Five of the oldest cannabis markets in the U.S. are facing declining year-over-year sales figures for the first time since launching their respective commercial retail programs for adult use.

After pandemic peaks equated to record growth across much of the industry in 2021, Colorado and Oregon dispensaries are now facing the brunt of 2022’s correction, while Nevada and Washington retailers also are on track to report double-digit downturns in terms of percent decreases to their sales totals this year. And California, which began adult-use retail more recently, on Jan. 1, 2018, also is amidst a shrinking regulated market (as far as sales go).

With the exception of Alaska, which does not tax sales to end users and therefore does not keep records pertaining to those transactions, according to its Department of Revenue, those five states represent the most mature adult-use markets in the U.S. They also represent some of the oldest medical markets, too, with California pioneering that reform front in 1996.

And age has something to do with the trends of 2022, according to Cooper Ashley, analytics manager, and Mitchell Laferla, data analyst, at cannabis data and research company Headset.

“The biggest contributing factor to whether a market is growing this year is where it’s at in its market maturity,” the analysts said via email. “The separation is not actually geographical in nature, rather it’s about legacy markets (California, Nevada, Colorado, Oregon, Washington) versus new markets (Massachusetts, Michigan, Illinois).”

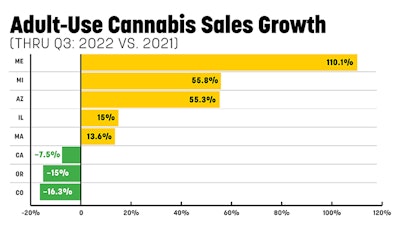

Specifically for states that track adult-use sales separately from medical sales, Maine, which launched its adult-use retail program in October 2020, Michigan (December 2019) and Arizona (January 2021) experienced the largest percent increases for adult-use sales through the first three quarters of 2022 compared to the same time period in 2021, according to data collected by CBT.

Editor’s note: CBT’s analytics for this article were derived from data from the Arizona Department of Revenue, California Department of Tax and Fee Administration, Colorado Department of Revenue, Illinois Department of Financial and Professional Regulation, Maine Office of Cannabis Policy, Massachusetts Cannabis Control Commission, Michigan Cannabis Regulatory Agency, Nevada Department of Taxation, Oregon Liquor and Cannabis Commission, and Washington State Liquor and Cannabis Board.

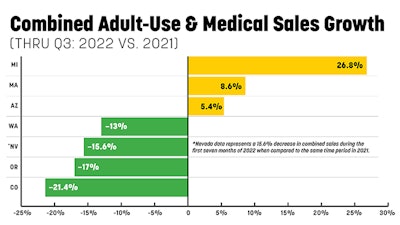

While Michigan and Arizona’s adult-use retail markets experienced in excess of 55% growth through the first nine months 2022 (compared to 2021), factoring in the shrinking medical markets in those states provides a more complete picture of overall growth.

Michigan’s combined adult-use and medical sales figures through the third quarter of 2022 represent a 27% increase over 2021, while Arizona’s combined figures represent a 5.4% increase. (See “Newer Markets & 2023 Predictions” section below, which includes a more thorough analysis of up-and-coming state marketplaces.)

“Michigan, for example, is the growth leader in 2022, and, as a state, it is still growing to meet the demand in a rec market that is [3] years old,” the Headset analysts said. “In Washington, for example, which has a very established adult-use market of nearly a decade, they are seeing the double-digit slides. In Washington, the market converged on local demand several years after sales began, so, without the ‘growth phase’ seen in Michigan, Massachusetts [and] Illinois, they are getting hit the hardest by some of the well-known industry pains such as price compression.”

Washington’s combined adult-use and medical retail sales shrank 13% in the first three quarters of 2022, compared to the same timeframe in 2021, while Oregon and Colorado’s market declines were further exacerbated by factoring in both patient and consumer sales figures.

But why are Oregon and Colorado’s markets experiencing deeper downturns than a state like Washington, which is just as mature in the cannabis space?

