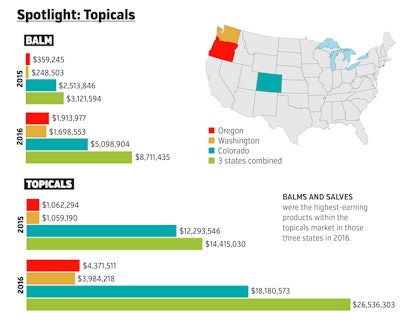

Sales of topical cannabis products grew rapidly in Colorado, Washington and Oregon during 2016, rising from $14.4 million in 2015 to $26.5 million last year, according to data from BDS Analytics. That year-to-year 84-percent boost in dollar sales is impressive, although the topicals market remains a relatively small slice of the $2.33 billion cannabis pie in those states (as calculated by BDS Analytics).

Still, topicals represent a healthy, and swiftly growing, marketplace for cannabis entrepreneurs and businesspeople. And the category may offer more crossover appeal to cannabis newbies who might be put off from smoking or vaporizing flower and concentrates.

A variety of different styles of products characterize the topicals market: lotions, sprays, massage oils, etc. But one subcategory in particular gained impressive traction during 2016: balms and salves.

In 2015, balms represented 22 percent of the topicals market in all three states combined with more than $3 million in sales. But in 2016, sales nearly tripled to $8.7 million, and the subcategory’s claim on market share grew quite a bit to nearly 33 percent. Last year, balms became the market leader among topicals. Balms’ boosted market share came at the expense of patches—which sank from 26 percent market share in 2015 to 19 percent in 2016 (dropping it from the category leader in 2015 to second place last year)—and creams, which fell from 19 percent to 15 percent.

The increase has been seen to varying degrees in Colorado, Washington and Oregon.

The most dramatic market-share acceleration occurred in Washington, where balms’ numbers rose from 23 percent of the topicals market in 2015 to 43 percent just one year later. Meanwhile, overall sales of topicals in the state rose from just under $1.1 million in 2015 to nearly $4 million, an increase of 276.5 percent.

The story is similar in Oregon, where balms grabbed 34 percent of the market in 2015, but rose to 44 percent in 2016. Sales in Washington of any category of cannabis product usually eclipse sales in Oregon, but Oregonians really like their topicals, spending nearly $4.4 million in 2016—just a touch higher than sales in Washington.

In Colorado, balms stood in third place (20 percent) in the 2015 topicals market, behind patches (29 percent) and creams (21 percent). But balms vaulted to No. 1 in 2016, comprising 28 percent of the near $18.2 million topicals market for that year. Meanwhile, patches fell to 25 percent and creams to 17 percent.