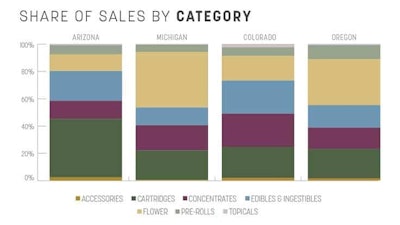

With the new year starting and the cannabis industry projected to reach $70.6 billion by 2028, according to Grand View Research, it’s important to take a look at where the greatest market opportunities currently lie. LeafLink analyzed product categories—“Accessories,” “Cartridges,” “Concentrates,” “Edibles and Ingestibles,” “Flower,” “Pre-Rolls,” and “Topicals”—by overall competitiveness, from May to October 2021 in four top U.S. cannabis markets: Michigan, Oregon, Arizona, and Colorado. We also included the average competitiveness, which is a measure across all product categories for a given state.

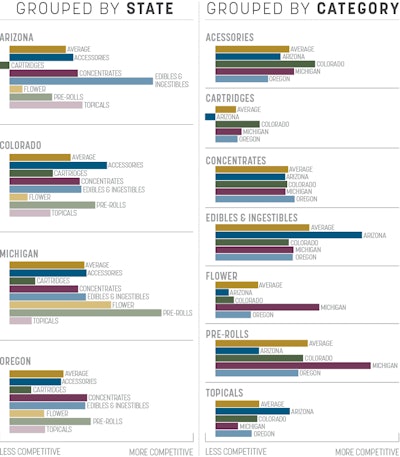

Our competitiveness metric uses LeafLink platform data to measure the difference between the percentage of brands that sell the category in the given market and the percentage of statewide sales for which the category accounts. In other words, competitiveness measures how saturated a particular category is—the bigger the market share of a category and the fewer brands competing in it, the less competitive that market segment is.

Category Competitiveness

On average, “Edibles” is the most competitive category, followed by “Pre-Rolls.” Meanwhile, “Cartridges,” “Topicals,” and “Flower” are the least competitive on average, relative to all categories. “Cartridges” in Arizona is the least competitive category across all the states we analyzed.

Out of all the categories and states, “Edibles” in Arizona and “Pre-Rolls” in Michigan are the most competitive categories, followed by “Flower” in Michigan and “Accessories” in Colorado. Oregon does not have any of the most competitive categories, but the most competitive category within the state is “Pre-Rolls.”

While “Edibles & Ingestibles” is overall the most competitive category, the story can be more complicated when trying to assess the greatest market opportunities. Depending on what a company’s core products are, it may make sense to move into a more competitive space if that category is directly related to its core business. That way, the company can seize the opportunity to drive revenue within the related category. For example, a “Flower” company could benefit from entering the “Pre-Rolls” market, even if the category is relatively more competitive, rather than entering another less competitive, less familiar category.

High Sales + Low Competition = Opportunity

In Arizona, “Cartridges” dominate sales, and yet the category showed the lowest saturation in our analysis. Because of the high sales and relatively few brands selling “Cartridges,” there seems to be an opportunity for more brands to enter the “Cartridges” market in Arizona.

“Flower” in Colorado tells a similar story. Saturation is relatively low, and the state’s share of “Flower” sales is considerable. Given that Colorado is such a robust market, with total sales surpassing $2 billion in 2020, there might be opportunities for brands to enter the “Flower” category.

Opportunities in Higher Competition Categories

While there are opportunities with less competition, we wouldn’t dissuade brands from entering more competitive categories. Both the competitiveness and share of sales for “Flower” are relatively high in Michigan, which means there is a lot of potential revenue to capture. Legalization and high flower prices, which attracted new entrants in 2020 and 2021, now present an opportunity for operators to differentiate themselves in ways other than value pricing. Michigan cannabis companies should focus on their marketing and branding for “Flower” to differentiate themselves in order to capture market share.

For companies, determining what categories to focus on is a balancing act between competitiveness and revenue. No categories should be disregarded, but brands should always keep in mind which categories bring in the least revenue.