As legal adult-use cannabis markets evolve, how does the consumer base change? Are the purchasing patterns of a seasoned Oregon consumer who has been shopping on the legal market since 2015 similar to those of a purchaser who walked into a Michigan adult-use dispensary for the first time in 2020?

It turns out the answer is largely yes—product purchase patterns are quite similar across U.S. state markets, regardless of market maturity.

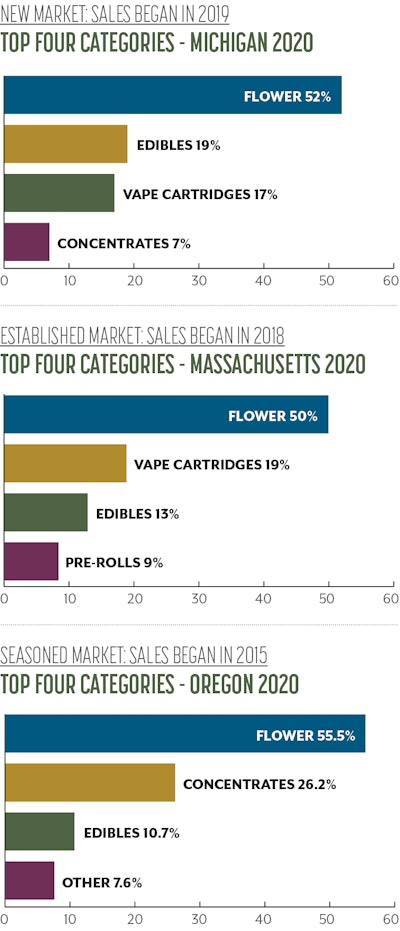

Brightfield Group has broken down 2020 cannabis sales by product category for three states: Michigan (new market), Massachusetts (established market), and Oregon (seasoned market). The three demonstrate that there are some universal trends in product popularity, namely:

- Flower, edibles, and vapes/concentrates are top sellers.

- Flower is highly popular, driving at least half of sales and at least double the revenue of the second-ranking product types, in both new and seasoned markets.

The data shows that there are minor shifts in market behavior over time, however. Some examples include:

- Edibles and drinks are more popular in newer markets. These products drive about 11% of sales revenue in mature Oregon, 13% in established Massachusetts, and 19% in new Michigan.

- Vapes and concentrates are only slightly more popular in mature markets versus new markets, but they do begin to significantly outpace edibles as markets mature. Vapes and concentrates together drive 26% of sales revenue in mature Oregon, 27% in established Massachusetts, and 24% in new Michigan.

The message for those planning inventory and stocking shelves for burgeoning and maturing state industries alike? There will always be a market for these top sellers (barring regulatory limitations), though edibles sales may wane over the long-term.

While the breakdown of cannabis consumers in each state may be different demographically, with customers consuming for various reasons, when they leave the dispensary, the product mixes in their baskets tend to look very similar.