For all the turbulence that 2020 wrought, Illinois launched adult-use cannabis sales, and the program’s revenue more than doubled in less than a year. With the state’s adult-use program in its second year, growers and industry stakeholders are assessing how the market is shaping up.

“Overall, being that Illinois came online kind of late to the party, there might be some in the national cannabis industry that don’t necessarily think it’s super far along as far as its product availability and product quality,” Victoria Mendicino, chief of staff at vertically integrated multi-state operator (MSO) Revolution Global, said in December 2020. “But I would invite them to definitely take a closer look because there’s some really high-quality product out there.”

Conversations in Illinois revolve around how to match supply with demand, including by licensing more businesses: dispensaries, craft growers, infusers and transporters especially are needed, according to stakeholders. As one of only two states to legalize recreational cannabis sales through its state legislature, and one with an eye toward repairing the harms of the drug war, Illinois is the subject of both praise and criticism as its adult-use program matures.

Matching Supply with Demand

Illinois began adult-use sales on Jan. 1, 2020, with a bang. The state’s retail adult-use and medical sales for January 2020 amounted to roughly $62.6 million, up from about $27.4 million in retail medical sales for December 2019. Demand was so intense, multiple stores temporarily closed during that first week of adult-use sales or limited adult-use sales so they could prioritize medical patients as they struggled to keep up with a newfound customer base. Many of those customers were Illinoisans who had never legally purchased cannabis in their home state.

More than a year later, the situation is less extreme, but problems remain with syncing up customers and the supply chain.

“The first year has been a relatively undersupplied market with a shortage of retail outlets and slightly less than adequate supply of cannabis, but maturing very quickly,” Dusty Shroyer, chief operating officer at Revolution Global, said in January. “Everybody got to work right away—all the cultivators here take the industry really seriously. Everybody started building more space, bringing more product to market and evolving their current product lines and making them even better, because just the whole industry at large is evolving.”

Illinois-headquartered Revolution Global produces cannabis for the Illinois medical and adult-use markets with about 75,000 square feet of indoor cultivation, processing, manufacturing and laboratory space in the city of Delavan. It also runs the medical cannabis store New Age Care in Mount Prospect, Ill., where it plans to add adult-use pickup orders in March or April. Revolution Global also plans to add about 75,000 more square feet of cultivation space in Delavan, Ill., which it expects to come online in summer 2021.

But until then, Shroyer said it’s tough to keep up with the demand in one of the U.S.’s most populated states.

“We don’t make enough—we wish we had more,” he said. “We’re working on more grow space all the time so we can produce enough.”

As with Revolution, vertically integrated MSO Cresco Labs is headquartered in Illinois and got in on adult-use legalization at the ground level. Melissa Wagamon, regional vice president for the Great Lakes at Cresco, recalled that at the beginning of 2020, lines wrapped around Illinois dispensaries, but that has largely subsided. (The company is now up to running 10 of its own Sunnyside dispensaries in the state.)

“I think what we’re seeing is that the industry is really better able to supply the market now than what we used to be [able to do],” Wagamon said in December 2020. “I think there’s still more room to grow there, for sure, but I think it’s been a wonderful year.”

To try to better align its own cannabis production with demand for medical and adult-use product, Cresco completed an expansion of its Lincoln, Ill., cultivation center in April 2020 to add 180,000 square feet of indoor and greenhouse growing space. The Lincoln location is one of three growing facilities—and the largest—that Cresco has in the state; its others are an indoor cultivation and processing facility in Joliet and an indoor cultivation facility in Kankakee.

“We were able to open the cultivation center at Lincoln, which has really helped us have more supply,” she said.

This past year hasn’t gone the way anyone anticipated, and Wagamon noted the drastic effect the COVID-19 pandemic has had on Cresco’s operations.

“I would say we’ve completely overhauled the way we work, everything from schedules to staffing to the way people move throughout the facilities even,” Wagamon said. “So, there’s been an intense amount of effort put in, I would say, [including] contact tracing and all of those things. We work pretty heavily with an epidemiologist, and that’s been a real help for us.”

Matching supply and demand largely falls on the plant-touching supply chain and has improved since adult-use sales launched, said Toi Hutchinson, senior adviser to Gov. J.B. Pritzker for cannabis control.

“A lot of the supply things have been eased over time, just as cultivators can catch up with the growing demands of it,” she said. “But what the state is trying to do is get more operators online so that there’s more grows, and hopefully those issues will smooth out as we keep treading along.”

