COVID-19’s Impact on Legal Cannabis

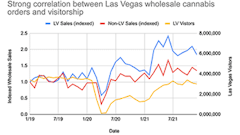

Demand from adult-use consumers and registered patients surged to unprecedented levels during the pandemic. Sales rose rapidly in almost every state market—from established adult-use programs like Colorado and Oregon to medical-only Arizona and Oklahoma—in the spring and early summer. Monthly sales have leveled off as of late summer and autumn but remain significantly elevated compared to pre-COVID.

Elevated demand has persisted even after enhanced unemployment payments through the Coronavirus Aid, Relief, and Economic Security (CARES) Act expired in July. With strong sales continuing despite record unemployment, economic uncertainty, and little relief from the federal government, it appears that COVID-19 has revealed cannabis to be a recession-proof commodity, along the lines of alcohol.

Strained and Uncertain Supply

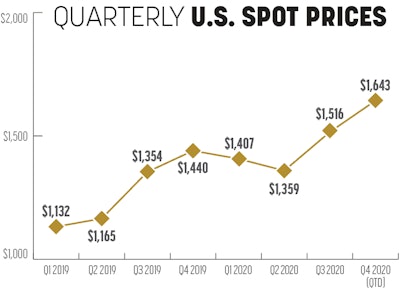

In states with more mature legal markets, such as Colorado and Oregon, production capacity had largely stabilized beginning in 2019. Prices in both states, which had already recovered last year, saw increases this year as existing production capacity was strained by record-breaking sales.

In states with new and younger adult-use markets—namely, Massachusetts, Michigan and Illinois—cultivators were already struggling to build out production capacity to meet demand. The unprecedented demand that manifested during the pandemic combined with the usual strain on supply that occurs in new markets has pushed wholesale prices in those states to very high levels. In Illinois, for example, the Spot Index has approached $4,000 per pound on numerous occasions this year.

The usual injection of new supply from the autumn harvest is uncertain this year due to the devastating wildfires on the West Coast, some of which burned near prime outdoor cultivation regions such as California’s Emerald Triangle and Southern Oregon. The possibility of a smaller-than-usual harvest, with crops lost or damaged from the fires, smoke, high winds, power outages, evacuations, and other factors, has exerted upward pressure on wholesale prices in some of the country’s largest legal markets.

Despite the tragic events that have characterized 2020, there are silver linings for the legal cannabis industry. Licensed cannabis businesses have been designated as essential in nearly every state. They have used their experiences operating in an industry that was already heavily regulated and uncertain to successfully meet myriad public health requirements necessitated by the pandemic. And, even though supplies have been tested and prices have been on the upswing this year, shelves are not bare and young legal cannabis supply chains have continued to function even as more established businesses and industries have been challenged.