[PRESS RELEASE] – TORONTO, May 8, 2025 – TerrAscend Corp., a leading North American cannabis company, reported its financial results for the first quarter ended March 31, 2025. All amounts are expressed in U.S. dollars and are prepared under U.S. generally accepted accounting principles (GAAP) unless indicated otherwise.

First Quarter 2025 Financial Highlights

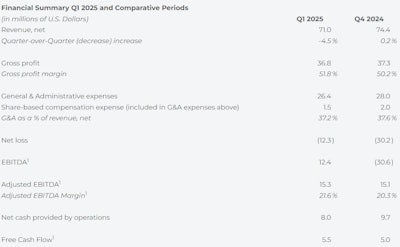

- Net revenue was $71 million, compared to $74.4 million in Q4 2024, reflecting a 4.5% seasonal decline.

- Gross profit margin was 51.8%, up 160 basis points compared to 50.2% in Q4 2024.

- GAAP net loss was $12.3 million, compared to a net loss of $30.2 million in Q4 2024.

- EBITDA¹ was $12.4 million, compared to an EBITDA loss of $30.6 million in Q4 2024.

- Adjusted EBITDA¹ was $15.3 million, compared to $15.1 million in Q4 2024.

- Adjusted EBITDA Margin¹ was 21.6%, compared to 20.3% in Q4 2024.

- Net cash provided by operating activities was $8 million, compared to $9.7 million in Q4 2024.

- Free cash flow¹ was $5.5 million, compared to $5 million in Q4 2024.

"Despite a challenging industry environment, revenue performed in line with our guidance, while gross margin and EBITDA margin outperformed our expectations during the first quarter of 2025,” TerrAscend Executive Chairman Jason Wild said. “Revenue totaled $71 million, a sequential decline of 4.5%, primarily due to seasonality, while gross profit margin increased to 51.8% and adjusted EBITDA margin improved to 21.6%. These results were driven by strong revenue growth and margin expansion in Maryland, along with our continued leadership in the New Jersey market. General and administrative expenses declined by an additional $1.6 million in Q1, following a $3.6 million reduction in Q4 2024, as part of our ongoing G&A reduction program aimed at achieving $10 million in year-over-year savings for 2025.

“Following the end of the quarter, we completed the acquisition of a dispensary in Ohio, expanding our footprint to six U.S. states. We also announced a definitive agreement to acquire a fourth dispensary in New Jersey, pending regulatory approval. Our continued accomplishments, including our eleventh consecutive quarter of positive operating cash flow and seventh consecutive quarter of positive free cash flow, reflect the strength of our business. Combined with a robust balance sheet, over $150 million in owned real estate, minimal leaseback obligations, and no significant debt maturities until late 2028, we are well-positioned to drive further operational efficiencies, grow our core business, and strategically pursue additional acquisitions at increasingly attractive valuations.”

First Quarter 2025 Business and Operational Highlights

- Achieved 11th consecutive quarter of positive operating cash flow and seventh consecutive quarter of positive free cash flow.

- Maintained a leadership position in New Jersey.2

- Made significant progress with the expansion of cultivation and manufacturing capabilities in New Jersey.

- Further improved market share position in Maryland and now only 1.4 market share points away from the No. 2 position in the state.2

- Expanded Maryland cultivation capacity by an additional 50% with the first harvest expected in late June.

- Continued preparations for potential Pennsylvania adult-use implementation, leveraging the company’s 150,000-square-foot cultivation and manufacturing facility and Apothecarium retail network of six dispensaries.

- Completed a series of initiatives expected to reduce general and administrative expenses year-over-year in 2025 by at least $10 million.

- Repurchased 637,000 shares as part of the $10 million share repurchase program initiated in August of 2024.

Subsequent Events

- Completed the acquisition of Ratio Cannabis, a well-situated and profitable dispensary in Ohio, marking the company’s entrance into its sixth state.

- Signed a definitive agreement to acquire a high-performing dispensary in New Jersey, which, upon closing, would bring TerrAscend’s total number of dispensaries up to four in the state.

1. EBITDA, adjusted EBITDA, adjusted EBITDA margin and free cash flow are non-GAAP measures defined in the section titled “Definition and Reconciliation of Non-GAAP Measures” below and reconciled to the most directly comparable GAAP measure at the end of this release.