“There are probably multiple reasons that Colorado and Oregon are loss leaders,” the analysts said. “Oversupply could definitely be contributing as both have been in the news for such issues this year. Oregon specifically has issued a licensing moratorium until 2024 to help with an oversaturated market. Pricing is definitely an issue in both of those markets. [We] also believe that both Colorado and Oregon had some of the largest sales surges during the pandemic, so, in a way, they had the furthest to fall in the market correction.”

Colorado

For example, Colorado’s combined adult-use and medical sales grew 63% from February to July 2020—highlighting the month right before COVID shutdowns began in the U.S. to the immediate aftermath of a pandemic boom for cannabis sales—according to data from the state’s Department of Revenue.

Stepping back to take stock of the bigger picture, Colorado’s monthly sales averaged nearly $192 million from March 2020 to May 2021—during the entirety of the pandemic boom—representing a 35% increase from the $145 million monthly average from January 2019 to February 2020 (a pre-COVID baseline).

Now in the post-pandemic market correction, Colorado’s combined adult-use and medical monthly cannabis sales averaged nearly $150 million through the first 10 months of 2022—much less than the boom period, but a little more than the pre-pandemic market.

As far as price compression goes, Colorado’s median market price for unprocessed dried flower from cultivator to retailer hit a quarterly peak at $1,721 per pound in January 2021. That rate fell nearly 62% to $658 per pound as of Oct. 1, 2022—the lowest price since the state launched its adult-use market in January 2014.

Based on 2022 monthly sales averages through October, Colorado’s combined adult-use and medical retail market is projected to hit $1.8 billion for the year, a bit shy of 2021 and 2020 tallies.

Here’s a snapshot of yearly sales totals since the state implemented both commercial markets:

| Year | Colorado (Total Sales) |

|---|---|

| 2021 | $2,228,994,553 |

| 2020 | $2,191,091,679 |

| 2019 | $1,747,990,628 |

| 2018 | $1,545,691,080 |

| 2017 | $1,507,702,219 |

| 2016 | $1,307,203,473 |

| 2015 | $995,591,255 |

| 2014 | $683,523,739 |

Oregon

Much like Colorado, adult-use pioneer Oregon is on its way to a double-digit decline in 2022.

Monthly sales peaked at nearly $111 million (combined adult-use and medical) in April 2021 but have steadily declined since, to less than $80 million in October 2022, according to data from the Oregon Liquor and Cannabis Commission (OLCC).

Oregon’s monthly sales averaged more than $99 million from March 2020 to May 2021—during the pandemic boom—representing a 49% increase from the nearly $67 million monthly average from January 2019 to February 2020 (a pre-COVID baseline).

Now in the post-pandemic correction, Oregon’s combined adult-use and medical cannabis sales averaged nearly $84 million through the first 10 months of 2022.

The post-pandemic market downturn comes as average adult-use retail prices for flower have dropped from $161 per ounce in the fall of 2020 to an all-time low of roughly $116 per ounce in November 2022, according to OLCC. The average wholesale price also dropped to an all-time low of approximately $600 per pound in recent months.

RELATED: Oregon Cannabis Prices Swing From Pandemic Peaks to Record Lows

Based on 2022 monthly sales averages through October, Oregon’s combined adult-use and medical retail market is projected to record roughly $1 billion in sales after coming just short of $1.2 billion in 2021.

Here’s a snapshot for the last five years:

| Year | Adult-Use | Medical | Combined |

|---|---|---|---|

| 2021 | $1,084,419,088.65 | $99,671,207.50 | $1,184,090,296.15 |

| 2020 | $1,001,772,323.73 | $109,255,234.20 | $1,111,027,557.93 |

| 2019 | $726,003,565.94 | $69,130,251.65 | $795,133,817.59 |

| 2018 | $584,635,176.55 | $63,757,258.58 | $648,392,435.13 |

| 2017 | $423,949,620.66 | $69,881,980.62 | $493,831,601.28 |

Nevada

Market maturity, oversupply, price compression, less demand, the illicit market, basket sizes, licensing structures, taxes and myriad other factors can impact sales growth/declines in various state-legal cannabis markets.

In 2022, pricing drove a lot of the sales woes in legacy markets, according to Cooper and Laferla.

