These are volatile times in the cannabis industry. From wholesale price compression and supply chain pressures to shifting regulations and changing consumer trends, businesses must be ready and eager to tackle anything as the market continues to evolve.

Colin Kelley, senior operating partner at Merida Capital Holdings, will speak at Cannabis Conference 2023 on how operators can leverage an understanding of all the major drivers and impacts to their business to control what they can and plan for the rest—in a sense, moving from surviving to thriving in an industry plagued with challenges.

Here, Kelley offers a preview of his tips for businesses looking to be successful in any environment, from creating a living budget to evaluating costs and making changes to strengthen their financial positions.

Editor's note: Colin Kelley will speak at Cannabis Conference on the "ALL-ACCESS PASS: Built To Last: Shifting From Reacting To Planning Ahead To Withstand Market Volatility" session, which will run from 10:30 to 11:15 a.m. on Wednesday, Aug. 16. In this session, learn how to look for the interdependencies in your business, how to create a living budget, how to evaluate your fixed and variable costs, and how to streamline your production, post-harvest, processing, packaging, labeling, (and so much more). Visit www.CannabisConference.com for more information and to register.

Melissa Schiller: What are some of the most pressing issues facing cannabis operators today, from wholesale price compression and supply chain pressures to consumer behavior and spending?

Colin Kelley: [As far as] common themes, we’re seeing that it’s a very tight money-raising environment or fundraising environment. Capital is very tight. It’s also coming in different forms. There’s a lot less equity investment than what we’ve seen in the past. Folks are taking on debt and then the terms of that debt are very different.

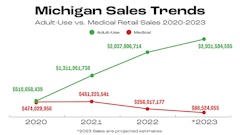

We’re seeing in a lot of markets, especially more mature markets, wholesale price compression, and we’re seeing consumer spending come lower. It pinches the cultivators and the manufacturers of products. Their wholesale prices come down. Dispensaries are then taking those retail prices and pushing down, as well, so top-line [revenue] for a lot of retailers is actually down, as well, as the average basket size for many retailers is down 12% to 15% across many different markets.

When you combine investment capital being very expensive and also price compression, it makes the math for creating a successful cultivation operation really challenging. People are still having to invest millions of dollars to get a cultivation facility up and running, and with price compression in the market, the payoff is not always there, especially depending on different regulatory benchmarks or hurdles. These certain things are really squeezing a lot of participants in the industry.

MS: How can cannabis operators control some of these factors, and plan for what they can’t control, in order to stay afloat in the industry?

CK: I think for a lot of folks, it’s first understanding what they can control and what they can’t control. That’s very important. And then [they must understand] where their core competencies or strengths lie. I’ve seen a lot of excellent cultivators that have ventured too far out into creating and licensing brands, and then they’re not getting the traction on the brands that they had hoped [for] or anticipated. So, there’s also a little bit of an openness required, where someone might be an excellent cultivator and they might need a partner who’s someone that’s very good at creating and launching brands. [Then] they can both focus on their strengths and both do well together.

[Operators should also be] looking at the types of resource allocation, whether that’s people—who are the right people for the organization?—or their dollars. It might be being able to have a modular approach to their business, so they’re not having to roll out 30,000 square feet of canopy, or 50,000 or 100,000 square feet of canopy. As a cultivator, they could turn on and off 5,000-square-foot rooms or greenhouses. Look at those and say, “OK, what growing environment do I want or need to use? Do I need to use different growing environments that have different cost structures for different products?” I think folks really need to look critically at those areas of their business.

Then, like I said, it’s looking at all the different areas of the business. If it’s a brand, they’ll go, “Oh, we’re going to move into this state.” And if you’re licensing your brand and getting a 15% royalty, you’ve set the required threshold of tractions or sales in that market pretty high in order for 15% to mean anything or to be profitable for somebody.

MS: What are some best practices when it comes to creating a living budget for your business? Have these best practices changed in this current economic environment?

CK: I think some of the fundamentals have not changed. The fundamentals [are], I think, the individuals being self-aware and then the organization being self-aware. As owners, it’s [thinking about], “What am I really good at? Where are there challenges for me personally, and how do I surround myself with people who are really good at those things that I find particularly challenging?” And then that factors into our budget, where we’re hiring people and spending money and time and resources on folks that can execute on certain areas of the business really efficiently. Maybe I’m not as strong [in one area], so it’s better for me to pay somebody else to do that.

I think of the company as a living being, just like me. What is the company really good at? It probably requires looking at the passions of the individuals involved, the vision, the mission, the market and the market dynamics. This is where what I call a corporate self-awareness becomes really important, and it also needs to be a little flexible to say, “OK, we’re really good at being cultivators or really good at making these great live resin vape carts.” And then [you have to look] at it relative to the realities of the market. If there has been massive price compression or if people aren’t consuming that category of product as much as you’d perhaps like, those are things that we maybe can’t control. How do you as an organization move forward when you’re like, “OK, I just need more people to buy live resin carts?” It might be, “OK, how can I take my scientific knowledge and the company’s know-how and apply it in an area that is getting traction in the marketplace?”

When we talk about a live budget, I think it’s very important to think about that, that it is a live, living document. It allows the companies to be agile and responsive. It also requires that evaluation frequently. Where is this working? Where is this not working? Where is the line in the sand where, if the price per pound of X product goes below this line, I stop executing? Where do I have to shift? Where do I have to reevaluate as opposed to just continuing to chase it down?

MS: How can cannabis businesses evaluate some of their fixed and variable costs and make changes to better their financial positions?

CK: I started to think about this session specifically in some conversations I was having, where there were a lot of people and companies that were surprised by the impact that the environment that they were in, in their state, was having on their businesses. They were surprised that there was price compression in California or Massachusetts or Michigan or Arizona, or they were surprised by different regulatory issues. They were surprised by different things, and what I saw was there were some operators that took those careful looks at their business on a regular basis, semi-monthly, and either they weren’t surprised, or they were able to very quickly adapt and plan to address this and implement changes.

One of the common practices around those people who were not surprised or who were very resilient and adaptable was that they used their financials as a jumping-off point. They’re saying, “What are our financials telling us about the operations of our company?” They were asking that question on a very regular basis. What are my expenses? They would start to classify their expenses based on, what are the expenses that are required to exist? And then the expenses that they chose to undertake, and what the impact was, then, on the operations of the business. Are there expenses where I can calculate an ROI for this?

I think those close looks start to then shine the light on or illuminate the areas of the business where people can make significant changes. They might be outsourcing their payroll [and it might be priced] too high. Their packaging costs might be too high. Some other elements of their business might have cost profiles that are now having negative impacts on the bottom line. So, they’re able to look at, is this something that I can change? Is this an area where I have control? [Can I] find a new vendor? [Can I] partner with somebody else who can do the distribution of this for me? So, then I save money on X, Y, and Z.

We’ve seen the companies that are willing to look at those expenses, look for those opportunities to be collaborative with other people in the marketplace, and that’s unlocked a lot of opportunities for people because they can then cost cut or control expenses to a certain extent. Beyond that, we have to look for ways to grow the business, and even though it doesn’t feel like it all the time, the cannabis market, in general, continues to grow overall. So, it’s just the opportunities to participate in that growth are now harder to find.

MS: What is one thing you'd like attendees to take back to their business after attending your session this year?

CK: I want them to feel really confident and comfortable in knowing and understanding their business, and [feel] confident in their businesses’ ability to be successful in any environment.

Editor’s note: This interview has been edited for style, length and clarity.

Join us this year at the Paris Las Vegas Hotel & Casino for Cannabis Conference, the leading education and expo event for plant-touching businesses.