_fmt.png?auto=format%2Ccompress&fit=max&q=70&w=400)

Studying strain data in Colorado, Washington and Oregon can be a gripping exercise for those happily predisposed toward spreadsheets and pie charts. Strains rise, and then sometimes fall, in terms of retail sales according to data from BDS Analytics. Some strains sell exceedingly well in one state, but do not register among lists of top strains in other states. A handful of strains remain popular in all states. And within states, those jars of different strains of aromatic cannabis on dispensary shelves constantly jockey for market share.

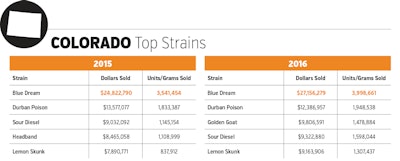

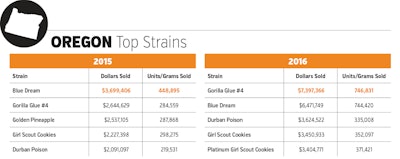

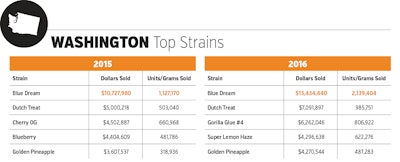

Let us consider Blue Dream, a smashing success of a strain in Colorado, Washington and Oregon. The sativa-dominant hybrid born in California is the No. 1 strain in Colorado and Washington, although in Oregon the strain fell behind Gorilla Glue #4 during 2016.

Colorado consumers possess a uniquely durable and robust passion for Blue Dream. Not only is it No. 1, but nearly twice as much of the strain has been sold, in terms of volume, as the No. 2 strain, Durban Poison. Since recreational sales began in Colorado on Jan. 1, 2014, dispensaries have sold more than 9.4 million grams of Blue Dream, racking-up more than $66.6 million in sales. By contrast, Durban Poison sold just a little more than half as much — over 4.8 million grams, with nearly $35.2 million in sales over the same period.

Blue Dream’s fortunes in Colorado are fluctuating. In the state’s medical channel, consumers spent $946,000 on the strain during April 2016, which marked the year’s high point for sales. By November 2016, sales of Blue Dream were down to $368,000, just slightly ahead of Sour Diesel at $330,000. In December, however, Blue Dream sales ticked-up to $542,800. In the recreational channel, September 2016 marked the high point, with $2.3 million in sales. But by November 2016 sales had fallen to $914,000, just ahead of Gorilla Glue at $732,300. By December, however, it had ticked back up to $1.2 million.

In Washington between July 2014 and September 2016, consumers bought more than $27.5 million worth of Blue Dream, which amounted to more than 1.1 million grams. Close behind, the No. 2 strain, Dutch Treat, sold $12.6 million.

The battle for strain supremacy in Oregon is heated. Since medical sales began in 2014, to when recreational data was added in October 2015, Beaver State consumers dropped more than $10.1 million on more than 1 million grams of Blue Dream, making it the No. 1 strain since 2014. But as we have already mentioned, the strain no longer reigns — Gorilla Glue #4 has replaced Blue Dream as the top strain of 2016.

Others kept solid sales in those three states during 2016. It’s not just Oregon consumers who open their wallets for the potent sativa hybrid Gorilla Glue #4 — the strain ranks No. 3 in Washington. Green Crack, a sativa-dominant strain, fits into the top 15 strains in two states: No. 6 in Colorado, No. 8 in Washington.

During 2016, Girl Scout Cookies, an indica-dominant hybrid, captured the No. 4 spot in Oregon and it held steady at No. 6 in Washington.

The dance between growers, dispensaries and consumers is one of the more interesting phenomena in the cannabis world, if not the retail world in general. Cannabis consumers’ tastes, collectively, do change over time, but what precipitates the shifts? Do the fluctuations in strain sales stem from what growers are sending into the market, or does consumer and/or dispensary demand end up dictating the strains growers are raising? As California, Nevada, Massachusetts and Maine soon enter the recreational market, and as other states like Florida begin offering medical cannabis sales, tracking the popularity of strains and styles will grow even more interesting.

Will Blue Dream dominate in the new states, or will entirely different strains capture market share in places like Maine and Massachusetts? We will soon find out.