Facility Lighting: LED Usage, Interest Continue to Increase

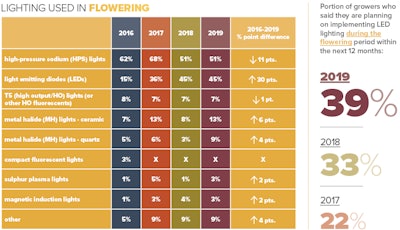

The first year (2016) CBT conducted the “State of the Cannabis Lighting Market” study, 21% of cultivators who participated in the research indicated they used light emitting diodes (LEDs) in propagation, and even fewer used LEDs in the vegetation and flowering stages (17% and 15% respectively). Each year, LED use has grown faster than any other type of lighting technology, with double-digit growth from 2016 to 2019 in all stages of plant growth. Four years later, nearly half of all research participants (47%) now use LEDs in propagation, and nearly half also use them in the vegetation (46%) and flowering stages (45%). LEDs are now among the top two choices of lighting types throughout the plant’s lifecycle. Among study participants, 39% said they are planning on implementing LED lighting during the flowering period within the next 12 months, which is up from 22% when CBT first asked this question in 2017.

However, the participants who indicated they do not use LEDs for the cannabis flowering cycle and do not plan to in the next 12 months (or are unsure) noted factors that prevented them from introducing LED technology. Top reasons included unproven technology (48%), too expensive (42%) and the payback/return on investment (ROI) is too long (21%).

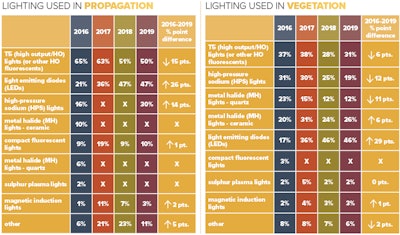

Propagation

Despite the growth in LEDs, half of survey respondents (50%) use T5 (high output/HO) lights or other HO fluorescents in the propagation stage, while 47% of participants use LEDs in propagation. The number of cultivators using T5 lights in propagation has decreased by 15% since CBT first asked about lighting used in the 2016 study.

Vegetation

LEDs are now used by more cultivators (46%) than any other lighting method in vegetation, which is a significant change since CBT introduced the study in 2016, when LEDs were ranked fifth in terms of lighting choices for veg. The second-most common lighting technology used is T5 (high output/HO) lights (or other fluorescents), as 31% of cultivators noted they use this type of lighting during this growth stage, while 26% use ceramic metal halide (MH) lights.

Flowering

According to this year’s research, the majority of cultivators (51%) use high-pressure sodium (HPS) in the flowering stage. A significant portion also use LEDs (45%), whereas in 2016, just 15% of growers indicated they used LEDs at this growth stage.

Why Cultivators Buy: Reasons Are Changing

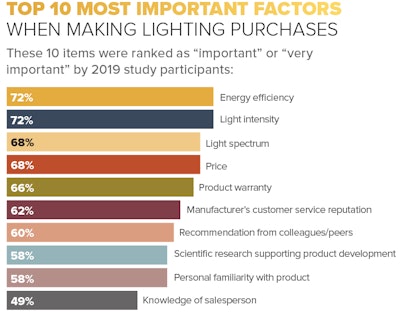

In 2018, study participants noted that light intensity, manufacturer’s customer service reputation and scientific research supporting product development were the top three factors they considered when making lighting purchases, rating them as “very important” or “important.” The rankings have changed greatly since last year, however. This year, light intensity still ranks No. 1 in terms of importance, but tied with it is energy efficiency (72%), which was rated lower in 2018 (68%) compared to other factors. Tied for second this year are light spectrum, which ranked fifth in 2018, and price (68%), which was rated lower in 2018 (66%).