Delay of Dispensary Licenses Coming Online

In 2020, Illinois state officials delayed issuing new dispensary licenses, drawing the ire of some, and—as part of an analogous controversy—also delayed issuing craft grower, infuser and transportation licenses. In the case of the dispensaries, the delay was just one of the debates that have cropped up.

The state was originally slated to issue 75 conditional dispensary licenses on May 1, 2020, according to its 2019 legalization bill, the Cannabis Regulation and Tax Act. But when officials shifted their focus to controlling the pandemic, they delayed issuing the licenses.

“[T]he impact of COVID affected almost every single governmental operation that there is, and there’s no way to separate the administering of everything in the midst of all of this,” Hutchinson said.

In September 2020, the state announced that 21 out of 937 applicants (who submitted 2,588 applications) received perfect scores, allowing them to participate in a lottery.

All 21 qualifying applicants met the social equity criteria, meaning owners or employees come from communities that were affected by cannabis prohibition or have a marijuana charge. Illinois’ social equity component of the application-scoring system is part of state efforts to encourage more people of color to enter the industry and to provide assistance to neighborhoods that have been heavily impacted by the war on drugs. (For more on the criteria, see bit.ly/IL-social-equity.)

Litigation and opprobrium abounded—some suits were filed by groups that didn’t win; and one by a group that did win, after Gov. Pritzker’s office stated in September that the state would rescore the applications. Some people in the winning groups had ties to the state government, while one winning applicant worked at KPMG, the firm that scored the applications.

“The recreational licenses [were] pushed back, and then when they did finally make the announcements, there were so many discrepancies,” Vincent E. Norment, CMO of applicant Parkway Dispensary and founder of the Marijuana Hall of Fame, said in November 2020. Parkway, a Black-owned social equity applicant, did not place in one of the winning 21 slots.

“So, then everything got put on hold, so Gov. Pritzker basically just restarted everything,” Norment said of the governor’s decision to rescore applications. “So, by restarting everything, who’s benefiting? The current dispensary owners.”

Norment said he isn’t upset with those owners, who are nearly all white men. “They have to follow the policies and the procedures,” he said. “Where do the policies and procedures come from? From the government. It comes from the state of Illinois and … the legislators, and they failed us.”

The U.S. Marines vet, entrepreneur and marketer, who now is re-applying, said he appreciates that some dispensaries, like Midway Dispensary near one of the Chicago airports, have continued to keep up a good supply for their medical patients.

Hutchinson said “anecdotal evidence” supports claims there were irregularities in the scoring but declined to share specifics aside from what has already been publicly reported. For example, the Sun-Times reported that the man who worked at KPMG and qualified for a lottery did not score applications and also that he no longer works at KPMG. In February, the Illinois secretary of state’s office provided CBT with documentation that lists him on the cannabis business license.

KPMG spokesman Russ Grote provided the following statement to CBT: “KPMG is honored to serve the state of Illinois to objectively score applications based on criteria set by the state with a diverse and well-qualified team. We are proud of our team’s performance.”

The state is now working on a “supplemental deficiency process,” Hutchinson said, so applicants can learn of their scores and fill in missing information.

Portia Mittons, co-chair of the Cannabis Business Association of Illinois’ Minority Access Committee and owner of The Coughie Pot, a dispensary in Sumpter, Ore., is part of a group that applied to cultivate, infuse, transport and dispense cannabis in Illinois that did not qualify for a license lottery in September.

Now, like Parkway, Mittons’ group, Bridge City Collective, have updated their applications to secure dispensary and wholesale licenses.

Prospective social equity applicants have some backing in the statehouse. In a January lame-duck session, state legislators proposed legislation to add another 75 dispensary licenses, which passed the Senate but stalled out in the House. Then, in February, state Rep. La Shawn Ford said he would put forth a similar proposal, according to the Sun-Times. The Illinois Legislative Black Caucus has also proposed establishing a cannabis equity commission.

“Certain things will take longer than others—nothing is really off the table,” Mittons said. “It’s just a matter of what we really think we can get done and really think we can make happen.”

Mittons said she participated in a call with state legislators and suggested to them that in the future, applicants be allowed to raise money before they possess a license—with a nod from the state that they are qualified up to a certain point—“because it’s hard to get investors to invest that much money on a chance, a possibility, a maybe.” In a January bill, per the Sun-Times, the lame-duck state Senate proposed “tiered and qualified” avenues for dispensary licensing.

