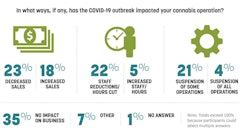

Despite price corrections from a post-pandemic sales boom, the cannabis industry is still showing major growth, and experts predict that growth will continue rapidly.

That’s according to the State of the Industry presentation put on Tuesday at the 2022 Cannabis Conference in Las Vegas, where thousands of attendees gathered to learn from 90-plus speakers and network with more than 180 exhibitors.

Noelle Skodzinski, editorial director of Cannabis Business Times and the Cannabis Conference, delivered the State of the Industry presentation, using data from media research partners to highlight opportunities available for cannabis while discussing the many challenges ahead for the industry as more states open up medical and adult-use markets.

RELATED: Highlights From Cannabis Conference Day 1

Cannabis data and research company Headset projects the cannabis market will be valued at $45.8 billion by 2025, according to the presentation. Skodzinski noted that would represent an 11% compound annual growth rate (CAGR) for the industry—more than double the anticipated CAGR of the alcohol market, which New Frontier Data projects will reach $72.5 billion by 2025.

Of course, getting to these levels will require facing and overcoming numerous challenges.

The industry is currently dealing with sales declines following a boom during the early days of COVID-19. However, Skodzinski noted that when compared to pre-COVID, current sales in legacy markets like Colorado, Washington and Oregon have actually grown.

For example, Oregon has experienced a 20% decline in monthly sales over the past year, yet the state’s sales are still up 25% over the past three years, according to Headset.

“The market has overall a very strong growth outlook, despite many challenges,” Skodzinski said.

Competition from illicit markets, lack of access to capital, marketing restrictions, and compliance with regulations while navigating changing and unclear state and federal legal landscapes are among some of the other major challenges facing retailers and cultivators, Skodzinski said.

She noted the multiple bipartisan efforts made at the federal level to introduce cannabis legislation that ends prohibition, expunges arrest records, ensures safe harbors for medical patients and more.

Meanwhile, CBD continues to await the go-ahead from federal regulators as well.

Skodzinski noted Brightfield Group forecasts the U.S. CBD market will reach at least $6 billion in 2027 without FDA regulations–a CAGR of less than 10%, according to the presentation slides. However, if the FDA begins regulating by 2024, that value will skyrocket to $11 billion for a CAGR of more than 40% by 2027.

Skodzinski also emphasized the push toward more social equity in the industry and said more action, resources and timely funding are still needed.

“We need advocacy so that the industry can reach its full potential,” Skodzinski said.

Other key highlights from the presentation include:

- If four more states legalize adult use on November ballots, half the country will have legalized cannabis.

- 69% of retailers are vertically integrated (based on 110 responses to Cannabis Dispensary's 2022 "State of the Cannabis Dispensary Report," due to be published in September).

- Adult-use cannabis tax revenue in the U.S. for 2021 was $3.7 billion.

- Canada and Ontario adult-use tax revenue from 2018 to 2021 totaled $18.1 billion.

- 92% of Americans support medical cannabis.

- Mergers and acquisitions (M&A) are tracking consistently, and many firms are projecting M&A will continue.

- There were 226,748 cannabis possession arrests in 2020.

Associate Editor Andriana Ruscitto contributed to this report.