One trend that seems to be reflected in the data is that slightly fewer cultivators are growing in more than one facility/location type. For example, the numbers of research participants who said they grow in a greenhouse only or a warehouse only both increased this year over last year.

Likewise, the number of cultivators who said they grow in a combination of facility types/locations (e.g., greenhouse and warehouse) decreased across all but one category; those who said they grow in a combination of a greenhouse and outdoors stayed level at 3%.

Greenhouse Growing on the Upswing

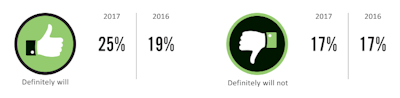

As markets continue to mature and cannabis is expected to increasingly be treated (and grown) like any other agricultural crop, longer-term industry shifts are anticipated, including a move away from indoor cultivation. In the short-term, such a shift is driven largely by cost. (Many cultivators also aim to be as environmentally sustainable as possible.) Declining wholesale prices continue to force cultivators to lower production costs to maintain and/or increase profit margins. The wholesale spot price monthly average for all U.S. cannabis sales dropped from $2,018 in January 2016 to $1,532 in January this year, according to industry research firm Cannabis Benchmarks. Since greenhouses are known to be more energy efficient than indoor cultivation (generally speaking), as they utilize free sunlight as their primary light source, it’s not surprising that an increasing number of cultivators (25% in 2017 vs. 19% in 2016) who don’t currently grow in greenhouses say they will definitely grow in a greenhouse in the next two years.

FUTURE PLANS

Of those who do not currently grow in a greenhouse: How likely is your operation to grow cannabis in a greenhouse in the next two years?

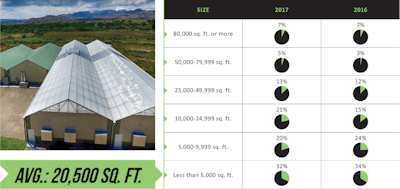

Does Size Matter?

According to this year’s data, crop size stayed relatively consistent among all cultivators as compared to last year; however, the numbers do show a very slight increase. The number of cultivators with relatively larger crops (10,000 square feet and up) all increased over last year, if only slightly (anywhere from 1 percentage point to 6 percentage points). Likewise, the number reporting smaller square footage for crop production (9,999 square feet and below) decreased by a few percentage points.

The average crop square footage among research participants also increased, albeit also ever so slightly. In 2016, the average was 18,000 square feet; this year, the average crop size came in at 20,500 square feet.

SPOTLIGHT ON SIZE

What is the square footage of your operation’s cannabis crop production?

ABOUT THE RESEARCH

The research for the “State of the Industry” report was conducted by independent research organization Readex Research, during January and February 2017. Results are based on a total of 237 research participants from North America.

The margin of error for percentages based on 237 respondents who currently own or work for an operation that grows cannabis is ±6.2 percentage points at the 95% confidence level.