Verano Holdings founder and CEO George Archos is anticipating an increased appetite for mergers and acquisitions as 2023 unfolds and more cannabis operators search for exits amidst ongoing pricing pressures.

And while some deals might appear too sweet not to sink one’s teeth into, Archos told investors March 30 during a fourth quarter and full year 2022 earnings call that the company will remain disciplined, patient and highly selective in its strategic expansion.

“Overall, we expect 2023 to be an inflection point for the industry and believe that it will be particularly difficult for smaller operators as they struggle to stay afloat in the absence of banking or tax relief, and continued pricing pressure,” he said. “However, this is a potential opportunity for Verano to acquire operators in attractive markets at favorable valuations.”

Those remarks come on the heels of Verano reporting $879 million in revenue for 2022, a 19% increase versus 2021, with gross profit of $423 million, or 48% of revenue, according to a company press release.

The company’s net loss of $269 million for 2022 includes a $229 million impairment charge, primarily of intangible assets related to an Arizona cultivation licenses as well as Pennsylvania and Arizona goodwill, Chief Financial Officer Brett Summerer said during the earnings call.

Currently the fourth largest publicly traded cannabis company in the U.S. by market cap, Verano has an active footprint in 13 states with 126 dispensaries and 14 cultivation and production facilities that include more than 1 million square feet of capacity.

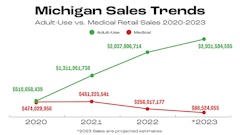

The company’s year-over-year revenue increase in 2022 was driven by the strength of adult-use sales launching in New Jersey, where Verano has three dispensaries and 120,000 square feet of cultivation, and increased retail contributions from Florida, where Verano has expanded its footprint from 41 to 66 MÜV medical cannabis dispensaries since the beginning of 2022.

On a gross revenue basis, 72% of Verano’s 2022 sales were derived from its retail business with the largest contributions coming from Florida, Illinois and New Jersey, Summerer said. The remaining 28% of sales were derived from the wholesale side of the business, with the largest contributions coming from Illinois, New Jersey and Connecticut, which just launched adult-use sales in January.

Since Verano’s founding in 2014, Archos said the company’s strategy has been to build a self-sustaining business set up to thrive, “even under extreme market uncertainty, making no assumptions about changes to federal law.”

Looking ahead to 2023, the chief executive said Verano remains focused on generating $50 million to $75 million in free cash flow for the year and building long-term value. Those objectives come as many competitors are struggling to endure difficult macroeconomic conditions that have carried over from 2022.

“Taking a look more broadly, the industry continues to face challenges from a tax and banking perspective,” Archos said. “While we are encouraged by the momentum surrounding a passable SAFE Banking package, we were disappointed this did not pass in 2022. However, this has not impacted our business. We have built a business to be self-sustaining and have never run the company relying on contingencies related to federal legalization.”

The key is to be ready to swiftly capitalize on any federal changes, if and when they occur, Archos said.

Until then, Verano will remain focused on state-by-state opportunities ahead, like in Maryland, where adult-use sales are projected to launch in the latter half of 2023 following voters’ passage of Question 4 in the November election. Verano has four dispensaries and a 38,000-square-foot cultivation facility in the Old Line State.

In addition, Archos projects Verano’s medical footprint in Florida, Ohio and Pennsylvania will provide the company’s portfolio with an additional adult-use upside in the near future. Verano has 87 retail facilities in those three states, which Archos said he anticipates legalizing adult-use sales in the next two years.

While some multistate operators exited various states in recent months in an effort to streamline their businesses amidst inflationary challenges impacting the industry, Archos said the team at Verano is knuckling down on its current footprint or adapting where necessary so that supply meets demand.

In Illinois and Massachusetts, for example, Verano scaled back total output to optimize its headcount during recent oversupply conditions in those markets, but the company maintains the ability to ramp-up production upon future opportunity, Archos said. Dollars per labor hour, which the company increased 26% quarter-over-quarter, and transactions per head at retail, which went up 14% quarter-over-quarter, are metrics Verano regularly tracks to help drive efficiency, Archos said.

“With decades of experience building businesses for longevity, downturns are not new to me,” he said. “And even with market conditions deteriorating in certain states, I believe the strength of our strategy is more apparent than ever. We do not need to exit any unattractive, fragmented markets, as we have had the wherewithal to avoid them from the start. We have methodically built today’s footprint, and we see the opportunity on the horizon to strategically build off this base.”

While the company remains in good position to evaluate growth opportunities at attractable prices through M&A action, Archos said, he reiterated that Verano’s “painstakingly strategic” history of growing its footprint has provided the company stability that’s representative of its current position in the industry.

With that in mind, Verano’s No. 1 priority in 2023 will be continuing to strengthen its balance sheet and focus on generating as much cash flow as possible, he said.

“We understand that preserving cash is more important now than ever before given the burdensome tax structure our industry faces and the difficult capital markets environment,” Archos said. “We have always sought to employ a thoughtful approach in deploying capital with discipline and balance—and we will continue to do so.”

While Verano spent $119 million on capital expenditures in 2022, company executives made the decision late last year to significantly decrease that spend in 2023, with expectations to be in the $25 million to $50 million range.

But Archos clarified that the company won’t be putting a hard cap on 2023 capital expenditures at the expense of growth.

“If we see opportunity, we will invest ahead of it appropriately,” he said. “But in the meantime, we are able to fully supply our markets with our current footprint.

Join us this year at the Paris Las Vegas Hotel & Casino for Cannabis Conference, the leading education and expo event for plant-touching businesses.