California’s fully legalized, regulated cannabis market is not that old, with adult-use sales beginning Jan. 1, 2018, but the state’s rich cannabis history has made it an epicenter of cutting-edge cannabis products. The Golden State’s diverse population of about 30 million adults also makes it a great market for R&D testing.

Using Brightfield Group’s U.S. Consumer Insights, we can explore which less dominant product types California consumers are trying compared to the general U.S. cannabis consumer population. Considering cannabis culture is one of the West Coast’s main exports, these consumer trends can offer a window into what may be coming for other emerging markets across the country.

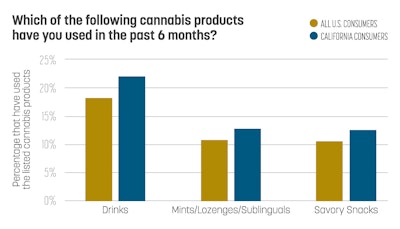

Product types particularly popular among California cannabis consumers, when compared to the broader U.S. market, include beverages, mints/lozenges/sublinguals, and savory snacks.

Cheers to Cannabis

When it comes to cannabis beverages, Californians are ahead of the adoption curve. Through 2021 and into Q1 2022, Cali cannabis consumers were 21% more likely to try a cannabis beverage than the average U.S. cannabis consumer.

Plus, in Q3 2021, 29% of California cannabis consumers reported drinking a cannabis beverage—the highest percentage recorded in an adult-use state.

With the unique opportunity to compete with alcohol industry, the cannabis beverage space is one of fierce innovation and competition. Looking to Brightfield’s U.S. Distribution Trends, the flavors appearing most often on California dispensary shelves are, in descending order of distribution, lemon, lemonade, watermelon, mango, and strawberry. These five flavors combined represent 39% of cannabis drinks distributed in the state. Other well-represented flavors in California (that are also popular nationwide) include lavender and grapefruit.

Orally Minded

Mints and sublinguals tend to be less familiar product types that require some education to properly dose. However, like drinks and savory snacks, California consumers tend to try these products more often than the average U.S. consumer.

Salty Snacking

Brightfield’s Consumer Insights portal consists of self-reported survey data on how people use cannabis and can capture product insights beyond dispensary sales and distribution figures.

Consumer-reported use of THC-infused savory snacks hovers around 10% nationally. However, regulated savory snacks seldom are available on dispensary shelves, indicating consumers are either illicitly purchasing them or making their own.

In California, however, there is more availability for infused savory snacks such as beef jerky, cheese puffs and popcorn, which could be contributing to a higher percentage (12.6% versus 10%) of consumers opting for the salty edibles options.

Whatever the source, the more cannabis brands can learn from both in-store and illicit purchases, the better they can serve them in legal channels.