Editor’s note: This article includes the Massachusetts segment of Cannabis Business Times’ special report on the downfall of medical cannabis in 17 adult-use markets that was published on Aug. 26, 2025.

After Massachusetts voters legalized medical cannabis in the November 2012 election, the first medical cannabis dispensary opened for business 2 1/2 years later in June 2015 in Salem.

By January 2016, the program had more than 19,000 qualified patients registered. That number increased to roughly 50,000 patients by the end of 2017 and nearly 68,000 patients in March 2020, according to the Massachusetts Cannabis Control Commission (CCC).

Although Massachusetts launched adult-use sales on Nov. 20, 2018, the medical program continued to grow thereafter, notably because then-Gov. Charlie Baker deemed medical cannabis retailers as essential businesses, but not adult-use retailers, in a COVID-19 order requiring all nonessential businesses to shut down.

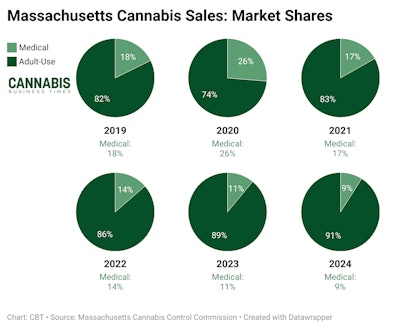

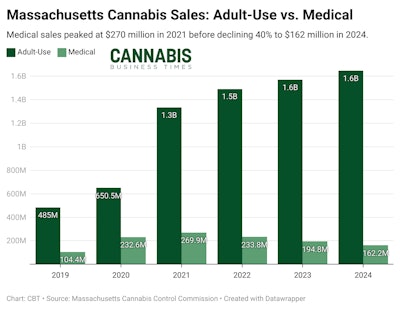

In turn, medical cannabis’s share of the state’s overall marketplace grew in 2020, representing 26% of overall sales, before declining in subsequent years, down to 9% in 2024, according to the CCC.

Active patient numbers peaked at more than 100,000 patients in February 2021 and have only declined slightly since—to 91,758 as of July 2024—according to the CCC.

Still, Massachusetts’ medical cannabis sales have dipped 40% since a COVID-related peak, from $270 million in 2021 sales to $162 million in 2024 sales, according to the CCC. This is likely attributed to falling sales prices and shrinking basket sizes.

In 2025, medical cannabis sales have somewhat stabilized: As of August, medical retail sales are projected to finish the year at roughly $158.5 million.

While Massachusetts’ medical cannabis patients must renew their certifications annually through a health care practitioner, the state incentivized the program by eliminating a $50 annual registration fee in 2019 and exempting medical cannabis from the 10.75% excise tax, 6.25% sales tax and 3% local tax imposed on adult-use cannabis.

However, that incentive partially lost some appeal amid falling prices in the adult-use marketplace, where the average flower price of $391 per ounce in 2021 dropped 63% to $144.5 per ounce in 2024, according to the CCC.