[PRESS RELEASE] – CHELMSFORD, Mass., May 8, 2025 – The Cannabist Co. Holdings Inc., one of the most experienced cultivators, manufacturers and retailers of cannabis products in the U.S., reported its financial and operating results for the first quarter ended March 31, 2025. All financial information presented in this release is in U.S. generally accepted accounting principles (GAAP), unaudited, and in thousands of U.S. dollars, unless otherwise noted.

Management Commentary

“Through the first quarter of 2025, we have continued to make progress on our plans to simplify and optimize the business, which drove a sequential improvement in margins,” The Cannabist Co. CEO David Hart said. “We are reducing operating and overhead costs and have advanced ongoing initiatives to improve operating performance, as we rationalize SKUs and enhance our pricing architecture across active markets. To that end, we saw an improvement in retail gross margin and success from house brands, such as dreamt. As we continued to refine the footprint during the quarter, we completed the exit of the Washington, D.C., market, sold one dispensary in California, and closed three underperforming locations in Colorado. We remain focused on completing remaining divestitures in Florida, California and Illinois, which will help to further simplify the business and provide liquidity.

“With respect to our pending debt restructuring transaction, on April 29, holders of our senior notes voted to approve the proposed arrangement resolution. The principal remaining step in order to advance the transaction is to obtain court approval for the transaction in Canada. Court proceedings are scheduled for later this month to consider our approval request and debtholder objections.

“As we have discussed previously, our priorities throughout 2025 will continue to be liquidity and balance sheet management alongside operational improvements to simplify, reduce costs, and optimize the business. We look forward to opening additional retail locations in Ohio and Virginia this year and are prepared for the transition to adult use in Delaware.”

Top 5 Markets by Revenue in Q1[3]: Colorado, Maryland, New Jersey, Ohio, Virginia

Top 5 Markets by Adjusted EBITDA in Q1[3]: Colorado, Maryland, New Jersey, Ohio, Virginia

| [3] | Markets are listed alphabetically |

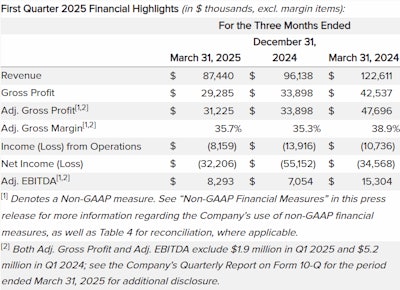

Financial Highlights for First Quarter 2025

- First quarter revenue of $87 million, a decrease of 9% compared to Q4, in part due to the closure of three locations in Colorado and the sale of one location in California.

- Adjusted gross margin in the first quarter was 36%, up 45 basis points sequentially compared to Q4.

- Adjusted EBITDA in Q1 of $7.1 million; adjusted EBITDA margin increased more than 200 basis points sequentially to 9.5%.

- For the 11 markets remaining following divestiture of Florida and Washington, D.C., Adjusted EBITDA margin was 9.8% in Q1.

- Capital expenditures in the first quarter were $2 million; the company continues to expect capital expenditures to average $2 million to $3 million per quarter in 2025, primarily for new store openings.

- The company ended the first quarter with $18.9 million in cash, as compared with $33.6 million at the end of Q4.

- Subsequent to quarter close, on April 17, the company closed on the sale of its remaining MMTC license in Florida for gross proceeds of $5 million; the sale of one cultivation facility in Florida is pending finalization.

- Subsequent to quarter close, on April 29, holders of senior notes voted to approve the previously announced arrangement to extend the maturities of senior secured notes to December 2028, with options to extend through 2029. The principal remaining step in order to advance the transaction is to obtain court approval for the transaction in Canada. Court proceedings are scheduled for later this month to consider the company’s approval request and debtholder objections.

- Subsequent to quarter close, company affected a corporate restructuring for an estimated $3.8 million in annualized cost savings due to adjustments to align with a simplified footprint; this is in addition to several rounds of corporate restructuring during 2024, where the company achieved $23 million in annualized cost savings.

Operational Highlights for First Quarter 2025

- For Q1 2025, wholesale revenue increased 3.5% sequentially to $16 million; wholesale accounted for approximately 18% of total revenue, compared to 16% in Q4.

- Retail gross margin increased 180 basis points over Q4, as efforts continue to rationalize SKUs and improve pricing architecture across our markets.

- During Q1, launched the dreamt brand in Massachusetts, New Jersey and Virginia—adding to the initial success of dreamt in Maryland, where the product was the top selling sleep SKU within the company’s Maryland stores.

- As a result of the sale of one dispensary in California, and closure of three underperforming locations in Colorado, the quarter-end active retail count was 55, compared to 59 at the end of Q4.

- Subsequent to quarter close, in April, the company signed management services agreements for two retail locations in California that are pending final sale, bringing the active retail count to 53.

- Subsequent to quarter close, the company launched adult-use sales at the third retail location in New Jersey, Cannabist Mays Landing, which opened on Dec. 31, 2024.

- The company has additional retail locations in development, including one in Virginia and three in Ohio, with one Ohio location expected to open in Q3.

Non-GAAP Financial Measures

In this press release, the company refers to certain non-GAAP financial measures, including Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Gross Profit and Adjusted Gross Margin. The company considers certain non-GAAP measures to be meaningful indicators of the performance of its business. These measures are not recognized measures under GAAP, do not have a standardized meaning prescribed by GAAP and may not be comparable to (and may be calculated differently by) other companies that present similar measures. Accordingly, these measures should not be considered in isolation from nor as a substitute for our financial information reported under GAAP. These non-GAAP measures are used to provide investors with supplemental measures of our operating performance and thus highlight trends in our business that may not otherwise be apparent when relying solely on GAAP measures. These supplemental non-GAAP financial measures should not be considered superior to, as a substitute for, or as an alternative to, and should be considered in conjunction with, the GAAP financial measures presented. We also recognize that securities analysts, investors and other interested parties frequently use non-GAAP measures in the evaluation of companies within our industry.

With respect to non-GAAP financial measures, the company defines EBITDA as net income (loss) before (i) depreciation and amortization; (ii) income taxes; and (iii) interest expense and debt amortization. Adjusted EBITDA is defined as EBITDA before (i) share-based compensation expense; (ii) goodwill and intangible impairment, (iii) adjustments for acquisition and other non-core costs; (iv) gain on remeasurement of contingent consideration, net, (v) fair value changes on derivative liabilities; and (vi) fair value mark-up for acquired inventory. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Revenue. Adjusted Gross Profit is defined as gross profit before the fair mark-up for acquired inventory. Adjusted Gross Margin is defined as gross margin before the fair mark-up for acquired inventory.

The company views these non-GAAP financial measures as a means to facilitate management’s financial and operational decision-making, including evaluation of the company’s historical operating results and comparison to competitors’ operating results. These non-GAAP financial measures reflect an additional way of viewing aspects of the company’s operations that, when viewed with GAAP results and the reconciliations to the corresponding GAAP financial measure, may provide a more complete understanding of factors and trends affecting the company’s business. The determination of the amounts that are excluded from these non-GAAP financial measures are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the company’s reported results of operations, management strongly encourages investors to review the company’s consolidated financial statements and publicly filed reports in their entirety.

Reconciliations of non-GAAP financial measures to their nearest comparable GAAP measures are included in this press release and a further discussion of some of these items is contained in our annual report on Form 10-K.