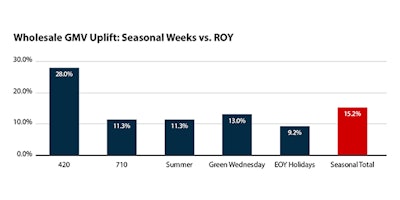

This year, more than ever, brands and retailers need to be prepared for the cannabis holiday calendar. LeafLink platform data shows that wholesale gross merchandise value (GMV) is 15% higher during seasonal periods compared to the remainder of the year (ROY). For upstream cultivators and manufacturers, around half of total revenue comes from seasonal sales.

Based on LeafLink ordering trends, there are five distinct top sales periods:

- 420 (April 20): 28% wholesale uplift

- OIL/710 Day (July 10): 11% wholesale uplift

- The touristy dog days of summer (July/August): 11% wholesale uplift

- Green Wednesday (Thanksgiving weekend): 13% wholesale uplift

- End-of-year holidays (late December): 9% wholesale uplift

To prepare for the busiest times of the year, brands and retailers can effectively manage inventory to avoid stockouts, offer the right assortment of products, and fine-tune discounting and promotional activities.

1. Optimize inventory levels.

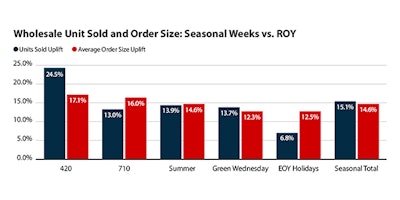

Like any consumer packaged goods (CPG) business, cannabis retailers should consider stocking up before high-volume seasonal periods. Higher transaction counts and lower basket sizes at retail, largely a result of aggressive discounting, result in much higher than normal inventory requirements.

Data courtesy of LeafLink

For instance, during the weeks leading up to 420 last year, brands on LeafLink’s platform sold about 25% more units compared to the month prior. That’s a lot of storage space and working capital most cannabis businesses don’t have available today to fully capitalize on holiday sales.

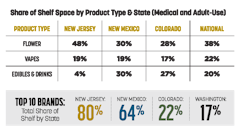

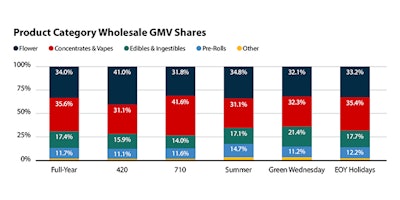

2. Find the right product assortment.

- 420 (April 20): Flower – 21% increase in category share of sales

- OIL/710 Day (July 10): Concentrates and vapes – 17% increase

- The touristy dog days of summer (July/August): Prerolls – 26% increase

- Green Wednesday (Thanksgiving weekend): Edibles and ingestibles – 23% increase

- End-of-year holidays (late December): Holiday-themed products

Data courtesy of LeafLink

For retailers, choosing the right kind of inventory is the only way to properly allocate shelf space and maximize basket sizes. To adequately meet consumer demand during seasonal trends, stores can prioritize selling specific products based on the time of the year. Packaged flower has the highest sell-through in late March/early April, concentrate products in June/early July, ready-to-smoke products during the summer, edibles for Thanksgiving, and holiday-themed cartridges and edibles cheer for the end of the year.

For brands, it’s essential to allocate flower and biomass throughout the post-harvest season to meet retailer demand. Cultivators with outdoor canopy can benefit by preserving enough packaged flower units for the 420 deal season and biomass for pre-rolls during the summer, despite market pressures to process excess flower into distillate during the winter.

3. Fine-tune promotional activities.

Discounts and deals are commonplace across both wholesale and retail transactions during holiday periods. Last year, more than 5,100 retailers purchased discounted products on LeafLink’s platform during the top sales days and LeafLink’s point of sale partners reported about 90% of baskets included a holiday period special. Cannabis retailers and their consumers clearly expect discounts during seasonal times.

For retailers, promotions should aim to increase transactions and, perhaps more importantly, basket sizes. In some markets, especially out West, competitive discounting is promoting a “race to the bottom,” which negatively affects margins and profitability. To counter retail softness during high sales periods, deals can be crafted along customer segments to upsell shoppers: targeted marketing strategies such as sponsored and targeted email marketing, product ads and samples, and trade shows and events can help result in better spend return on investment and higher basket sizes.

For brands, it’s key to create deals for dispensary customers. On average, brands offering seasonal discounts on LeafLink’s marketplace saw a 31% increase in sales and sample requests more than doubled. With dispensaries stocking up on products for holiday periods, brands giving volume-based discounts and customized deals can maintain margins while driving top-line sales.

As the industry navigates strong headwinds in 2023, having the right strategy for seasonal sales will be a key to survival. By avoiding stockouts, presenting buyers the right product assortment, and offering value-add discounts, cannabis companies can thrive in the highest volume times of the year.

Ben Burstein is strategy analyst at LeafLink.