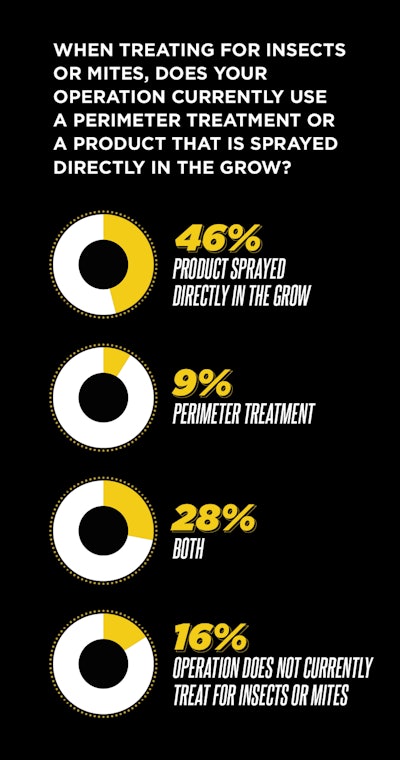

With the wide variety of growing practices in commercial cannabis cultivation, not to mention state-level requirements, variety in growers’ approaches to treating pests such as insects and mites is natural. But this 2022 “State of the Pest Control Market Report” research showed some clear trends.

Nearly half of research participants treat pest problems with “product sprayed directly in the grow” (46%), while 9% reported using “perimeter treatment” only. But more than one-fourth of the study participants reported using “both” (28%).

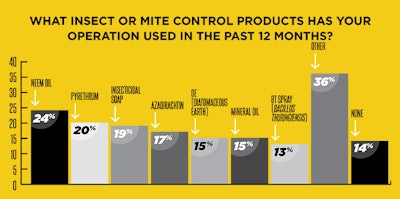

“Neem oil” topped the list as the most-often cited insect or mite control product used by research participants in their commercial grows in the past year, named by nearly one-fourth (24%) of growers in this study. “Pyrethrum” (20%) and “insecticidal soap” (19%) were the next most common choices, followed by the neem seed derivative “azadirachtin,” used by 17% of study participants to control insect or mites in the past 12 months. The top 7 most cited products are included below. More than a third (36%) of participants selected “other,” with several reporting using beneficial and predatory insects, though this study question focused on nonbiological controls.

When asked about preferred product class for insect and mite treatments, nearly one in five study participants reported they prefer “traditional synthetic – EPA regulated” (19%) products to fight insect or mite issues. “Insecticidal soaps” were noted as the preferred product class by 16% of research participants, with an additional 15% of growers naming minimal risk pesticides such as “essential oils – FIFRA 25(b) exempt” as their preferred product class.

Many research participants who selected “other” noted their use and preference for beneficial insects, predatory mites and other biologicals to control cannabis cultivation pests. This aligns with the fact that 63% of participants attribute biological controls/beneficial insects to their pest management success.

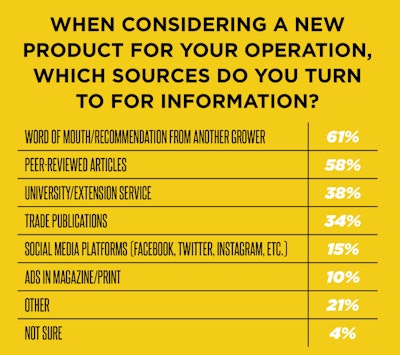

When asked about sourcing information on new products, the responses from cannabis cultivator participants are a clear reflection of the industry’s move toward mainstream acceptance.

Sixty-one percent of research participants turn to “word of mouth/recommendation from another grower” when sourcing new product information. But that was followed closely by “peer-reviewed articles” (58%) and “university/extension service” (38%)—two information sources that, for all practical purposes, didn’t exist for commercial cannabis growers just a few years ago.

Thirty-four percent of research participants turn to “trade publications” as a source of information when considering new products for their growing operations.

Sourcing and Adopting New Products

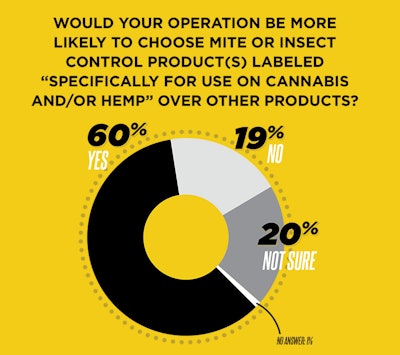

Knowing that pesticide manufacturers have cannabis cultivators in mind proved to be a major influence for growers choosing mite or insect control products. Nearly two-thirds (60%) of study participants said they would be more likely to choose control products labeled “specifically for use on cannabis and/or hemp” over products without such labeling.

In considering which three factors are most important for product adoption and use in growing operations, compliance and cost made strong shows. More than half of grower participants noted “presence on state level approval lists” (55%) as among their top three most important factors. Nearly half named “cost” (49%) as a top-three factor in their product adoption or use.

Opinions of industry insiders and the EPA both carried weight for study participants when adopting pest control products for use in their growing operations. Nearly one-third of growers included “info on EPA-approved product label” and “testimonials/recommendations from other operations” among their top three most important factors for product adoption or use, with 32% and 30% respectively.