When we measure growth among major categories (those exceeding $100 million in retail sales), pre-rolled cones rose most rapidly through the third quarter of 2016, vaulting 179 percent to $107 million in recreational and medical sales across Colorado, Oregon and Washington.

But pre-rolls are a fairly small subset of the overall cannabis market in those states, which should surpass $2.4 billion in calendar year 2016.

Flower dominates sales in the three states, totaling more than $1 billion and rising 46 percent, in terms of retail sales, compared to the same nine months last year. That represents enviable growth within any industry.

But for investors and entrepreneurs, concentrates offer especially tantalizing opportunities.

Concentrates represent the second-largest sales category within those states' total cannabis sales, earning $353 million through the third quarter. The kicker: The category rose 96 percent compared to the same period last year. Meanwhile, the third most popular cannabis category, edibles, captured $194 million in sales and grew 59 percent.

Concentrates Broken Down

So, let’s explore concentrates, a massive cannabis category that still enjoys especially aggressive growth.

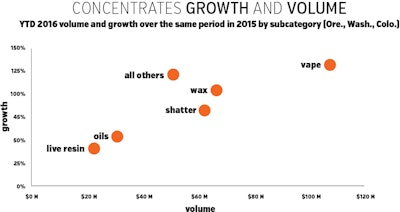

Within concentrates, pre-filled cartridges represent the most popular subcategory, bringing in $107 million in retail sales among the three states through Q3 and jumping 132 percent compared to the same period last year.

Consumers have warmly embraced these convenient, discreet “pens” — they easily fit into purses and pockets, do not produce smoke (the devices vaporize the concentrates in the cartridges) and broadcast comparatively little odor, compared to flower smoke (not to mention raw flower).

The subcategory leads most others in growth and is the largest in sales volume except in the Colorado medical channel, where wax and shatter are the most popular.

It’s not just consumers at Colorado medical dispensaries who find wax and shatter attractive. The two concentrate subcategories rank second and third respectively, with sales of $66.7 million and $62.4 million in the three states. Meanwhile, wax is the second-fastest growing concentrate subcategory (just behind pre-filled cartridges), at 105 percent.

With such impressive growth across most concentrate subcategories, concentrates have grown increasingly alluring to investors. Consider: In the first nine months of 2015, 465 brands had some form of concentrate sales in Colorado, Washington and Oregon. But through the first three quarters of 2016, that number leapt to 976.

The jockeying between brands for market share is volatile. Of the top 10 concentrates brands for the first three quarters of 2016, only five enjoyed top-10 positions during the same period in 2015.

While growth within the concentrates category remains the most impressive, investment and entrepreneurial opportunities abound within all the major categories. With flower enjoying 46 percent growth, and edibles growing 59 percent, the entire industry is ballooning at an impressive rate.