As more states legalize adult-use cannabis, more retailers that were formerly focused on medical patients must expand their operations to serve the broader market.

Take Missouri, for example, where regulators announced in early February—less than 90 days after voters approved adult-use legalization in the November 2022 election—that the state’s licensed medical cannabis dispensaries could launch adult-use sales the following day, Feb. 2.

Nearly all the state’s medical cannabis retailers requested to convert their licenses to a comprehensive license that would allow them to serve both markets, but what goes into preparing for such an expansion?

At Cannabis Conference 2022, Leah Heise, senior advisor for consulting firm Kearney; Duke Rodriguez, CEO and president of New Mexico-based Ultra Health; Sequoah Turner, director of retail for Nevada-based The Source; and Talley Wettlaufer, former senior VP of retail for multistate operator Curaleaf, shared advice for medical cannabis retailers expanding to serve a broader adult-use market.

Heise estimated that a dispensary’s sales increase by roughly 33% when transitioning from a medical to adult-use market, and she stressed that operators need a plan for every area of the business to accommodate these increased sales. From compliance and security to staff training and retail metrics, everything must be accounted for, she said.

“From a compliance standpoint, you need to start training your employees well ahead of adult use on adult-use regulations, how your customer flow is going to go, that your security is up to date, that the penetration is OK because you’re now going to have people queuing—and regulators hate people queuing,” Heise said. “Think about things like your bathrooms. Is your facility large enough to handle the number of bathrooms required by OSHA for your staff, which you’re probably going to have to quadruple?”

Despite the work required to expand to serve the broader market, Rodriguez said medical operators have an advantage in new adult-use markets that makes the transition well worth it.

“You are so far ahead of anyone else,” he said. “They’re just going out there, rolling the dice and praying for a win. It’s not going to work. This is work.”

Here, Heise, Rodriguez, Turner and Wettlaufer offer their top tips to navigate this workload and successfully make the jump from medical to adult-use sales.

1. Prioritize your team.

The shift to adult-use sales puts a lot of pressure on a dispensary’s employees, so Wettlaufer said that the staff should be the top priority as operators plan to expand.

“It’s such a cultural shift going from medical to adult use,” she said. “[There is] pressure that you put on the operations, but the pressure that you put on the team and the pace at which they need to operate is nothing like they’ve seen before.”

Staff training is essential to ensure that budtenders, who are accustomed to working with medical patients, know how to speak to customers and serve the broader adult-use market, Turner said.

“You do have to be very, very intentional with every decision that you make and make sure you are putting the employee at the center of those decisions because they are the voice of your leadership and of your decisions,” she said. “The medical consumer is a much more educated [consumer]. It’s a much more personal relationship, and then having to then go over to a high-volume, transactional model is very overwhelming for staff and for leadership if they are not properly trained and have a good understanding of what the customer journey looks like from the moment that customer enters the door.”

While training can be daunting for operators—and perhaps a little boring for the staff—Rodriguez said it can be fun and engaging for all parties.

“You can make it fun,” he said. “Plan ahead. Have conference calls. … Have each of your stores guess, put it in an envelope—what do you think our first week’s sales are going to be? What do you think the first day will be? Try to put out prizes. Get them to begin to bite the apple and be a part of the process because, believe me, they’re going to see significant transitions and it’s not going to be evenly distributed.”

“Pay special attention to those employees who hold your success,” Rodriguez added.

2. Anticipate the shift in customer relationships.

The panelists reiterated that a medical relationship with a patient is much different than a relationship with an adult-use consumer, and added that operators should assume that most patients will be converted to adult-use customers when the market goes live.

Navigating this shifting relationship can be tricky, they said.

“You’re still in the trust business,” Wettlaufer said. “You’re still building relationships, but there is a sales culture that really hadn’t existed in a medical dispensary, and that shift takes time and it takes the right leadership and the right people to participate in it.”

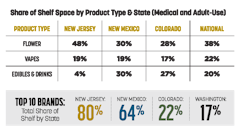

In an adult-use market, there will be more customers who have never used cannabis—or have not used it in a long time—and who are new to a particular product category, Wettlaufer said. For example, she said microdosing may not be popular in a medical market, but many adult-use consumers may be interested in lower-potency products. While flower sales usually remain stable between medical and adult-use markets, Wettlaufer said that, in general, edibles become a larger part of the adult-use business and concentrates tend to be a smaller piece of the pie.

“How do you bring people into the category? How do you make them feel comfortable?” she asked, adding that most budtenders aren’t edibles consumers themselves and may need some additional support to make them comfortable talking with customers about product categories they aren’t as familiar with.

