Projections of a multibillion-dollar cannabis market won’t materialize any time soon in New York.

Just this week, regulators from New York’s Office of Cannabis Management (OCM) said the state’s industry is expected to generate $4.2 billion in annual revenue and 63,000 jobs. But the question of when remains largely unknown.

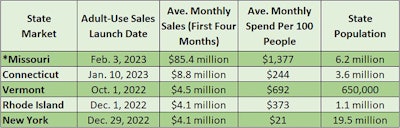

Sales figures from New York’s adult-use cannabis market considerably underperformed the state’s legalization peers during the first four months of retail operations, which began Dec. 29, 2022.

As of April 30, New York’s nine adult-use dispensaries and one adult-use delivery licensee had recorded more than $16.5 million in sales, a cumulative figure that OCM released during its most recent Cannabis Control Board (CCB) meeting May 11. State regulators have yet to make monthly sales data available to the public.

Among five states that launched adult-use retail markets in late 2022 and early 2023, New York’s initial sales figures rank at the bottom of the totem pole despite the Empire State’s massive population base of roughly 19.5 million people. Connecticut, Rhode Island, Vermont and Missouri have reported greater retail totals through four months.

Two years ago, on the heels of New York former Gov. Andrew Cuomo signing the Marihuana Regulation and Taxation Act (MRTA) into law, the state’s forthcoming adult-use cannabis market was projected to have massive financial implications from the onset.

New York’s 9% cannabis excise tax on adult-use sales was forecasted to generate $115 million in revenue in fiscal 2023, which ended March 31, and another $158 million in tax revenue in fiscal 2024.

These estimates were according to New York State Comptroller Thomas DiNapoli’s April 2021 review of the state’s enacted budget (government budgets usually include multiyear financial forecasts).

Based on the excise tax revenue projections from two years ago, New York’s licensed retailers were expected to sell nearly $1.3 billion in cannabis to adult-use consumers between April 1, 2022, and March 31, 2023—far more than the $16.5 million in sales state regulators announced this month.

Also based on DiNapoli’s budget review, retail sales were expected to grow to $1.75 billion for fiscal 2024 (which began April 1). But a lot has changed since those initial estimates: notably regulations that prohibit existing medical operators from entering the adult-use market until at least Dec. 29, 2023, as well as the state’s inability to secure funding through private equity sources to help stand up justice-involved dispensary operators.

More specifically, the Dormitory Authority of the State of New York (DASNY), which CCB board member Reuben McDaniel oversees as president and CEO, was tasked with raising $150 million from the private sector to help the state’s social equity retailers, referred to as Conditional Adult-Use Retail Dispensaries (CAURD), get up and running with real estate locations.

To that end, eight “concerned” CAURD licensees sent McDaniel and other state regulators a letter May 8 expressing their collective frustration and disappointment in the process for obtaining compliant real estate for their dispensaries.

“As experienced business owners, we are accustomed to performing a deep financial analysis of our business endeavors and participating in competitive markets with accessible information,” they wrote. “By contrast, in the CAURD program, we are cosigned to a process that is monopolized by DASNY and [the fund manager] by way of financial information, service providers, and access to real estate.”

The eight business owners also wrote that while they appreciate how the CAURD program was intended to alleviate them from common barriers to entry, including access to property, capital and service providers, they are now “very clearly and quickly learning” that the regulatory structure is working to their disadvantage in the current landscape.

Amid these struggles by CAURD license holders to launch their dispensaries, those who benefit from government funded programs have also been shortchanged on legalization promises so far.

Instead of the forecasted $115 million in revenue from the excise tax, New York’s adult-use dispensaries have provided roughly $1.5 million in state revenue from this tax as of April 30. The cannabis excise tax revenue is earmarked for education (40%), community reinvestment (40%) and drug treatment (20%), according to MRTA.

While the OCM does not provide monthly cannabis sales figures to the public, Policy Director John Kagia said during the May 11 board meeting that state regulators want New York to be the most data-driven cannabis economy in the world.

“This is just a foundation of what we’re going to be building in the months to come,” Kagia said. “We’ve been thrilled to see the extraordinarily strong early performance of our first retail licensees, as it shows that New York cannabis consumers are ready for legal cannabis. And the more that consumers become aware of the quality and the value of the legal market’s products, the faster that they’re transitioning into our regulated stores.”

Notably, Kagia’s presentation highlighted 95% growth in April sales figures compared to March, with 70-plus brands in the statewide adult-use market and an average of 149 SKUs per store. Also, dried flower (37%) and prerolls (14%) represented roughly half of all sales in April, while concentrates/vapes (29%) and ingestible products (20%) represented the other leading categories.

The $16.5 million in statewide sales through the first four months of the year only scratch the surface of where New York’s market is heading. Kagia said he expects retail sales numbers to “grow very quickly” in the months ahead based on two factors: more adult-use consumers transitioning to licensed dispensary purchases (enticed by a growing diversity of product offerings); and more licensed dispensaries that will open their storefronts.

“We have already approved locations for 50 CAURD licensees across the state, and our teams are working tirelessly to support these licensees with the retail activations,” he said.

Despite New York’s intent to roll out an adult-use program that prioritizes 150 social equity retailers, many of these justice-involved licensees may have yet to set a firm foundation in the space by the time well-funded medical cannabis licensees are granted access to the adult-use market under a revised regulations proposal.

RELATED: New York’s Medical Cannabis Operators Could Switch to Adult Use by Year’s End

To date, 12 CAURD licensees are operational, including nine storefronts and three delivery-only businesses. But six of nine dispensaries are located in New York City, where the police department estimates 1,300 unlicensed cannabis establishments are dwarfing the regulated market. The other three dispensaries are in Schenectady (just northwest of Albany), Ithaca and Binghamton, leaving vast regions of New York—from Buffalo to Rochester and Syracuse—without access to the regulated market.

In response to the proliferation of illicit cannabis businesses, Gov. Kathy Hochul signed legislation into law May 3 that authorizes the OCM to take enforcement actions against businesses selling cannabis without licenses. In addition to regulatory inspections, the office will be empowered to assess civil penalties and seek court-ordered injunctions against unlicensed businesses.

OCM executive director Chris Alexander said during the May 11 board meeting that the office will use these new enforcement powers responsibly.

“I want to be clear: We’ve said this a lot. We’ve talked about this topic a lot,” he said. “[We] have given significant warnings and notice to the public. We are building something special here in New York. And if you are not in-line with that effort to create a diverse and accessible and equitable marketplace, then we will shut your business down.”

Up to this point, state regulators have focused on seizing illicit products, Alexander said. They are now focused on closing doors.