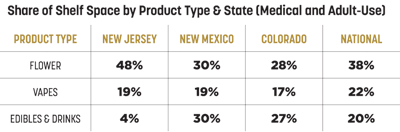

A cannabis consumer can only purchase what is available to them. Availability is a persistent issue in cannabis, and customers and patients in emerging markets are limited to the products a retailer stocks. Given that some of these new markets don’t have any baked goods on the shelf, while others have yet to establish a premium cannabis flower segment, it’s clear that innovation opportunities lie in the holes left unfilled by existing operators in the space. Using Brightfield Group's data on mature markets, let’s look at some of the high-level product type opportunities in the emerging markets of New Jersey and New Mexico, which both launched adult-use sales in April.

New Jersey

New Jersey’s adult-use cannabis market opened April 21, one day after the 4/20 holiday and about a year after Gov. Phil Murphy signed cannabis legalization bills into law.

So far, the market has seen mostly flower and vapes, while other product type offerings are limited. Edibles are lagging behind vapes with only a 4% share in June; however, this doesn’t mean edibles are not on dispensary shelves. Instead, what is on shelves is limited and outnumbered by vape and flower options. When examining national averages, vapes and edibles & drinks have a similar share of retail space (22% and 20%, respectively), suggesting ample opportunity for New Jersey operators (and those looking to break into the state) to expand their edibles offerings.

New Mexico

New Mexico launched adult-use cannabis sales April 1 and is expected to follow a similar growth trajectory as neighboring Arizona—quickly converting its medical market into a profitable, operational adult-use market. However, with the state’s proximity to more mature cannabis markets in the West, New Mexico has a product type breakdown that is more in line with the Colorado market, according to Brightfield data.

From April through June, flower’s share dropped from 41% to 30%, while vapes’ and edibles’ shares rose by 4 percentage points and 2 percentage points, respectively. Brightfield insights show a trend of new markets first having flower—logically, as it’s what has to be produced first—with extracts and edibles ramping up later. Sometimes, flower’s share can drop as a wave of new edibles hits the market, despite the same flower options being available. Colorado, New Mexico’s northern neighbor, has a high share of edibles on dispensary shelves when compared to the national average, and many of the top-distributed brands in the state are edibles or drink brands—like Wana, incredibles, and Keef. New Mexico’s edibles scene has room to expand, as 35% of edibles in the state are either chocolate, lemon, or apple flavored, indicating there are opportunities to introduce different flavor combinations to win over customers.

When examining national averages, vapes and edibles have a similar share of retail space (22% and 20%, respectively), suggesting ample opportunity for New Jersey operators (and those looking to break into the state) to expand their edibles offerings.

Top 10 Brands

The top 10 brands by distribution in New Jersey comprise more than 80% of the market. However, this is to be expected given the prevalence of vertically integrated MSOs that can provide massive suites of product types under a single brand name, and the fact only about a dozen dispensaries operate in the newly opened adult-use market (for now).

In New Mexico, consolidation at the top is not as staggering, with the top 10 brands accounting for 64% of retail shelves in the state. For comparison, the top 10 brands in Colorado occupy about 22%, while the top 10 in Washington have only 17%. New Mexico and New Jersey will likely see a plethora of new brand entrants within the coming years, which could chip away at the massive share early players enjoy in these states. The brands aware of the white space opportunities in new markets could find a niche not yet filled.