[PRESS RELEASE] – NEW YORK, May 12, 2025 – Ascend Wellness Holdings Inc. (AWH), a vertically integrated multistate cannabis operator focused on bettering lives through cannabis, reported its financial results for the quarter ended March 31, 2025. Financial results are reported in accordance with U.S. generally accepted accounting principles (GAAP) and all currency is in U.S. dollars.

Business Highlights

- AWH remains committed to implementing its densification strategy, which is expected to result in an approximate 50% increase in store count in the medium term. The company continues to maintain its data-backed focus on premier locations in high-density population centers in its expansion efforts.

- Currently, the company is targeting 10 new stores to come online in 2025, including three in Ohio and one in Pennsylvania.

- In Illinois, three partner stores have now opened, Markham in Q1, and North Riverside and Lynwood subsequent to the quarter end, with an additional partnership opportunity recently identified.

- In New Jersey, the company expects to open its first partner store in Little Falls in the coming months, with three additional partner locations identified for later this year.

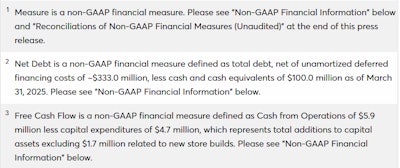

- Maintained focus on reducing expenditures in support of the company's cost savings transformation initiatives, which have positively impacted both adjusted EBITDA1 of $27 million and adjusted gross margin1 of 40.8% in the quarter.

- The company has continued to make solid progress in improving its balance sheet and working capital, highlighted by the $100 million of cash and cash equivalents on hand and the generation of $5.9 million in cash from operations.

- Launched a share buyback program in January 2025. Pursuant to a normal course issuer bid (NCIB), the company may repurchase up to the lesser of: (i) 10,215,690 shares of the company's class A common stock (common shares); and (ii) $2.25 million worth of common shares in the open market. As of April 30, 2025, the company has repurchased 1,571,500 common shares via the NCIB program.

Financial Highlights

- Revenue:

- Total net revenue declined 5.9% quarter-over-quarter to $128 million.

- Retail revenue decreased 6.6% quarter-over-quarter to $84.4 million.

- Wholesale revenue decreased 4.4% quarter-over-quarter to $43.6 million.

- Net Loss:

- Net loss of $19.3 million in Q1 2025 compared to net loss of $16.8 million in Q4 2024.

- Adjusted EBITDA1:

- Adjusted EBITDA1 was $27 million for Q1 2025, representing a 21.1% margin1. Adjusted EBITDA1 decreased 10.7% and adjusted EBITDA margin1 decreased 110 basis points quarter-over-quarter.

- Balance Sheet:

- As of March 31, 2025, cash and cash equivalents were $100 million, a sequential increase of $11.7 million. Net debt2, which equals total debt less unamortized deferred financing costs less cash and cash equivalents, was $233 million.

- Cash Flow:

- Generated $5.9 million of cash from operations in Q1 2025, representing the ninth consecutive quarter of positive operating cash flow, and free cash flow3 of $1.2 million.

Management Commentary

"Building on the groundwork we laid in 2024, we have begun to execute the key steps needed to drive long-term value across our business," CEO Sam Brill said. "Our priorities remain on improving our profitability, maximizing our asset efficiency and enhancing our cash flow generation. Backed by our strong balance sheet, we are advancing our densification strategy and rolling out consumer-focused retail initiatives, including a refreshed e-commerce platform, across our footprint. We expect the actions we've taken will begin to deliver measurable benefits in the second half of the year."

Frank Perullo, co-founder and president, said, "We have done the work to position the business for success, and we anticipate in the coming months we'll be launching new products, as well as opening locations to advance our densification strategy. These initiatives reflect our commitment to expanding access, enhancing the consumer experience, and reinforcing our position as a leading operator in an increasingly dynamic and competitive market."

Roman Nemchenko, Chief Financial Officer, concluded, "Over the quarter, we further strengthened our balance sheet and ended the quarter with a strong cash position. This enhanced liquidity will enable us to capitalize on accretive transactions in an increasingly buyer-friendly environment, while pursuing strategic opportunities to further solidify our capital structure and reduce near-term debt pressures. The progress we have made reflects the disciplined execution of our team, and we are well-positioned to advance our long-term goals."

Q1 2025 Financial Overview

Net revenue decreased by 5.9% sequentially to $128 million, of which 4.4% of the decrease was attributable to a decline in retail revenue and 1.5% of the decrease was due to a decline in third-party wholesale revenue. Retail revenue totaled $84.4 million, representing a 6.6% decrease compared to the prior quarter, primarily due to the softening of sales in Illinois, Michigan, New Jersey and Massachusetts resulting from a combination of pricing pressure and volume, partially offset by the contribution of adult-use sales in Ohio and the ramp of new partner stores in Illinois. Third-party wholesale revenue totaled $43.6 million, representing a 4.4% decrease compared to the prior quarter, attributable to declines in New Jersey, partially offset by improvements in Illinois.

Q1 2025 gross profit was $39.6 million, or 30.9% of revenue, as compared to $46.9 million, or 34.5% of revenue, in Q4 2024. Q1 2025 adjusted gross profit1 was $52.2 million, or 40.8% of revenue, as compared to $56.9 million, or 41.9% of revenue, for the prior quarter. This decrease was primarily driven by pricing declines resulting from competitive pressures in both the retail and wholesale sectors.

Total general and administrative (G&A) expenses for Q1 2025 were $37.1 million, or 29% of revenue, compared to $40.8 million, or 30% of revenue, for Q4 2024, reflecting a benefit from certain cost-savings initiatives implemented in late 2024.

Net loss attributable to AWH for Q1 2025 was $19.3 million, compared to $16.8 million in Q4 2024, primarily impacted by lower margins, partially offset by a benefit from certain cost-savings initiatives.

Adjusted EBITDA1 was $27 million in Q1 2025 and adjusted EBITDA margin1 was 21.1%, a 110-basis-point decrease compared to Q4 2024, primarily attributable to the impact of lower margins.

Cash and cash equivalents at the end of Q1 2025 were $100 million, and net debt2 was $233 million. Cash from operations was $5.9 million in Q1 2025, representing the ninth consecutive quarter of positive operating cash flow, and free cash flow3 was $1.2 million.