“For example, in Nevada, which we consider a mature market, has seen average basket size shrink by 12.6 percent year-over-year while average discount has increased 7 percentage points in the last year,” the analysts said. “In October 2021, average discount was 12.8 percent and has increased linearly to 19.8% in October of this year.”

Average item price and equivalized volume prices (the price per unit of product, such as price per gram or milligram) fell mostly across the board, which drove down that basket size, they said.

“And then retailers are discounting heavily on top of that to try to make up for low margins with generating more consumer volume,” the analysts said. “However, that just leads to more price compression, razor thin margins and smaller sales totals.”

In Nevada, that’s factored into the state’s $532 million in combined adult-use and medical sales through the first seven months of 2022, representing a 15.6% decrease compared to the same time period in 2021, according to data from the state’s Department of Taxation.

Based on monthly trends through July 2022, Nevada’s combined adult-use and medical retail market is projected to record nearly $900,000 in sales for the year after eclipsing the $1 billion mark in 2021.

Here’s a snapshot for the last four years:

| Year | Nevada (Total Sales) |

|---|---|

| 2021 | $1,042,148,599 |

| 2020 | $786,480,038 |

| 2019 | $701,700,416 |

| 2018 | $579,561,580 |

Washington

The nation’s second-oldest adult-use cannabis market, Washington’s state industry has run the gamut in recent years, from wildfires in 2020 to a heat dome in 2021 and a fatal dispensary shooting in 2022.

And despite being among the highest taxed markets in the U.S. (including a 37% cannabis excise rate), the Evergreen State has managed to somewhat lessen the impact of the post-pandemic correction compared to a few of its peers—notably Colorado, a fellow pioneer that also launched adult-use sales in 2014.

And yet Washington’s sales surge during the pandemic, featuring a 33% increase in average monthly sales compared to pre-pandemic monthly averages, tracks closely with Colorado’s 35% sales surge. Still, price compression has steered Washington’s retail figures to a 13% year-over-year slide through the first three quarters of 2022, according to data from the state’s Liquor and Cannabis Board.

Based on monthly trends through September, Washington’s combined adult-use and medical retail market is projected to come just shy of $1.3 billion in sales in 2022, after eclipsing $1.4 billion in each of the previous two years.

Here’s a snapshot for the last four years:

| Year | Washington (Total Sales) |

|---|---|

| 2021 | $1,475,218,076.89 |

| 2020 | $1,429,744,017.90 |

| 2019 | $1,115,474,486.58 |

| 2018 | $1,018,867,193.25 |

California

California’s cannabis retail market stood in an interesting spot in 2022: caught trending closer to some of the more mature markets in the West despite an adult-use sales launch that aligns closely with Massachusetts.

Through the third quarter of 2022, California’s adult-use dispensaries recorded just more than $4 billion in sales for the year, representing a 7.5% decrease from the same period in 2021, according to the state’s Department of Tax and Fee Administration (CDTFA). Meanwhile, Massachusetts, which launched a commercial adult-use market in November 2018, 11 months after California, is experiencing 13.5% sale growth through the third quarter of 2022.

The difference between one state’s sales decline versus another state’s growth in this instance offers a glance beyond the simplicity of market maturity as a driving factor for those trends. For starters, California has expansive rural regions in San Bernardino, Los Angeles, Riverside and Kern counties—where the illicit market can thrive—and elsewhere throughout the state. In particular, San Bernardino County is roughly twice the size of Massachusetts with 5 million fewer people.

Next, while California’s Department of Cannabis Control (DCC) has made strides in expanding the state’s licensed retail footprint—including by more than 20% in its first year after taking the streamlined reins as the state’s regulatory body—it still has a long ways to go. As of earlier this year, California had roughly 2.4 dispensaries per 100,000 residents, much fewer than its Pacific Coast neighbors, making it more difficult to answer demand in certain areas of the state.

And for Massachusetts, until Vermont launched sales in October 2022, it was surrounded by five other states that had yet to implement adult-use retail programs. While Massachusetts’ flower prices did plummet to an all-time low of $220 per ounce on average at adult-use retail in October, that compression wasn’t necessarily impacted by competition from bordering markets or the scale of the illicit operations as seen in California.

