% higher than that of other state markets on LeafLink with at least 10 sellers of flower between April and July 2021.

Conversely, Oregon has a major cannabis surplus, and prices are only 66% of Michigan’s. Still, Oregon cannabis consumers prefer flower to other products, driving a higher percentage of market share for flower in Oregon as compared to Michigan. Oregon retail buyers are responding by purchasing smaller quantities of flower more often –– on average every two weeks. Oregon’s abundant supply chain enables retailers to continually stock fresh flower without driving competition for product.

Markets at Work

In response to these market conditions, Michigan growers are expanding their capacities and reinvesting capital from flower sales. This self-funded approach is a sign of maturity and overall market strength, and the impact of additional capacity is already being felt as Michigan flower prices fluctuate within a band, rather than just increasing over time.

Oregon’s $1 billion market continues to experience oversupply, and in 2019 state lawmakers passed legislation to allow Oregon growers to export product to other legal markets if and when interstate cannabis trade becomes a reality. At that time, an entirely new set of market dynamics will come into play.