While the world turned upside-down in the spring of 2020, the general profile of cannabis consumers began shifting as well.

“There was a significant amount of new customers,” Socrates Rosenfeld, co-founder and CEO of online ordering platform I Heart Jane, says. This pointed to a growing comfort with the idea of cannabis, particularly among those who perhaps hadn’t tried it in the past or hadn’t consumed anything beyond flower. “Product discovery was another trend. We saw people adding new products, new complements or substitutes to their cart. That was really interesting.”

With 500,000 SKUs on the platform, consumers across the U.S. have been able to settle into the shopping experience from their home.

“We've seen a lot more activity and searches and adding multiple items to a card, comparatively shopping, within category and cross-category,” Rosenfeld says. New product silos—like concentrates, in particular—have been rising in the sheer number of sales transactions over the past year.

This coincides with the ascent of online ordering and curbside pickup more broadly. On the retailer’s side of the transaction, this means more data—which allows for a more nuanced approach to purchasing and inventory tracking.

Before March 2020, Rosenfeld says that I Heart Jane was tracking 17% online ordering across the U.S. As the quarantine lifestyle became the norm, that stat jumped to a peak of 50%. “That’s held steady, six, seven, eight, nine months,” he says.

So, with more sales coming from digital platforms and more customers getting acquainted with concentrates, what can retailers do to capitalize on this trend?

“Really, it starts with flower,” Rosenfeld says, pointing to the inhalation aspect. “That’s really the threshold into concentrates.”

It’s important for retailers to understand that customer flow, however. Whereas budtenders can help guide the individual customer through the physical space of a dispensary, that process is a bit more distant now—but only in the analog sense.

“It all kind of leads back to [retailers] understanding the consumer and understanding how their SKUs move,” Rosenfeld says. “And I can't overemphasize that point.”

Prior to digitization and the onset of the pandemic’s new rules, consumers mostly shopped in-person (remember that online ordering was only 17% of I Heart Jane sales prior to March 2020). Shoppers might have milled around the dispensary, debating different products and perhaps making a series of decisions on the spot. Now, on an online platform, those movements are tracked. Items go into carts, then they’re replaced as the shopping experience continues. Search terms lead to new discoveries. Flower devotees drift over to the concentrates tab, examining deals and comparing THC potency rates. It’s a wealth of new data.

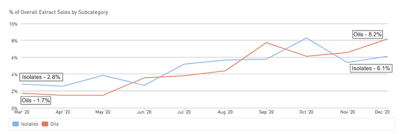

concentrates sales data cannabis

concentrates sales data cannabisThis invigorated interest allows retailers to grow more sophisticated with the suite of product offerings in-store. Classic flower customers may find that a well-timed deal on isolates will catch their attention. Whereas flower and edibles, in many cases, are the more familiar product categories, the concentrates segment requires a bit more of an active retail approach to educate consumers and convey the unique properties of “isolate,” “wax,” “shatter” and so on. For many, especially those newly converted to the market, those terms are unknown.

It’s a two-way transaction, with the dispensary offering education and the customer offering a willingness to explore new product categories.

“Once you have information,” Rosenfeld points out, “now you're able to place better and better bets on what the consumer will want today and for years to come.”