“How do you talk to your budtenders about the product categories that their customers are looking for and how do you educate them on that and how do you get them into that mindset so that your customer feels like they understand and can connect?” Wettlaufer asked, and suggested that vendors should provide information about their products to dispensaries and educate the budtenders on any offerings that they may not be personally consuming.

Educated budtenders ultimately lead to customers being matched with products that meet their needs, which ensures a long-term relationship. And long-term relationships help dispensaries stay competitive as more licensees enter the market, Turner said.

“In almost every state that has gone adult use, there has come additional licenses,” she said. “That’s the roadmap that happens, so it’s really important if you’re one of the early adult-use dispensaries that you’re really sitting there, saying ‘What’s the best position for the long term? … How am I building a positive relationship with this customer that I can grow and build on and move through?”

Often, a surplus of products in medical markets means that dispensaries build relationships with patients through discounts and promotions that drive patient loyalty, but this strategy needs reconfigured when markets flip to adult use, Wettlaufer said.

She added that most adult-use regulations prohibit dispensaries from tracking customer data unless customers opt in, so retailers must convince consumers to opt in to a loyalty program and frequent one particular dispensary.

“Give them a very compelling reason to opt in and become loyal,” Turner said. “You really have to be intentional about the messaging and what you’re putting out there and the pillars that you’re building your loyalty program on. Is it going to retain and attract new customers? Are you being competitive within the landscape?”

3. Stay on top of the regulations.

In addition to proper staff training and navigating shifting customer relationships, dispensary owners must also focus on ever-evolving regulations when transitioning from medical to adult-use sales.

“Anticipate the rules to change constantly and expect the rules to be improperly interpreted,” Rodriguez said. “Understand the regulations yourself. Understand the statute. Make sure you tell the uninformed regulator, ‘This is what you meant to do.’ You are going to be heavily engaged in suddenly practicing law without a license.”

Expect the unexpected, he added, pointing to New Mexico’s decision to issue 1,000 new adult-use licenses within four months of the market launching in April 2022.

“Imagine how that feels when you lived in a market that a year ago had 34 legacy operators,” Rodriguez said. “I knew all 33 competitors and I could pick up the phone and talk to them and never worry about them taking my market share.”

To mitigate unexpected challenges, Turner said retailers should consider implementing a compliance department as they scale operations.

“You need a team that is dedicated to understanding the regulations, translating them into your daily operating principles and making sure that each department understands what they can and cannot do,” she said. “You will save yourselves thousands of dollars in fines just by making sure that you hire a team that is dedicated to understanding the regulations and translating them.”

In addition, Rodriguez said that an expanded adult-use market often comes with new expectations from regulators.

“Anticipate the regulator to treat you differently,” he said. “You live with these practices, and you believe that they’re going to carry over. You have to watch the signals from the regulator as they transition. Does their priority become issuing licenses? What is their new metric for success? If you stay with the history and say, ‘We’ve always done it this way,’ you might be shocked. … No matter what, use your past as your strength but be open to that environment rapidly changing.”

While regulations and expectations may quickly change for established operators, Wettlaufer said that all stakeholders are transitioning together, and businesses can look to other parts of the industry for clues on how to proceed.

“Continue to have dialogue amongst everyone in order to feel like you have a pulse on what’s going on and what’s driving people’s decision making,” she said. “And just remember it continues to change. It is so important to continue all of those relationships and understand that you will all evolve together.”

4. Embrace the data.

A robust system of data can also provide insight into how to successfully navigate the shift to adult-use sales, the panelists said.

“You need to become animals when it comes to data,” Rodriguez said. “You’ve got to know how many dispensaries per capita. You’ve got to know who’s down the street, what they’re labeling, how they’re packaging. You have to mystery shop everyone. I’m talking about micro-data, right down to the store level, and I’m talking macro-data as to what your revenue projections are for your entire state. You should make the projection long before the bureaucrats make their estimate. You should have your own ranges. You should know what you should be coming out with the first week, the first month, and then when they announce the first seven-day sales, you compare it to your numbers. When they announce 30 days, … you compare it to your numbers. You just keep updating and refining and refining and refining.”

While anecdotes from other businesses can be helpful, the panelists said retailers must ground themselves in facts and understand metrics like average transaction value (ATV), for example, which may not have mattered as much in a medical-only market.

“Data is vital to the success of your business,” Heise said. “A lot of companies don’t pay attention to the basic metrics, so they’re just kind of coasting along, and the ones that really can [analyze the data are able to] adjust. [They] look at their assortment and use data to do actual demand planning and make sure that [they] still have enough inventory to support [the] medical market so [they] don’t get dinged and create that value with new SKUs across [the] brand.”