Speaking more broadly about the dispensary licensing process, Mittons said, “It’s disheartening to see the devastation it has created and the lack of trust that it has created between potential applicants and the state. I just hope that we can rectify that because I don’t want people to get discouraged about entering into the cannabis industry.”

Revolution Global and Cresco Labs have both worked directly with applicants for dispensary licenses. (Cresco offered resources to Parkway through its Social Equity & Educational Development (SEED) program.) Wagamon said SEED, which also supports craft grow and infuser applicants in Illinois and entrepreneurs in other states, will continue into the future.

Mendicino said of dispensary licensing: “The applicants that we worked with were not amongst those that were chosen to enter the initial lottery, which we were disappointed about, but we’re continuing to support them through this process as it unfolds. And hopefully, we will see some more information from the state on that in the near future.”

Hutchinson noted that numerous other states opened adult-use markets without building in equity measures on the front end; Illinois has taken a different approach.

“We always knew that this was going to be a marathon, not a sprint, and we couldn’t anticipate every problem,” Hutchinson said. “But we designed this to be a slow, multi-year, multi-phased approach so that we could catch them as they happen, rather than being in a situation where everything’s all done and you can’t un-ring any bell.”

She said that “hindsight is 20/20,” adding, “I think we’re going to look at this time and start to do post-mortems on every decision that we’ve made in the process.”

Delay of Wholesale Licenses Coming Online

Illinois law originally stated that officials would issue up to 40 craft growers licenses, 40 infuser licenses and transportation licenses (which aren’t capped) by July 1, 2020. However, the state has also delayed that process, again citing the pandemic.

Tyler Williams and Winston McCauley applied as social equity applicants for craft grow, infuser and transportation licenses under the business name Winter Haze. Williams, founder and chief technical officer of Cannabis Safety & Quality (CSQ), a standards developer, said in December 2020 that Winter Haze mailed in its application eight months prior—in April 2020.

In addition, Williams said he became concerned about potential conflicts of interest in the scoring process because KPMG—which is grading wholesale as well as retail applications—employed somebody who qualified as a dispensary applicant. There could be conflicts of interest in the issuance of craft grow licenses, Williams posited, though he added that any subsequent delays would be his team’s “real concern.”

The Sun-Times reported in February that Illinois increased the amount it will pay KPMG to grade all applications from $5 million to about $14 million.

“The biggest concern that we have now is that the delays have been so significant that starting our process over from scratch would do more harm to the applicants who have been trying to correct and hold everyone accountable for getting this done correctly and fairly and equitably so that we can finish this process and move forward to make other structural, substantive changes,” Hutchinson said.

In December 2020, Williams said of the wholesale licenses, “It just seemed like it kept going on and on until finally the state came out and said these will not be released, indefinitely.” But then, in January, the state sent updates regarding grower, infuser and transporter license applicants, including to Winter Haze. The winners have not yet been announced.

As with the dispensary applicants, some of the craft grow, infuser and transportation applicants preemptively purchased or leased properties, Williams says, which he added he would not recommend. He added that Winter Haze signed an agreement with and paid a property owner in Peoria, Ill., to hold the property until the licenses would be released.

“Luckily, our seller was very easy to work with, and we were able to extend that for no extra money,” Williams said. “Other people, however, did not have that luxury. They purchased property; they are leasing properties. Some of them are still leasing properties. They’ve been paying rent this entire time on a building that isn’t operating—it’s just sitting there. That is one of the large costs that some people had to pay.”

Hutchinson said none of the plant-touching business applicants need a property to fill out an application. “We’ll be moving forward now to make sure that that’s much clearer going forward because we don’t want to see this replicated again,” she said.

Prospective business owners are seeking redress for having to wait for licenses. For example, Mittons said she and others are advocating for the state to pass legislation to give craft grows “the option to start off at 8,000 [square feet of canopy] instead of 5,000—the reason being, the statute says that you can do 5,000, then … you can go up to 8,000.” Craft growers are allowed three incremental increases of 3,000 square feet, then are capped at 14,000 square feet, according to the state’s legalization bill.

Diversification of Product

Illinois cannabis businesses see positives in their ongoing effort to diversify their product offerings to meet the needs of a changing consumer base who are interested in trying new things.