One thing working in California’s licensed operators’ favor in 2022 was the state’s elimination of its cannabis cultivation tax—a $161 rate per pound—on July 1.

Based on monthly sales trends through September, California’s adult-use retail market is projected to hit roughly $5.3 billion in sales in 2022 after recording nearly $5.8 billion in 2021. (Editor’s note: CDTFA first reported roughly $5.2 billion in sales for 2021 but has since added roughly $600,000 to that figure due to amended or late tax returns.)

Here’s a snapshot for the last four years:

| Year | California (Adult-Use Sales) |

|---|---|

| 2021 | $5,773,379,111 |

| 2020 | $4,700,062,872 |

| 2019 | $2,802,907,192 |

| 2018 | $1,980,376,977 |

Newer Markets & 2023 Predictions

While California still stands alone as the largest cannabis market in the world, Michigan will take over the second spot in the U.S. when 2022 retail figures are finalized in the books.

Michigan’s combined adult-use and medical cannabis sales are projected to reach nearly $2.3 billion by the end of the year, according to data from the state’s Cannabis Regulatory Agency. That’s a 28% increase from the nearly $1.8 billion in sales from 2021.

The newer growth markets remain the “most interesting,” Headset’s Cooper and Laferla said.

“Michigan and Illinois are high population states, so [we] think they will end up being really big markets comparatively,” the analysts said. “Michigan is already a $2-billion market in 2022, the second largest that we track behind California with Illinois a close third.”

Through November, adult-use sales in Illinois have surpassed $1.4 billion in 2022, a 13.5% increase from 2021, according to data from the state’s Department of Financial and Professional Regulation. And combined adult-use and medical sales have eclipsed $1.7 billion through November, according to Headset.

Illinois, with roughly 13 million residents, and Michigan, with roughly 10 million, represent the second and third most populous states that have fully implemented a commercial adult-use retail market.

“Everyone wants to know when these markets will level out; in reality it’s very difficult to predict,” Cooper and Laferla said. “However, we may already be seeing small signs that they are converging on demand. Michigan, for example, had 52 percent brand growth between 2020 and 2021. From 2021 to this year, brand growth has only been 4.5 percent, indicating that things are potentially slowing down.”

Massachusetts, a state of approximately 7 million people, has recorded roughly $1.6 billion in combined adult-use and medical cannabis sales through November, representing a 7.5% increase from the same 11-month period in 2021, according to data from the state’s Cannabis Control Commission.

“For newer markets, [we] would be surprised to see such large growth again in 2023, especially given that they are experiencing a lot of the pricing issues of the market at large,” the analysts said.

Arizona, which launched adult-use sales on Jan. 21, 2021, has experienced somewhat slower growth in its overall cannabis retail market, as its medical sales have dipped at a sharper rate than adult-use sales have grown in recent months.

In February 2022, when both markets peaked, adult-use sales were at $73 million and medical sales were at $58 million, according to the state’s Department of Revenue. Fast forward to September, adult-use sales remained $73 million while medical sales dropped to $32.5 million. The overall market shrank by roughly $26 million during those eight months.

Based on current trends through the third quarter, Arizona’s combined 2022 sales figures will closely mirror the $1.36 billion of adult-use and medical cannabis sales from 2021.

And in Maine, which implemented its adult-use retail program in October 2020, dispensaries are projected to record roughly $158 million in adult-use sales in 2022 based on trends through November, roughly doubling the $82 million in adult-use sales recorded in 2021, according to data from the state’s Office of Cannabis Policy.

Beyond that, five state markets fully implemented adult-use sales in 2022, including Montana (Jan. 1), New Mexico (April 1), New Jersey (April 21), Vermont (Oct. 1) and Rhode Island (Dec. 1).

In addition, New York regulators continue to work toward launching adult-use retail before the end of the year, while Connecticut plans to commence adult-use sales on Jan. 10, 2023, and Missouri and Maryland, which passed ballot measures in November, also could ignite commercial programs in 2023.

Despite the 2022 slides experienced in legacy markets, newer markets in states like these “likely will bolster total U.S. market sales” in the year to come, Cooper and Laferla said.