Businesses can also use public information, such as data on product categories that sell well in other adult-use markets, to their advantage, Rodriguez said.

“Don’t just look to traditional data,” he said. “Don’t just depend on … the licensing bureau or the regulator. Look at the tax data. Back into the numbers. See what gets turned in. You yourself can probably have better information than the regulator as to the real evolution of how this market is growing.”

5. Optimize the customer experience.

As sales increase with the launch of an adult-use market, retailers should consider alternative delivery models for customers, the panelists said, which can include online purchasing with in-store pickup, drive-thrus and home delivery.

“Think about alternative ways to get that product to your patient [or adult-use customer] compliantly,” Heise said. “Also think about if you’re in one of those weird states that makes you maintain a medical inventory … and a separate recreational inventory. Sometimes you have to have two vaults, two different experiences for a medical patient and a customer. That requires a lot of planning ahead of time, working with builders and redesigning your space at the same time you’re trying to stay operational and profitable.”

The panelists said that dispensaries should thoroughly vet their technology partners and test all platforms ahead of the first day of adult-use sales to ensure that everything works as expected.

Ultimately, the adult-use cannabis retail experience should be modeled after other successful retail experiences, Wettlaufer said.

“As you look to devise your program and think about your customer relationship, I would always say look at your other retail experiences,” she said. “How do they entice you to sign up for the loyalty program or for emails? How frequently do you get it, how frequently do you open it, and what does it say that gets you to open it? I think all of those things hold more and more true in an adult-use market, so my advice in everything, whether it’s your customer relationship, your retail experience, how you think about pricing and product assortment and all of that, is look around you. What is the most positive retail experience you have, whether it’s buying clothes or buying coffee or whatever it might be? Use those pieces to guide you on your journey to adult-use cannabis. The customers are the same and that’s what they’re looking for.”

6. Set reasonable expectations for your initial adult-use menu and pricing.

At the outset of adult-use sales, retailers should keep their menus limited with, for example, two different edibles for customers to choose from, the panelists said. Operators should try a product for 30 days, see if it picks up traction, and if not, a new product should be swapped in for the next 30 days.

Consumers likely won’t be hindered by the limited product offerings, Wettlaufer said.

“To start, they’re just happy to buy legal weed,” she said.

They will, however, dislike price gouging, which is a big no-no in new adult-use markets, the panelists said.

“Our average price is around $10 a gram,” Rodriguez said of New Mexico’s market. “Certain vendors went up to $18 a gram [at the start of adult-use sales], thinking ‘We can sell this all day long.’ ... Now that there are 1,000 licensees, … people remember. Those medical patients have long memories and those adult[-use] consumers will make you remember day after day what you did on that grand opening.”

Wettlaufer echoed that inflated pricing only serves to tarnish a dispensary’s relationship with consumers.

“You’re still in the trust business,” she said. “It’s about being authentic. It’s about building a relationship. If you blow the trust with your customer, they won’t forget that.”

Price gouging is always unacceptable, the panelists said, even in markets with limited supply to meet demand.

“Being supply-constrained, … I’d rather limit and ration the product I have to touch more customers to then have everybody have a positive experience so that I can further deepen that relationship rather than, I’m just going to get the most out of each sale,” Wettlaufer said.

7. Focus on retaining your medical cannabis patients.

Not only do medical cannabis patients help initially build a cannabis business, but they also spend more than adult-use customers, on average; Wettlaufer estimated that in most cases, patients purchase roughly 30% more products per transaction than adult-use consumers.

“Your medical consumer is more valuable to you than your adult-use [consumer],” she said.

Therefore, it is imperative for retailers to focus on retaining their medical cannabis patients during the expansion to adult-use.

This can be achieved through continued patient education and assuring patients that they can still rely on the dispensary for their medicine, Wettlaufer said. Retailers should ensure they have a service model that can provide the right experience for both patients and adult-use consumers, as well as a balanced menu and pricing that caters to both markets.

“[Patients] will be incredibly vocal when they are unhappy, … so it’s important to make sure you’re considering your messaging, you’re getting your message out to them well before adult use begins at your dispensary and you’re saying, ‘The experience is only going to get better. We’re going to be able to offer you more product, we’ll be able to offer you a special shopping hour’ and things of that nature to really make sure that you’re able to retain that customer because, honestly, that is what built the success of your dispensary, so you need to make sure that you’re still considering them in your operations,” Turner said.

Join us this year at the Paris Las Vegas Hotel & Casino for Cannabis Conference, the leading education and expo event for plant-touching businesses.