Data Remains a Constant for Cultivators

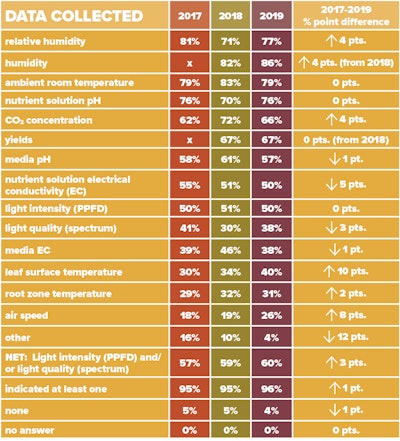

Decisions are, of course, more informed and potentially made easier when sufficient data exists to help guide cultivators. Since CBT posed the question, “What types of data does your operation collect in its cannabis growing environment?” in 2017, data collection has remained a strong and steady constant for cultivators. The vast majority of participants (96%) noted they collect data on some aspect of cultivation. The top three data points that cultivators measure are humidity (86%), ambient room temperature (79%) and relative humidity (77%). However, other metrics that cultivators indicated were important included nutrient solution pH, yields and CO2 concentration—all tracked by more than 60% of study participants. Lighting-specific data is also important: 60% of cultivators noted they track light intensity (photosynthetic photon flux density, or PPFD) and/or light quality (spectrum), which is consistent with the factors they consider when making purchasing decisions.

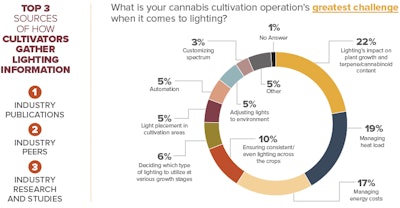

The top three outside sources for gathering lighting cultivation information remain unchanged, with industry publications, industry peers, and industry research and studies being the most turned-to resources.

LED Rebates: Fewer Explore the Cost-Saving Option

Between the 2017 and 2018 “State of the Cannabis Lighting Market” studies, the number of participants indicating they explored utility rebate incentives for LEDs increased from 40% to more than half (51%) of all respondents. This year, that number decreased, as only 36% of participants indicated that they pursued this option to offset the expense of implementing LED solutions. Only 12% of participants received rebates while 7% did not. Another 17% said they considered rebates but didn’t submit them yet. A majority of survey participants did not explore utility rebate incentives to subsidize the cost of LED solutions (64%), with 35% saying they were not aware of rebate programs.

Lighting Challenges: Top 3 Remain the Same

While there have been year-to-year differences and significant changes in four-year comparisons with other data points noted in this year’s lighting study, lighting challenges faced by cultivators have remained fairly consistent. The top three pain points remain the same: lighting’s impact on plant growth and terpene/cannabinoid content, managing heat load, and managing energy costs. Ensuring consistent/even lighting across the crops (10%) ranked slightly higher this year compared with 2018 (6%). Participants seem a bit more confident in deciding which type of lighting to utilize at various growth stages this year: 6% of research participants indicated this as the biggest pain point in their cultivation’s lighting operations this year, compared to 13% last year.

Facility Details: Production & Efficiencies

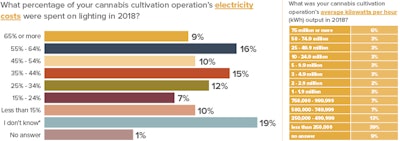

Other data points are significant for cultivators to determine their production efficiencies (or inefficiencies). For more than a quarter of cultivators who participated in the study (26%), lighting comprises a majority of their cultivation operation’s electricity costs, at 55% or more of the overall bill. Another 26% of participants say 35% to 54% of their electricity bill is spent on lighting. About 20% either don’t know the costs or don’t separate it out, either because they don’t oversee that aspect of the facility or don’t track it.

The majority of cultivators (51%) who participated in this year’s research indicated their cannabis cultivation operation’s average kilowatts per hour output in 2018 was less than 500,000, with most (39%) falling in the less-than 250,000 range.

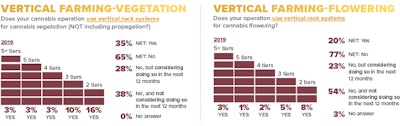

Vertical Cannabis Cultivation

Usage of vertical rack systems has increased slightly since CBT first asked (in the lighting market study in 2017) if cultivators used tiers and in which growth stage: 35% of participants noted they use systems in the vegetation stage this year (compared to 31% in 2017) and a fifth of study participants (20%) indicated they use vertical farming in the flowering stage (compared to 13% in 2017). Many who do not use tiers in cultivation now are considering them in the future, with 28% of participants considering implementing vertical rack systems in the vegetation stage in the next 12 months, and 23% considering the systems for flowering.