“I think when you look at the way a lot of states start, or even the way Illinois may have been a year and a half ago [before adult-use sales], a lot of the products that were in the market were relatively high-percentage THC, things like 10-milligram edibles or [products for] vaping or [inhaling] that maybe someone who doesn’t smoke might not even consider,” Wagamon said.

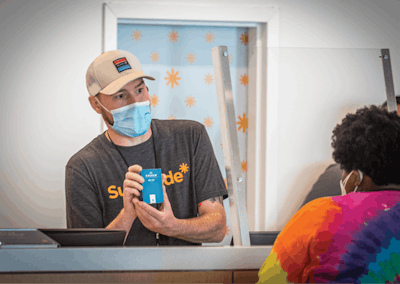

Cresco launched its eighth cannabis brand, Wonder Wellness Co., in late 2020, that caters to new customers—including people who are just starting to explore cannabis and want to try a low-dose products. The Wonder Minis sweet mints contain three milligrams of cannabinoids per dose.

“I think with Wonder, we try to work with our retailers to say, ‘Hey, budtenders, if there’s someone who is here for a first time and they’re interested but they’re not sure where to start, Wonder is a fantastic option for them,” Wagamon said.

COVID has complicated business’ ability to provide face-to-face education to customers, she said. Throughout the pandemic, Cresco’s retail business Sunnyside has expanded its online product descriptions for customers who place digital orders. “I’m really looking forward to a time when people can actually be in stores for longer, browse and have longer conversations with the staff,” Wagamon said.

Revolution Global also is adjusting its offerings through its edibles brands, Revolution Cannabis, Spectra and Spring Lake Craft Infusions. “We’re redoing all of our edibles line right now and improving them and really targeting where we think the market’s going in edibles, with smaller dose sizes ...,” Shroyer said.

The company considers itself a small-batch grower, harvesting cannabis from two of its 20 total grow rooms each week. “One thing is we keep it really simple,” Shroyer said. “There’s something about a steak with salt and pepper on it. It’s hard to beat.”

Using its own proprietary genetics, Revolution has created an oil that Shroyer said contains the original cultivar’s full terpene profile and equates to 100% cannabis.

“It’s that we understand that not all consumers care about that or know about the purity, but the ones that do really are the ones that people look to, to guide them, to help them find and make the best choices,” Shroyer said.

Because of the lingering supply issue, though, it isn’t exactly clear which products consumers most desire. “Until I’m kind of overproducing one product, it’s hard to get down to what would be selling the best because we’re finite in what we can currently produce in any one of our products,” Shroyer said. “We can’t quite meet the demand that’s out there for it.”

Support for Prohibition-Impacted Communities

As the pandemic rages on, Hutchinson said the state will strive to complete the work it set out to do: repair the harms of cannabis prohibition while serving the industry, medical patients and adult-use customers.

State officials have worked to approve cannabis-related social justice measures, as Hutchinson, a former state senator, and others in the legislature intended in the 2019 legalization bill. This past New Year’s Eve, for instance, Gov. Pritzker announced that the state has granted more than a half a million expungements and pardons to people who have been convicted of non-felony marijuana-related offenses.

“Things like cannabis convictions can impact people’s housing and school status and the job that they have,” Mendicino said. “So, the fact that there are thousands of people that don’t have that burden hanging around them anymore—we see that as the major win for [2020].”

Then, in January 2021, the governor’s administration announced that, using money obtained from cannabis sales, it awarded $31.5 million in grants to communities that have been heavily impacted by cannabis prohibition.

“You need education and job training and workforce development and violence interruption in communities that have been hardest hit—that those resources have been so significantly underinvested in,” Hutchinson said. “And that’s where you get a job force from.

“So, even for people who never, ever intend to touch the plant at all, you want folks to be able to live their full lives in the whole economic stream, even if they’ve been impacted by these awful drug policies for decades.”

This, in the face of a federal government that hasn’t expressed the same full-throated commitment, Hutchinson said.

“Congress is still silent,” she said. “We are talking about a drug that is still federally illegal and Schedule I, as if it has no medicinal benefit whatsoever, while we have an active, booming medical industry across this country.

“This is the biggest thing that I’ve ever worked on and the hardest thing that I’ve ever worked on. I think the most important takeaway from that is that the fight to do this is worth it. It’s important; it’s not going to go away. We have to stay at the forefront. We have to keep knocking down doors.”