2. According to BDSA.

First Quarter 2025 Financial Results

Net revenue for the first quarter of 2025 was $71 million, a 4.5% decrease sequentially, as expected, largely due to seasonality, as compared to $74.4 million for the fourth quarter of 2024. Retail revenue decreased 6.4% sequentially, while wholesale revenue was flat. Pennsylvania and Maryland retail sales were flat to slightly up sequentially, while seasonal declines occurred in Michigan and New Jersey. In wholesale, sequential growth in Pennsylvania and Maryland was offset by a decline in New Jersey.

Gross profit margin for the first quarter of 2025 was 51.8%, compared to 50.2% in the fourth quarter of 2024 and 48% in the first quarter of 2024. The quarter-over-quarter 160 basis-point expansion was driven by improvements in Maryland, Pennsylvania and Michigan, while New Jersey remained relatively flat quarter-over-quarter.

General and administrative (G&A) expenses for the first quarter were $26.4 million compared to $28 million in the fourth quarter of 2024. G&A expenses decreased by an additional $1.6 million in the first quarter, following a $3.6 million reduction in the fourth quarter of 2024. This continued G&A expense reduction over the past two quarters reflects the company’s ongoing initiatives to optimize G&A expenses, which are expected to reduce G&A by $10 million year-over-year in 2025.

GAAP net loss for the first quarter of 2025 was $12.3 million, compared to a net loss of $30.2 million in the fourth quarter of 2024.

Adjusted EBITDA, a non-GAAP measure, was $15.3 million for the first quarter of 2025, or 21.6% of revenue, compared to $15.1 million, or 20.3% of revenue, in the fourth quarter of 2024. The sequential improvement in adjusted EBITDA margin was primarily driven by gross margin expansion and lower G&A expenses.

Balance Sheet and Cash Flow

Cash and cash equivalents were $29.4 million as of March 31, 2025, compared to $26.4 million as of Dec. 31, 2024. Net cash provided by operating activities in the first quarter of 2025 was $8 million, compared to $9.7 million in the fourth quarter of 2024. This represented the company’s 11th consecutive quarter of positive cash flow from operations. Capex spending was $2.5 million in the first quarter of 2025, mainly related to expansions at the company’s Maryland and New Jersey facilities. The 50% expansion of cultivation in Hagerstown, Md., was completed in April, with the first harvest expected in late June. The expanded edibles production in Boonton, N.J., was completed in early May. Free cash flow was $5.5 million in the first quarter of 2025, compared to $5 million in the fourth quarter of 2024, representing the company’s seventh consecutive quarter of positive free cash flow. During the quarter, the company made $0.7 million of distributions to its New Jersey minority partners and paid down $1 million of debt.

As of March 31, 2025, there were approximately 369 million basic shares of the company issued and outstanding, including 293 million common shares, 13 million preferred shares as converted, and 63 million exchangeable shares. Additionally, there were 42 million warrants and options outstanding at a weighted average price of $3.57.

Definition and Reconciliation of Non-GAAP Measures

In addition to reporting the financial results in accordance with GAAP, the company reports certain financial results that differ from what is reported under GAAP. Non-GAAP measures used by management do not have any standardized meaning prescribed by GAAP and may not be comparable to similar measures presented by other companies. The company believes that certain investors and analysts use these measures to measure a company’s ability to meet other payment obligations or as a common measurement to value companies in the cannabis industry, and the company calculates: (i) Free cash flow from net cash provided by operating activities less capital expenditures for property and equipment which management believes is an important measurement of the company's ability to generate additional cash from its business operations, and (ii) EBITDA and adjusted EBITDA as net loss, adjusted to exclude provision for income taxes, finance expenses, depreciation and amortization, share-based compensation, loss (gain) from revaluation of contingent consideration, gain on disposal of fixed assets, impairment of goodwill and intangible assets, impairment of property and equipment and right of use assets, unrealized and realized loss on investments, gain on derecognition of right of use assets, unrealized and realized foreign exchange loss, gain on fair value of derivative liabilities and purchase option derivative assets, and certain other items, which management believes is not reflective of the ongoing operations and performance of the company. Such information is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.