After a difficult 2019 that left cannabis companies reeling from dried up investment funds, brands started 2020 with minimally available capital, and the COVID-19 pandemic didn’t help. Strapped for funding, cannabis brands had to be strategic with the products they brought to market.

Despite this, Brightfield Group tracked 912 new product launches in 2020 (as of press time), with some products securing shelf space across different markets. Into 2021, cannabis innovation will only continue.

Legislative Changes Open Opportunities for Cannabis Brands

In the 2020 U.S. election, Arizona, Montana, and New Jersey legalized adult-use cannabis; Mississippi legalized medical cannabis; and South Dakota passed both medical and adult use. Of these states, Brightfield Group predicts New Jersey and Arizona will see adult-use sales in late 2021. New York and Rhode Island also could see recreational sales this year, as both state legislatures were already talking about adult-use legalization as of December 2020.

The West Coast has maintained a competitive edge over the East Coast due to its well-established markets, cannabis-friendly climate, and access to capital. Brands already operating in California or Nevada will be able to enter Arizona’s adult-use market with experience. Additionally, many brands already operate in Arizona’s medical market, such as Keef and DNA Genetics.

The East Coast cannabis market is much less established, with only Massachusetts having adult-use dispensaries for more than a year. The multistate operators that sell medical cannabis on the East Coast—like Curaleaf and Cresco Labs—will likely help transition East Coast markets to adult-use, as they have done in Illinois. East Coast legalization will provide much-needed capital to the U.S. cannabis market; but with brands fiercely competing on the West Coast, we’ll likely see most of the innovation on the West rather than the East. Products that can successfully compete in these markets may then establish themselves across the U.S.

Product Technology Advancement Continues

Looking from a product perspective, Brightfield Group expects cannabis edibles technology will continue to advance toward quicker, more precise onsets. Several brands in the U.S. and Canada introduced gummies, drinks, and powders with improved THC bioavailability for more effective uptake. By improving how THC is absorbed in the body, cannabis companies can more accurately provide a uniform onset time and length of experience.

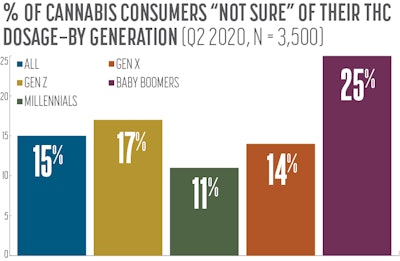

In 2020, consumers became more aware of their THC doses. Brightfield Group’s U.S. Cannabis Consumer Insights reveals that only 15% of all cannabis consumers in Q2 were “not sure” of the dosage they take, down from 21% in Q1. Generationally, Baby Boomers are the most likely to not know their dosage, but still only 25% report not knowing. With only 11% of Millennials unaware of their dosage, edibles brands must continue to innovate to suit consumers’ experiential desires. Predictable dosages only serve to add more credibility to an edibles brand, and the quest for ingestible products that mimic inhalable experiences will keep this category innovating through 2021.