When Cannabis Business Times first published the “State of the Cannabis Cultivation Industry Report” a half decade ago, only four states had legalized adult-use programs, close to a dozen states had no legal cannabis programs whatsoever, and hemp was illegal except for research pilot programs. Today, 11 states have fully legalized cannabis, just a small number of states have no legal cannabis programs, and hemp cultivation is permitted at the federal level.

What does this momentum mean for cannabis cultivators? With information and insights from study participants about their operations from multiple years, it is now possible to examine key trends and get a clearer picture of how the market has evolved.

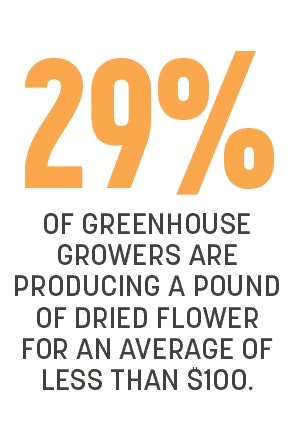

Each year, cultivators are reporting lower production costs no matter whether they grow indoors, in a greenhouse or outdoors. Dramatic decreases were seen in greenhouse production. In response to the question, “What is your operation’s average production cost per pound of dried flower produced,” the number that fell in the middle of responses (the median) for greenhouse growers in 2018 was $300; that figure is now $233. Indoor and outdoor cultivators also are reducing production costs, with the median response to the same question dropping from $425 two years ago to $396 this year for indoor growers, and from $175 in 2018 to $100 this year for outdoor growers.

Perhaps the efforts to reduce cannabis production costs are due to increased competition/declining prices, the primary business challenge participants have cited throughout the years of the study, including this year. Despite these and other fiscal hurdles, however, fewer cultivators (4%) said their revenue declined in 2020 compared to 2019 (11%). More cultivators (29%) reported increases in revenue during their most recently completed fiscal year compared to the 2019 study (22%), and 15% indicated no change. That may not seem like something to celebrate, until you consider that many participants (43%) could not answer that question, as they have not been in business for two years—a reminder that this is still a young industry that continues to attract interest and expand.

Not only is the industry growing, but the facilities that participants are cultivating in have also continued to expand during the past five years. Each year, a vast majority of participants report plans to add square footage to their cultivation sites in the next two years, and that remained unchanged in 2020, with 81% of participants reporting they have plans to expand.

This report, made possible each year with the support of Nexus Greenhouse Systems and based on a study conducted by third-party researcher Readex Research, provides benchmarks cultivators can use to compare their businesses and a look at the major trends and happenings that have occurred in this very dynamic market. We look forward to continuing to monitor the growth and changes, and to see what the next five years bring.

Read the rest of the 2020 State of the Cannabis Cultivation Industry Report

Letter: Five Years Inside the State of the Industry

Introduction: Tracking Data Reveals Industry Shifts, Sustained Growth

2020 Cannabis Research: Revenue and Profits Plateaued, But Solid

2020 Cannabis Research: Where Cultivators Grow

2020 Cannabis Research: Industry Optimism, Expansion Continues

2020 Cannabis Research: Challenges Are One Constant in a Dynamic Industry

_fmt.png?auto=format%2Ccompress&fit=crop&h=141&q=70&w=250)