After growth skyrocketed between 2018 and 2019, participants in the 2020 “State of the Cannabis Cultivation Industry Report” hit a plateau in their revenue trajectory. The average reported revenue inched up from $3.73 million in 2019 to $3.74 million in 2020.

The median company revenue (the number where half of participants reported a higher revenue and half reported a lower revenue) fell from $273,000 in 2019 to $269,000 in 2020. A slightly higher percentage of cultivators (34%) noted revenues of $1 million or more this year compared to last year (32%); this upward trend has continued during the five years Cannabis Business Times has conducted the “State of the Cannabis Cultivation Industry Report” with 24% noting revenues of $1 million or more in 2016.

However, more cultivators reported revenue growth and fewer reported losses in the most recently completed fiscal year. Only 4% of participants indicated revenue had declined this year, compared to 11% in 2019 and 8% in 2018. And more than a quarter of participants (29%) reported revenue growth, with 17% of those participants noting that the increase was 25% or higher. Another 15% had steady revenue with no change compared with the previous year. Close to half of participants (43%) could not respond to that question because they have not been in business for two years.

Modest Profit Increases

As with reported revenue, more participants in this year’s study noted profit increases and fewer indicated they experienced profit losses. Although the changes weren’t significant between 2019 and 2020, the trends are positive, with 27% reporting profit increased in 2020 compared to 22% in 2019, and 5% reporting profit decreased compared with 7% in 2019. Another 14% reported no change, down from 15% who reported no change in 2019.

Profit growth was moderate, with fewer people reporting gangbuster percentage increases of 50% or more (8% in 2020 versus 12% in 2019) and more reporting modest profit jumps. In the 2019 study, nearly half (48%) of participants could not compare revenue and profit changes because they were not in business the previous year. In the 2020 study, the number is slightly lower (43%) but still notable.

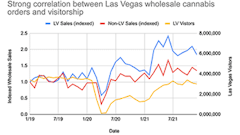

COVID-19 Factor

CBT conducted the 2020 “State of the Cannabis Cultivation Industry” research in April amid the COVID-19 pandemic that the world is still grappling with. It is too soon to tell what the business impact will be, but 63% of participants indicated that COVID-19 has already affected their operations, with the following ramifications: “decreased sales” (23%), “staff reductions/hours cut” (22%), “suspension of some operations” (21%) and “suspension of all operations” (4%). However, nearly a fifth of participants (18%) reported increased sales, and 5% said they increased staff hours. One bright note for the industry is that most states deemed cannabis companies essential businesses, so they could remain open, with modifications to prevent the spread of the virus.

Read the rest of the 2020 State of the Cannabis Cultivation Industry Report

Letter: Five Years Inside the State of the Industry

Introduction: Tracking Data Reveals Industry Shifts, Sustained Growth

2020 Cannabis Research: Revenue and Profits Plateaued, But Solid

2020 Cannabis Research: Where Cultivators Grow

2020 Cannabis Research: Industry Optimism, Expansion Continues

2020 Cannabis Research: Challenges Are One Constant in a Dynamic Industry

_fmt.png?auto=format%2Ccompress&fit=crop&h=141&q=70&w=250)