Occasion-based marketing focuses on when and where consumers are using products. This approach can help brands develop a strong customer relationship by aligning messaging with what current and potential customers are doing while using certain products.

Fitting into many occasions, cannabis can be marketed for very different people and purposes. People report consuming cannabis first thing in the morning, right before bed, and during various activities in between. Marketing for cannabis occasions can also include holidays like 420 (April 20) or 710 (July 10, or “oil day”).

One of the most interesting opportunities for occasion-based marketing is in video games. Cannabis use “before/while playing video games” increased 86% from Q1 to Q3 in 2020. In Q3, 54% of consumers enjoyed cannabis during this occasion, and Brightfield Group has dubbed them “CannaGamers.”

Appealing to CannaGamers

Despite the 54% of cannabis consumers using cannabis while playing video games, products that include video games in their marketing capture a mere 0.2% of the U.S. cannabis market. When looking at just vape products, this positioning has less than 1% market share. Brands that sell inhalables have a great opportunity here to appeal to CannaGamers while there is very little competition.

Cannabis products positioned for use with video games increased distribution at the end of 2020 and saw increased social chatter, according to Brightfield Group’s Innovation Insights portal. “Video games” was the second-fastest growing topic among cannabis consumers on social media in the second half of 2020. Nearly all the products positioned for video games are inhalables (vapes, flower, and concentrates). Vapes make up 81% of market share for this positioning.

Products positioned for video games include the use case in its description. For example, Heavy Hitters’ Super Lemon Haze cartridge is described as “Good for: Beach time, playing video games, pre-gaming your favorite concert” on some dispensary menus.

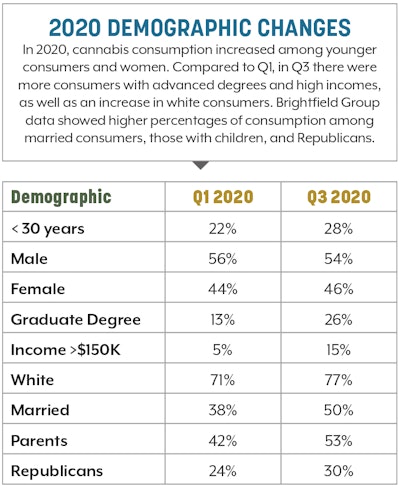

CannaGamers follow similar trends to the wider cannabis consumer population, (see overall demographic changes in chart) such as an increasing number identifying as Republican. Thirty-two percent of CannaGamers are Republicans, compared to 30% for the wider cannabis-consuming population, which increased between Q1 and Q3 2020, following the trend of red states legalizing cannabis.

There also were more CannaGamers with advanced degrees and higher incomes in Q3 2020 compared to Q1. In Q1, 14% of CannaGamers had advanced degrees. In Q3, 30% did—a 114% increase. In Q1, 6% of CannaGamers earned $150K or more. In Q3, 17% reported earning that amount. With coronavirus pandemic restrictions and fears keeping people home, they likely had more time to spend on video games.

We also saw more married and parent CannaGamers, a trend seen in the general cannabis consuming population but more pronounced for CannaGamers. In Q3, more than half of CannaGamers were married, and another 61% have children (a 30% increase from Q1 to Q3).

Unlike the general cannabis consumer population, the gender balance of CannaGamers skewed even more male in Q3 than it did in Q1.

However, although 39% of all CannaGamers are women, they make up the bulk of CannaGamers aged under 30; 55% of 21- to 29-year-old CannaGamers are women. During the pandemic, these young women consumed cannabis more often than their male counterparts.

Gen Z women in general trended toward more consumption than women who are older, but CannaGamers even more so. Forty-six percent of Gen Z women reported consuming cannabis multiple times a day, and they represent a virtually untapped niche.