Edibles, concentrates and other infused products are seeing the rapid development of professional brands with consistent packaging, messaging and brand images. Flower, however, has largely been left unbranded, leaving a void that could offer significant potential to producers.

Flower, more so than other cannabis products, will always have to compete with the illicit market, and therefore pressure exists to either keep prices down or focus on premium products.

However, the three main reasons that patients and consumers look to the legal versus illicit cannabis market when purchasing flower are: avoiding legal complications, receiving a consistent experience, and greater product selection. The desire to avoid legal complications was cited as the key reason for shopping at dispensaries by 55 percent of cannabis users in a recent Brightfield Group survey.

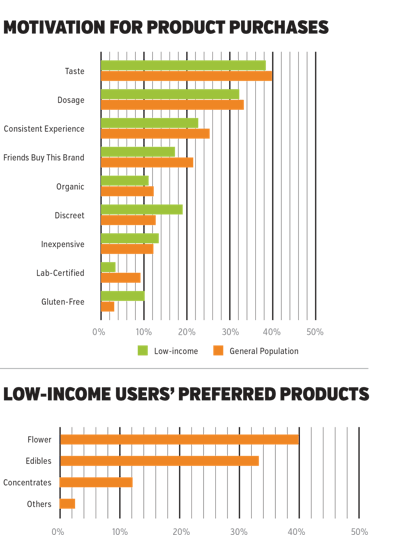

A recent survey of more than 1,200 California medical patients showed that 25 percent of medical patients (both high- and low-income) are concerned with receiving a consistent experience. This is one selling point that branded flower can offer – a reliable, consistent experience on which users can depend.

Lower-income users, who make up more than a third of California medical marijuana patients, are a prime target market for branded flower. Despite their lower-income status, the average California medical patient with income less than $30,000 per year spends more than $80 per week on cannabis products. They use cannabis more often, and show preferences for flower over other cannabis products. They, too, are looking for consistency in cannabis products, and survey results show they are just as brand-loyal as higher-income consumers.

A handful of companies are betting on branded flower, including celebrity brands such as Marley Natural (Bob Marley) and Willie’s Reserve (Willie Nelson).

In Washington, where vertical integration is prohibited, branded flower is increasingly becoming the norm, and as of August 2016, more than half of all flower is now branded, according to a Brightfield Group analysis of product offerings at nearly 300 medical and recreational shops in Washington.

In California, branded flower is less commonplace, but a few notable brands are emerging. Caviar Gold, for example, has been successful with concentrates-infused pre-rolls and flower. The brand is carried in 26 percent of California dispensaries, leads the state’s pre-roll market with 6-percent market share and receives some of the strongest consumer satisfaction ratings of any brand, according to Brightfield Group research.