Colorado

Colorado’s Robust First Half of 2016: Solid Growth in Every Category

Year-to-date through July, Colorado’s cannabis industry continued its brisk growth, increasing 34 percent over the same period in 2015. According to BDS Analytics, a Boulder-based firm that tracks retail cannabis sales, Colorado sales reached $721 million through July. The state’s cannabis industry is on track to surpass $1.3 billion in sales in 2016, compared to $1 billion last year.

With $123 million in retail sales, July 2016 was Colorado’s biggest month yet. This was the third time in the last eight months that the state set a new monthly record. The adult-use market drove the success with 49 percent growth over July 2015. It was only the fifth-largest month for the state’s medical market, which contracted 2 percent, the first decline in 10 months.

“Colorado’s adult use channel has never declined in any given month compared to one year earlier,” says Tom Jones, director of analytics at BDS Analytics. “In fact, it has never grown less than 30 percent.”

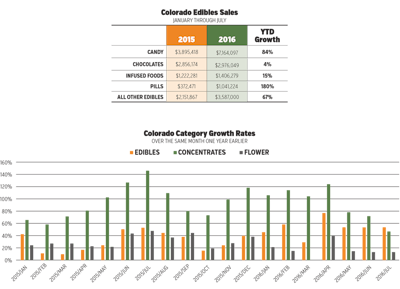

For the first time ever, edibles’ growth exceeded concentrates’ with respective growth rates in July 2016 over July 2015 of 54 percent and 47 percent. Concentrates saw triple-digit growth in seven of the last 12 months, and it is possible that there is less room for the category to sustain such robust expansion compared to the smaller edibles category. July is also a heavy tourist month in Colorado, and those customers may prefer the ease and discretion afforded by edible products.

Every edibles subcategory except chocolates grew in the double or triple digits year-to-date this July over January through July 2015 in Colorado, with pills jumping 180 percent and candy surging 84 percent. Chocolates slowed to just 4 percent growth due primarily to a 3 percent decline in units sold. By contrast, candy units sold increased 77 percent.

Washington

High Growth in Washington

In Washington, for which detailed data are currently available through May for the adult-use market only, year-to-date retail sales increased 115 percent to $229 million. While the state is on a blistering growth trajectory, its volume was still just 75 percent of Colorado’s $308 million over that same period.

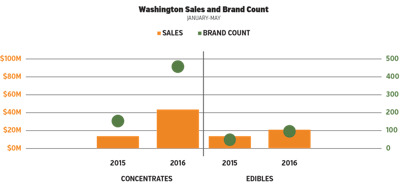

Washington eclipses Colorado in one specific category — pre-rolled joints — with $18 million in sales compared to Colorado’s $17 million in the adult-use channel through May. No other Washington category comes close to pre-rolled’s 848 percent growth over the same five months in 2015. Still, other categories remain attractive investment targets in Washington, with concentrates up 260 percent to $46 million, edibles up 76 percent to $21 million, and flower’s continuing boom with 84 percent growth to $142 million.

Companies must combine compelling product with strong marketing to make a dent in Washington, however, as the space is crowded. During the first five months of 2015, 160 brands competed just for concentrates business. This year, that number jumped to 458. In edibles over the same period, the brand count rose from 37 to 92.

Based on existing growth patterns, Washington state will exceed $500 million in sales this year, compared to $356 million in sales revenue in 2015.

All data sourced from GreenEdgeTM, BDS Analytics’ proprietary data mining tool.